The USD continues to lose ground against the euro, and with the ECB’s upcoming decision, the EURUSD rate could soar towards 1.1750. Discover more in our analysis for 8 August 2025.

EURUSD forecast: key trading points

- Appointment of Stephen Miran to the FOMC Board

- The euro corrects after strengthening against the USD

- EURUSD forecast for 8 August 2025: 1.1750 and 1.1580

Fundamental analysis

The EURUSD outlook remains positive for the euro. The market faces uncertainty around the US Federal Reserve. The appointment of Stephen Miran to the FOMC Board surprised many investors. Expectations of Fed monetary policy easing are gradually weakening the US dollar. This news benefits the euro, which continues to strengthen as confidence in the USD wanes.

The ECB shows no rush to ease monetary policy amid some inflation stabilisation, with July’s figure holding steady at 2%, matching previous forecasts.

The central bank maintains a wait-and-see approach regarding interest rate changes, providing significant support to the euro. The next eurozone rate review is scheduled for September, and many economists believe the ECB may keep the rate unchanged, given the current level of inflation risks.

EURUSD technical analysis

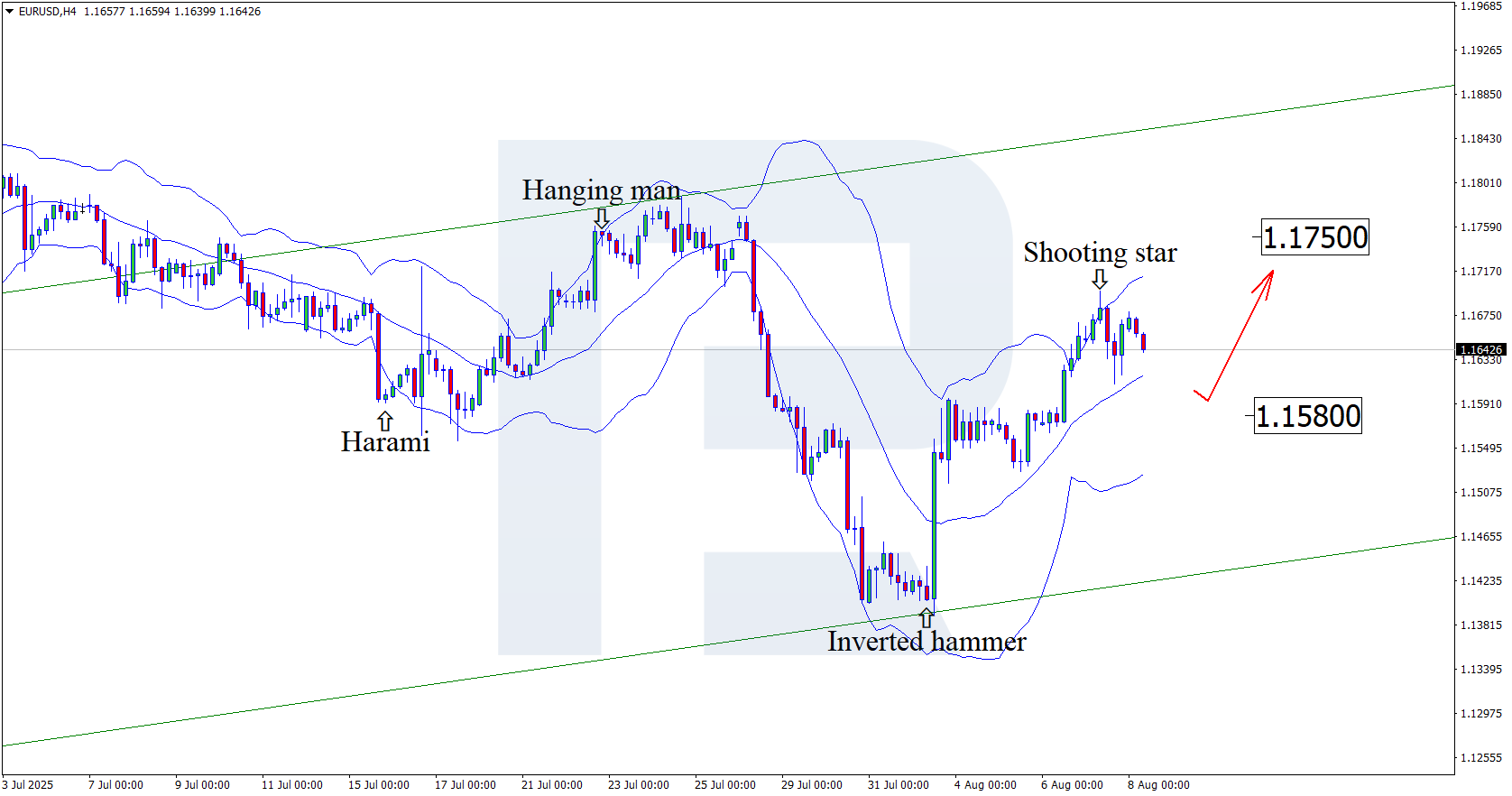

On the H4 chart, the EURUSD pair has formed a Shooting Star reversal pattern near the upper Bollinger Band. At this stage, the pair may continue a corrective wave in line with this signal. Considering the recent sharp rise in quotes, a pullback towards the nearest support level at 1.1580 is possible. A rebound from this support would open the way for a continued upward movement.

However, today’s EURUSD forecast does not rule out a rise towards 1.1750 without testing the support level.

Summary

The appointment of Stephen Miran to the FOMC Board and expectations of Federal Reserve monetary policy easing weigh on the USD. Technical analysis of EURUSD suggests a move towards the 1.1750 resistance level after the correction is completed.