The EURUSD pair dipped to 1.0387 on Friday. The US tariff actions force the market to move cautiously. Find out more in our analysis for 28 February 2025.

EURUSD forecast: key trading points

- The EURUSD pair is falling for the third consecutive day

- The market avoids risks due to concerns about the US tariff plans to impose higher trade tariffs next week

- EURUSD forecast for 28 February 2025: 1.0371 and 1.0316

Fundamental analysis

The EURUSD rate plunged to 1.0387, marking the third consecutive day of decline for the primary currency pair.

The US dollar rose by nearly 1% yesterday after US President Donald Trump confirmed the news about trade tariffs. They will take effect from 4 March: 25% tariffs on Canada and Mexico and 10% tariffs on China.

Despite the current decline, the EURUSD pair ends February with gains. Investors now expect two Federal Reserve interest rate cuts in 2025. This is due to the latest macroeconomic reports, which reflected worrying signals. For example, the second US GDP estimate for Q4 2024 showed a slowdown in growth to 2.3% from 3.1% in Q3.

The market now has the US core PCE data on its radar, which is scheduled for release today.

The EURUSD forecast is negative.

EURUSD technical analysis

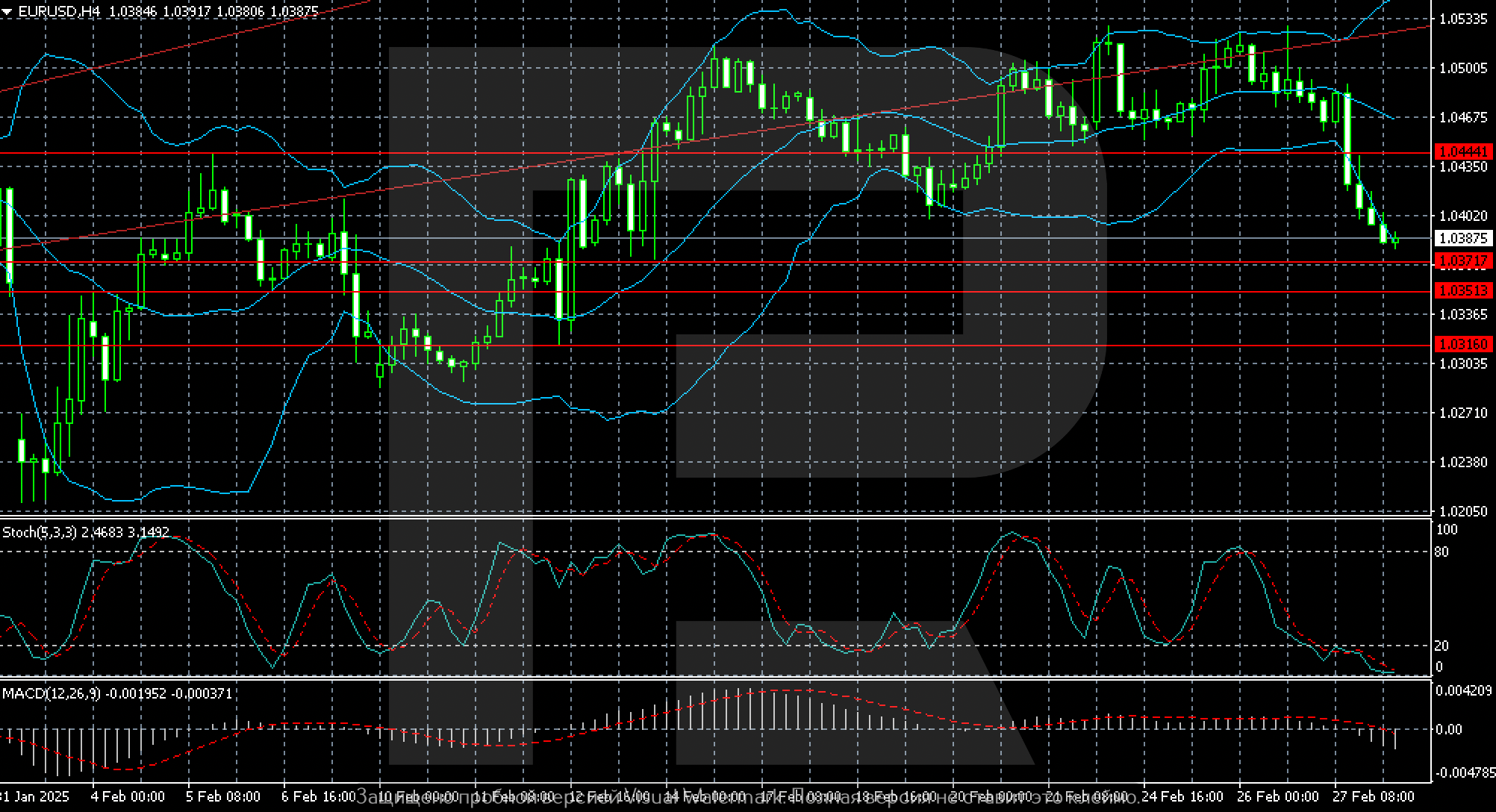

The EURUSD H4 chart shows a directional movement towards the intermediate support level at 1.0371, from where the market will move to 1.0351. A stronger support level is at 1.0316.

Summary

The EURUSD pair is falling for the third consecutive day. Investors assess the risks of aggravation of the global situation as very high. The EURUSD forecast for today, 28 February 2025, suggests a decline to 1.0316 through the 1.0371 and 1.0351 support levels.