The EURUSD pair reacts strongly to the Federal Reserve decision, with the euro attempting to build up upward momentum. Discover more in our analysis for 19 September 2024.

EURUSD forecast: key trading points

- The EURUSD pair may rise

- A Federal Reserve interest rate cut will exert long-term pressure on the US dollar

- EURUSD forecast for 19 September 2024: 1.1055

Fundamental analysis

The EURUSD rate is rising to 1.1126 on Thursday.

The US Federal Reserve lowered the interest rate by 50 basis points to 5.00% per annum from the previous 5.50%. The market believes the rate will be cut by another 50 basis points by the end of 2024 and by 100 basis points in total in 2025. The interest rate is expected to range between 2.75 and 3.00% in 2026, but these are just stock market forecasts.

The Federal Reserve is very cautious, noting in accompanying comments that it will not rush with rate cuts. At the same time, the regulator assessed inflation quite positively, believing that it would fall to the 2.00% target.

The US dollar came under pressure at the moment of the Fed’s statements but later cut its losses. From a fundamental perspective, the monetary policy easing stance will have a long-term negative impact on the USD position. The EURUSD forecast remains in favour of the euro.

EURUSD technical analysis

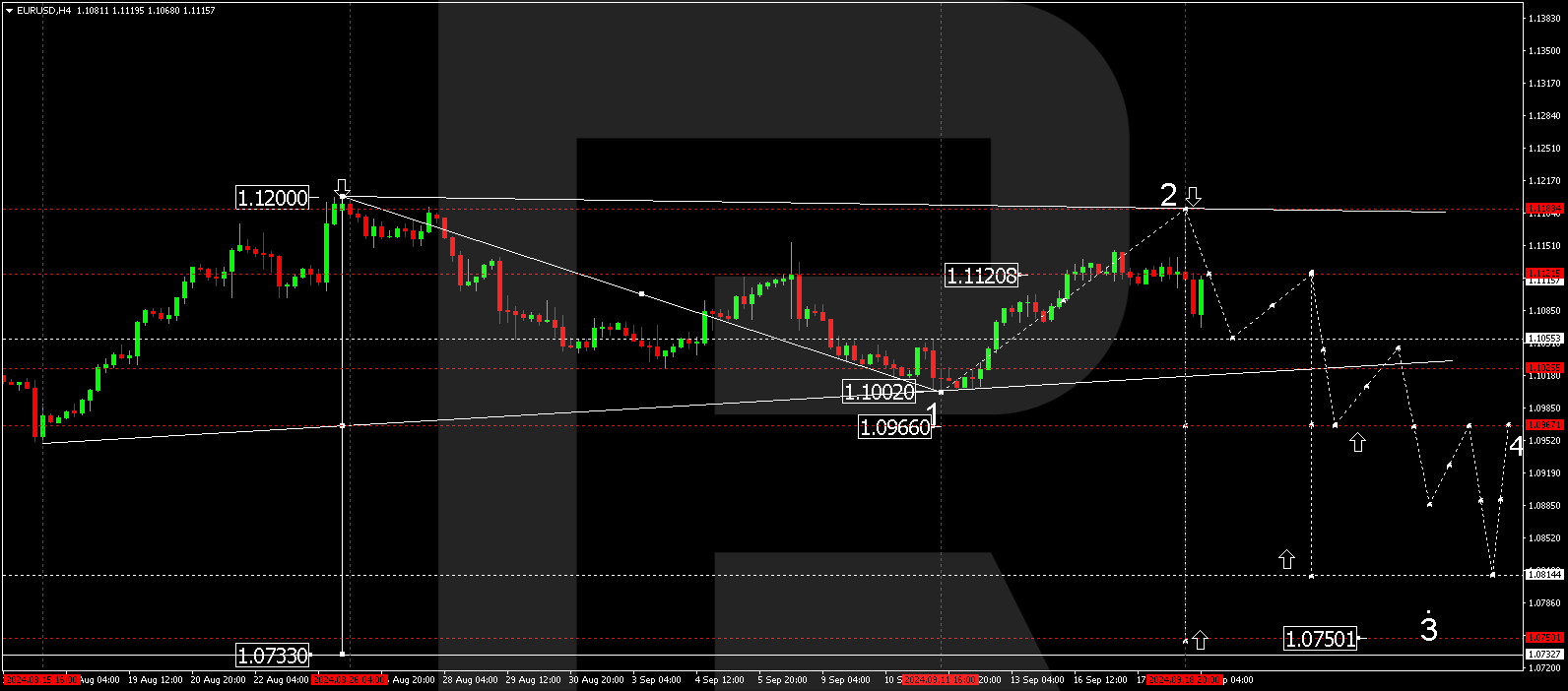

The EURUSD H4 chart shows that the market has pushed the price to 1.1188 on the fundamental background. A downward wave is currently forming, aiming for 1.1055. The price reached the downward wave’s local target of 1.1068 today, 19 September 2024. It will be relevant to consider a potential correction towards 1.1127. Once the correction is complete, the price could decline to 1.1055, the first target.

Summary

The EURUSD pair is looking for options for recovery. Investors reacted very emotionally to the US Federal Reserve's decision. Technical indicators in today’s EURUSD forecast suggest a potential downward wave to the 1.1055 level.