EURUSD declines ahead of Powell’s pivotal speech

The EURUSD rate is undergoing a slight correction as traders prepare for the Fed chair’s speech. Find out more in our analysis dated 23 August 2024.

EURUSD forecast: key trading points

- Markets expect the Federal Reserve chair to provide guidance on future US monetary policy actions

- Traders estimate a 25% likelihood of a 50-basis-point interest rate cut by the Federal Reserve in September

- The European Central Bank may lower interest rates twice more this year

- EURUSD forecast for 23 August 2024: 1.1080, 1.1020, and 1.0960

Fundamental analysis

Following growth that many analysts considered excessive, the EURUSD rate shows signs of a correction. Investors anticipate that Federal Reserve Chair Jerome Powell’s speech at Jackson Hole will clarify the future direction of US monetary policy.

Markets will be closely watching for any hints of a potential interest rate change. Despite a reduced likelihood of a significant rate cut in September, investors still expect monetary policy easing. The possibility of a 50-basis-point interest rate cut by the Federal Reserve next month is currently estimated at 25%, down from 38% on Wednesday, while the likelihood of a 25-basis-point cut is 75%.

However, Powell may refrain from providing specific details, as crucial August employment and inflation data will be released after his speech but before the Federal Reserve meeting scheduled for 17-18 September.

Meanwhile, the European Central Bank will probably have two more interest rate cuts this year as inflation continues to ease, in line with ECB policymakers’ expectations. According to the EURUSD forecast for today, these prospects could support the US dollar and trigger a deeper correction in the currency pair.

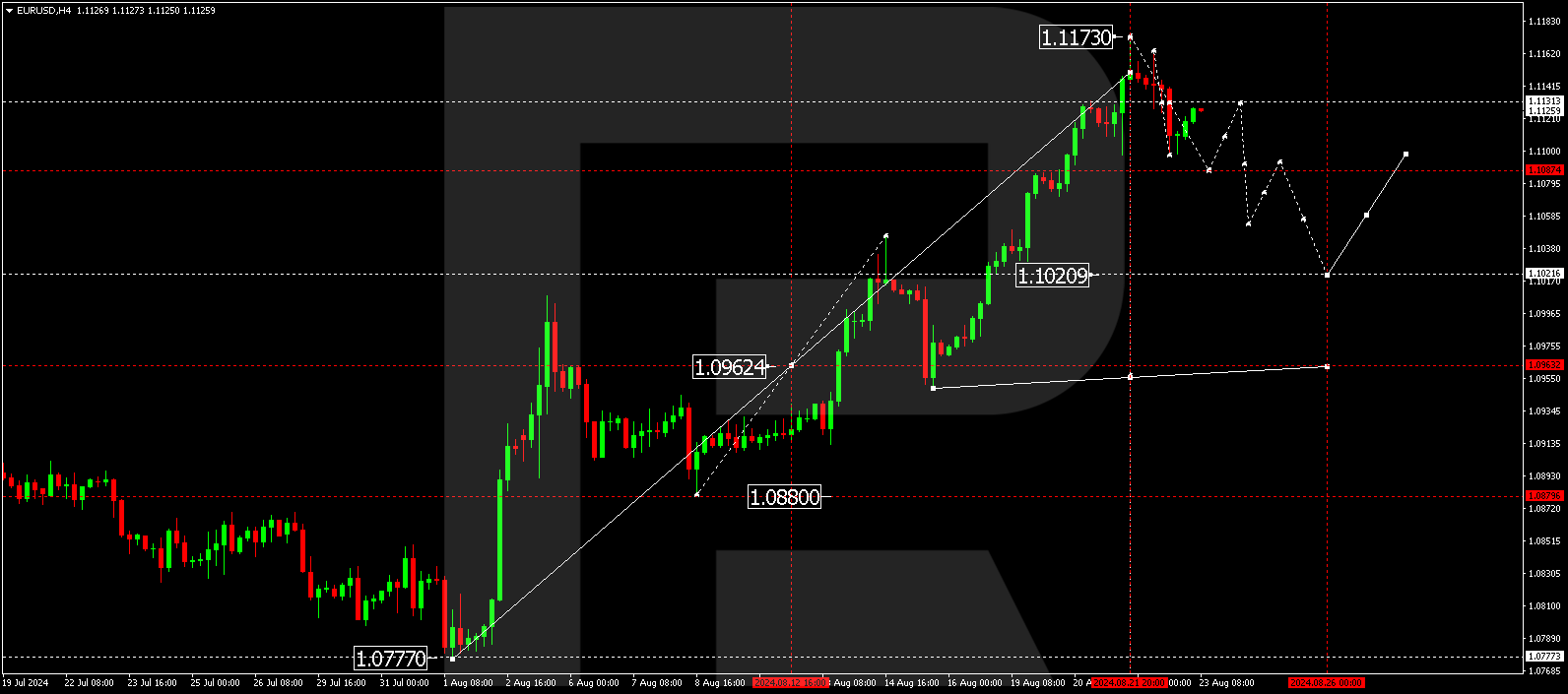

EURUSD technical analysis

The EURUSD H4 chart indicates that the market is forming a downward wave towards 1.1088. The price is expected to reach this level today, 23 August 2024. Subsequently, a rise to 1.1133 is possible. The boundaries of a new consolidation range are forming at the top of the growth wave. With a downward breakout of the range, the wave could continue to 1.1020, potentially extending to 1.0960. Conversely, with a breakout above the consolidation range, the EURUSD rate could rise to 1.1195 before declining to 1.0960, the first target.

Summary

Jerome Powell’s speech at Jackson Hole could significantly impact the EURUSD rate. Analysts believe the US dollar is nearing a point where it could be considered oversold, potentially triggering a substantial correction in the currency pair. Technical indicators in today’s EURUSD forecast suggest a decline to the 1.1080, 1.1020, and 1.0960 levels.