The EURUSD pair continues to fall. The market expects Friday’s inflation data to decrease, which supports the US dollar.

The primary currency pair dipped to lows seen on 1 May

The latest statistics showed that US new home sales decreased to 0.62 million in May from the previous 0.63 million, falling short of the expected 0.64 million.

The entire currency market eagerly awaits Friday’s core Personal Consumption Expenditures report. The core PCE is the US Federal Reserve’s favourite inflationary component, based on which it makes its monetary decisions. These expectations fully offset the significance of the previously released statistics. Core PCE is expected to show a decrease in the indicators. However, today’s report on weekly jobless claims can attract attention as the market needs signals about easing conditions in the employment sector.

Yesterday, the US treasury bond yield increased significantly across the range, bolstering the USD position and causing other currencies to decline.

EURUSD technical analysis

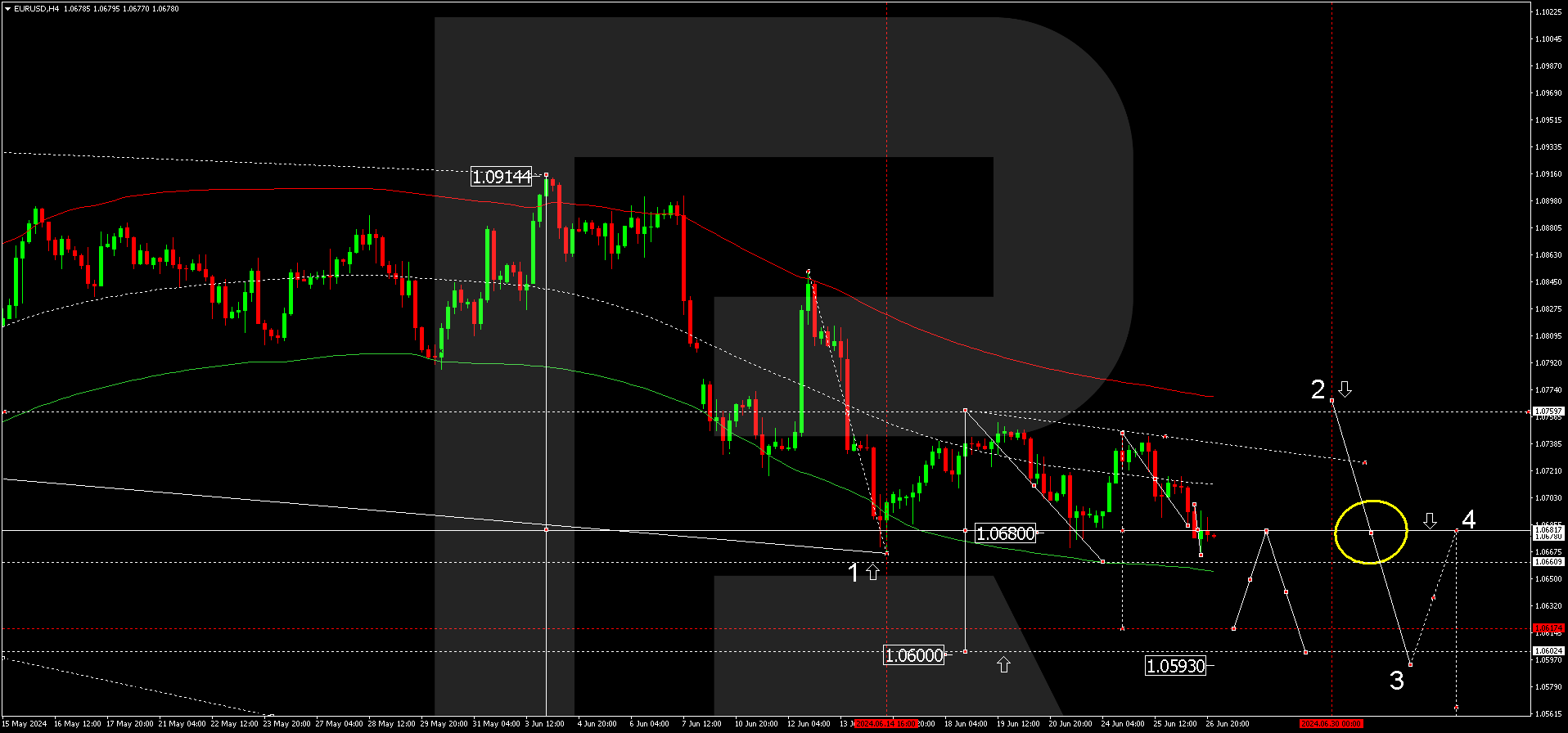

On the H4 chart, EURUSD has completed a decline wave, reaching 1.0660. A consolidation range is currently forming around 1.0680, a crucial level for the EURUSD forecast for 27 June 2024. A downward breakout will open the potential for a decline wave towards 1.0616, potentially continuing to the local target of 1.0600.

EURUSD technical analysis 27.06.2024

The Elliott Wave structure and a wave matrix with a pivot point at 1.0680 technically confirm this scenario. This level is considered crucial for a downward wave in the EURUSD rate. The market continues declining to the Envelope’s lower boundary, with the downtrend remaining relevant today. A growth wave aiming for the Envelope’s upper boundary might start only after the price reaches 1.0600.

Summary

The EURUSD technical analysis suggests a further decline towards the 1.0600 and 1.0570 targets. The news factor may contribute to this scenario.