EURUSD: expectations for a 50-basis-point Fed interest rate cut are growing

The EURUSD rate is correcting after declining for three consecutive sessions, with losses exceeding 1.19%. Discover more in our analysis for 17 September 2024.

EURUSD forecast: key trading points

- The likelihood of a 50-basis-point Federal Reserve interest rate cut is 69%, while the odds of a 25-basis-point rate reduction is 31%

- Investors are awaiting data on US retail sales and industrial production today, which are projected to decrease slightly

- Some analysts believe the US economy continues to grow, which may support the US dollar

- EURUSD forecast for 17 September 2024: 1.1115 and 1.1026

Fundamental analysis

The EURUSD rate continues to test the 1.1130 level, with the US dollar remaining under pressure as investors await the crucial Federal Reserve meeting, where interest rates are expected to be cut for the first time since 2020.

The markets have already priced in a possible 25-basis-point Federal Reserve interest rate cut. However, expectations are rising for a more significant 50-basis-point cut. According to the CME FedWatch tool, the likelihood of this event currently stands at 69%, up from 59% a day ago. The odds of a more modest 25-basis-point cut are estimated at 31%.

Today, investors are awaiting the release of US retail sales and industrial production data to better assess the state of the economy. Forecasts suggest a slight decrease in the figures. According to some analysts, the US economy continues to grow, outperforming most other countries; hence, the US currency is not expected to weaken sharply.

Nevertheless, BNP Paribas experts believe the situation may change if the US economy begins to slow down. In case of a possible recession, the Federal Reserve will likely lower interest rates more aggressively than other central banks, which may weaken the US dollar and increase its vulnerability.

As shown by Goldman Sachs research, the US dollar typically strengthens if rates are reduced amid economic growth. It is also noted that the US currency shows strong positions if the Federal Reserve cuts rates simultaneously with other central banks. In the current situation, several major central banks are cutting rates, which may positively impact the US dollar movements as part of today’s EURUSD forecast.

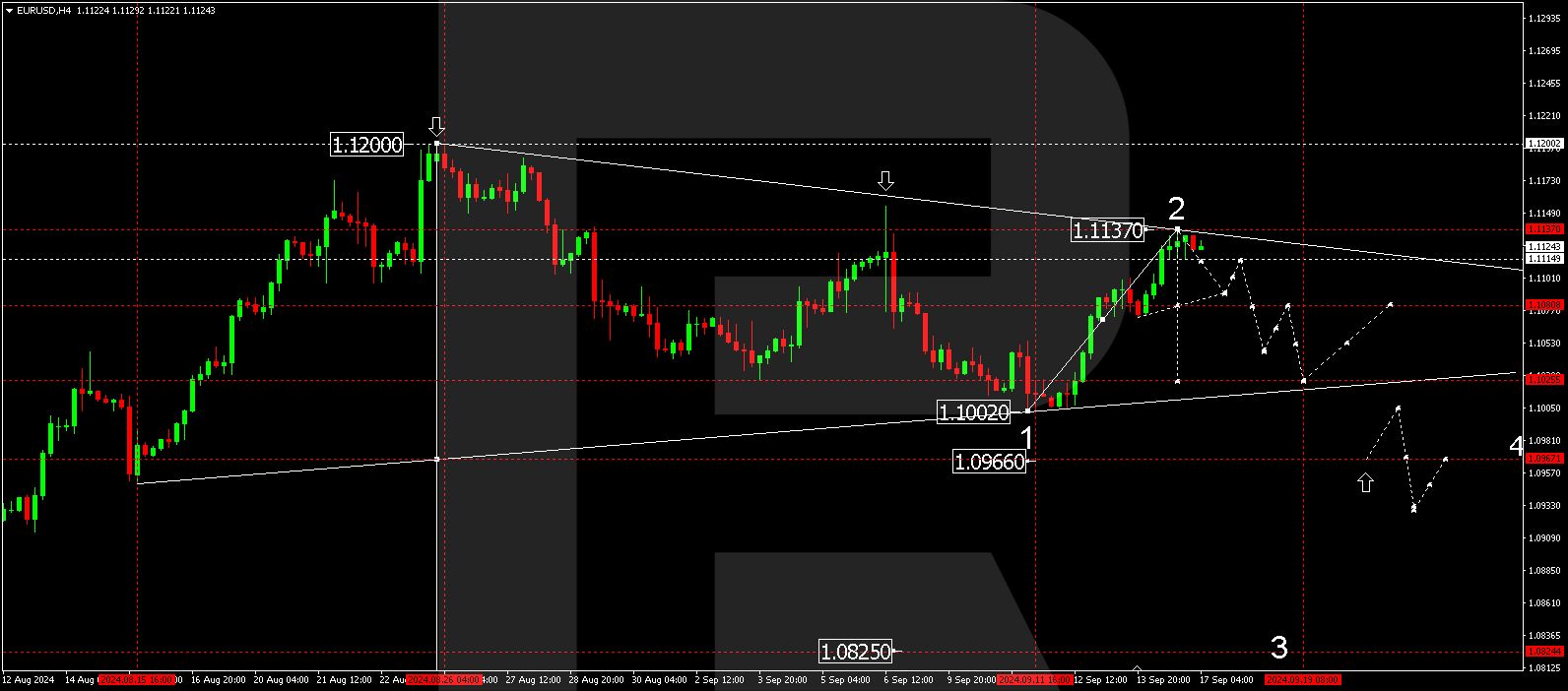

EURUSD technical analysis

The EURUSD H4 chart shows that the market has completed a growth wave, reaching 1.1137. A consolidation range could develop below this level today, 17 September 2024. It will be relevant to consider a potential decline to 1.1115. Breaking below this level may signal a further downward movement, with the target at 1.1026, the lower boundary of the triangle pattern. After reaching this level, the price could rise to 1.1080. Alternatively, the price might break above the current highs, surging to 1.1155. Subsequently, a new downward wave could develop, aiming for 1.1000.

Summary

The US dollar remains under pressure amid expectations of a Federal Reserve interest rate cut. Forecasts for today’s US economic data suggest a slight decline. However, experts’ opinions are divided, with some predicting a weakening of the US dollar in case of a recession and others expecting it to strengthen if the Federal Reserve lowers interest rates simultaneously with other major global central banks. Technical indicators in today’s EURUSD forecast suggest that a downward wave could start, aiming for the 1.1115 and 1.1026 levels.