The EURUSD pair declined on Friday, supported by robust US macroeconomic data. Read more in our analysis for 30 August 2024.

EURUSD forecast: key trading points

- EURUSD pair hits two-week low

- The dollar was bolstered by a strong GDP report and a slight moderation in expectations for the upcoming Federal Reserve meeting in September

- EURUSD forecast for 30 August 2024: 1.1121 and 1.1040

Fundamental analysis

On Friday, the EURUSD price fell to 1.1075.

The previous day's robust US statistics supported the dollar, reducing expectations for an aggressive rate cut by the Federal Reserve.

US GDP for Q2 2024 grew by 3.0% year-on-year, revised up from an earlier estimate of 2.8%. The unexpected improvement boosted market sentiment, indicating a more confident US consumer than anticipated. Currently, the base case scenario suggests a 25 basis point cut in the Fed Funds rate in September, with the likelihood of a 50 basis point cut now at 34%, down from 38% the previous day.

If the dollar maintains upward momentum, the week could end positively, potentially breaking a five-week losing streak. The EURUSD outlook remains favourable for the US dollar.

EURUSD technical analysis

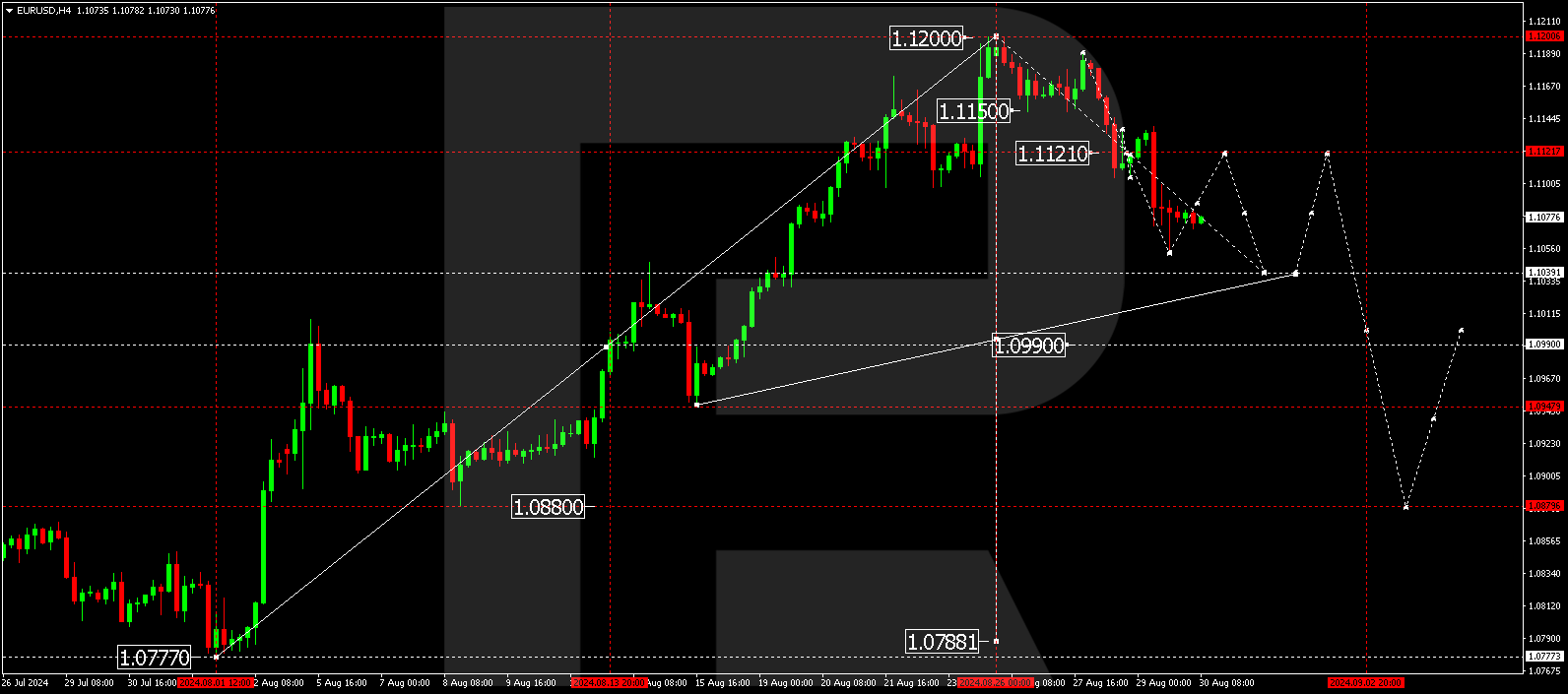

On the H4 chart, EURUSD quotes have reached a local target at 1.1055. An upward correction to 1.1121 (a test from below) is possible today, 30 August 2024. Following this, a further decline towards 1.1040 is expected, marking the first decline phase. After reaching 1.1040, a correction towards 1.1120 could occur.

Summary

EURUSD may interrupt its five-week rally and close the week with a decline. Technical indicators for today’s EURUSD forecast suggest a possible correction to 1.1121, followed by a decline to 1.1040.