The EURUSD rate fell to 1.1550 amid a stronger US dollar and political instability in France. Discover more in our analysis for 14 October 2025.

EURUSD forecast: key trading points

- Market focus: market participants are awaiting Friday’s inflation data from the eurozone

- Current trend: moving downwards

- EURUSD forecast for 14 October 2025: 1.1650 or 1.1450

Fundamental analysis

The EURUSD pair continues to decline moderately amid signs of easing trade tensions between the US and China, with both governments expressing readiness to resume negotiations. Additional pressure on the euro comes from political instability in France.

Sébastien Lecornu, France’s fifth prime minister in two years, resigned last Monday but was reappointed on Friday. He now faces a challenging path towards political survival as he prepares to present a draft budget law.

EURUSD technical analysis

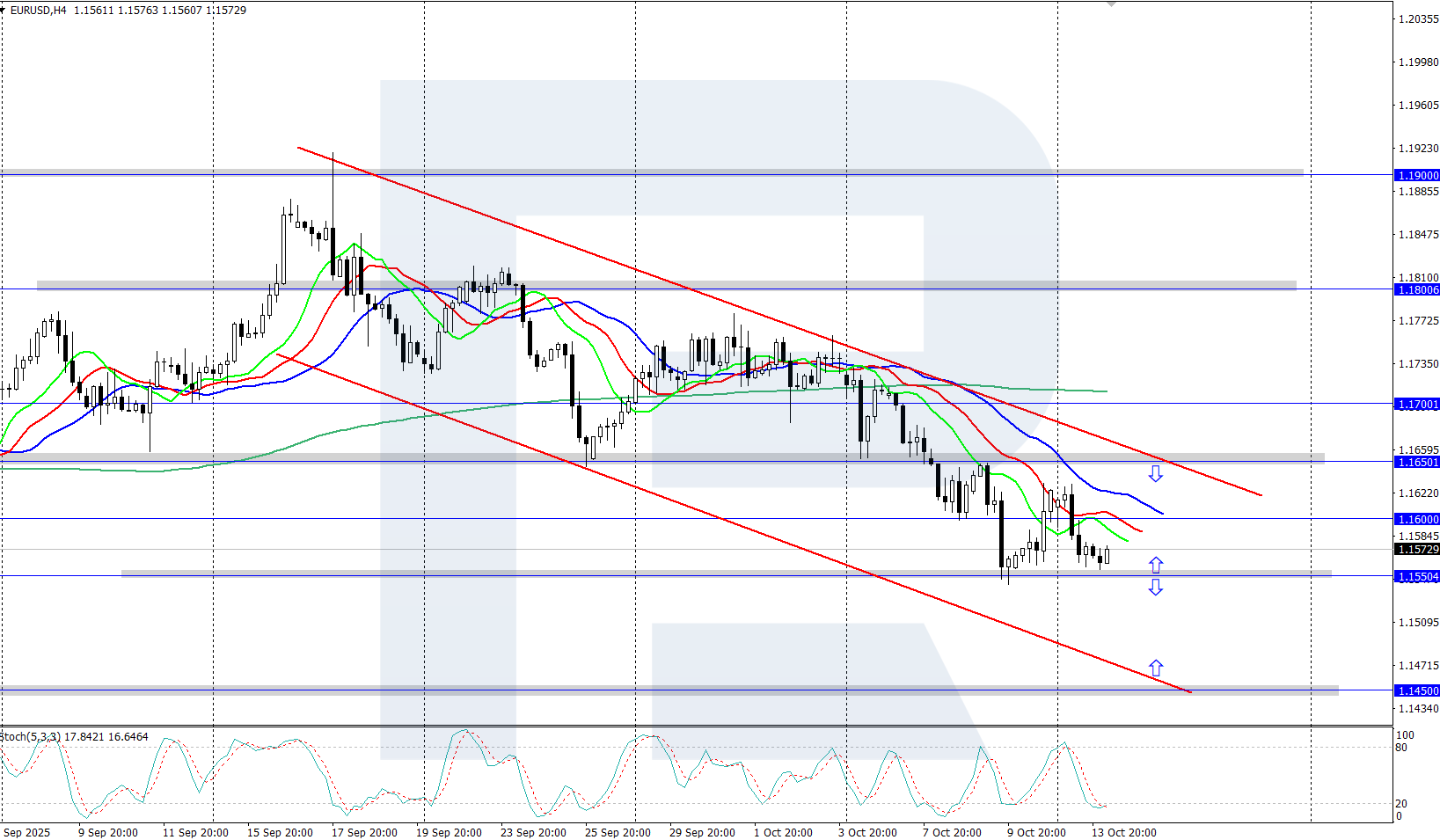

On the H4 chart, the EURUSD pair is edging lower from the 1.1900 resistance level. The market is currently in a local corrective decline, after which growth may resume. The key support level is now seen at 1.1550.

The short-term EURUSD forecast suggests that if buyers push the price above 1.1650, a further rise towards 1.1800 is possible. Conversely, if sellers gain a foothold below 1.1550, the pair could dip towards 1.1450.

Summary

The EURUSD rate entered a downward correction, trading below 1.1600. This week, market focus will be on upcoming eurozone inflation data.

Open Account