EURUSD forecast: strong US employment data puts pressure on the euro

EURUSD is declining for the fifth consecutive trading session. Read more in our comprehensive EURUSD analysis for today, 3 October 2024.

EURUSD forecast: key trading points

- In September, the number of jobs in the US private sector increased by 143,000

- The US manufacturing sector continues to shrink, with the ISM index at 47.2 points, indicating a six-month decline

- Investors’ attention is focused on the jobless claims data and the US employment report

- EURUSD forecast for 3 October 2024: 1.0982 and 1.0967

Fundamental analysis

EURUSD continued to decline on Thursday, approaching the significant support level of 1.1000. The strengthening of the US dollar is due to strong data on private sector employment, which has reduced the likelihood of aggressive Federal Reserve interest rate cuts. The probability of a 50-basis-point cut in November has dropped to 37.1% from 38.2%, while a softer 25-basis-point cut is now estimated at 62.9%.

According to the ADP report released on Wednesday, US private sector jobs increased by 143,000 in September, surpassing the forecasted 116,000. This is the highest figure in the last three months, reflecting a stable labour market, which puts additional pressure on the euro. For today’s EURUSD forecast, this trend suggests further declines in the currency pair.

Investors are particularly focused on upcoming jobless claims data on Thursday and the critical US jobs report on Friday, which could offer more clarity on the Fed’s future moves.

Meanwhile, US economic data presents a mixed picture. The manufacturing sector continues to contract, with the ISM Business Activity Index marking six consecutive months of decline at 47.2 points.

EURUSD technical analysis

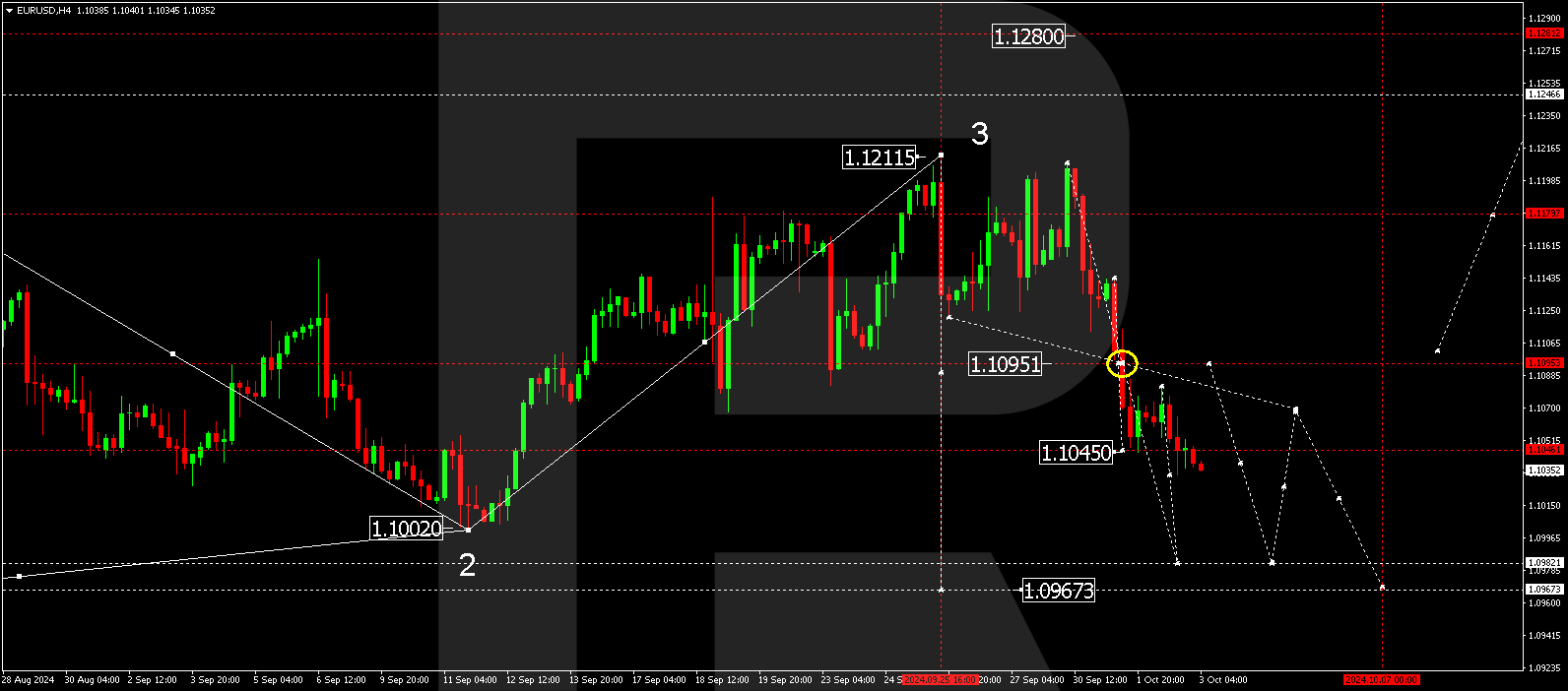

On the H4 chart of EURUSD, the market executed a downside wave structure to 1.1045 and a correction to 1.1082. Today, 3 October 2024, the market continued to develop a downward wave. At the moment, the level of 1.1045 has been broken downwards. The potential for a downward wave to the level of 1.0982 is open. After working off this level, a correction to 1.1095 (test from below) is possible. After the completion of this correction, we expect the beginning of a wave of decline in EURUSD to the level of 1.0967. The target is local.

Summary

EURUSD remains under pressure due to the strengthening US dollar, supported by robust employment data and expectations of future Fed actions. However, the slowdown in the US manufacturing sector raises concerns about the overall strength of the economy, which may provide temporary support for the euro near the 1.1000 level. Technical indicators suggest the downside wave continues, with key levels to watch at 1.0982 and 1.0967 in today’s EURUSD forecast. Keep an eye on key data releases for potential shifts in market sentiment.