The EURUSD pair is moving towards equilibrium. Bets on the Federal Reserve’s quick responses have diminished. Find out more in our analysis dated 9 August 2024.

EURUSD trading key points

- The EURUSD pair is stabilising

- The Federal Reserve’s target is price stability, not responses to stock market sentiment

- EURUSD forecast for 9 August 2024: 1.0944, 1.0888, and 1.0833

Fundamental analysis

The EURUSD rate is stabilising around 1.0921 at the end of this volatile week. The market is gradually finding equilibrium. No new crucial macroeconomic statistics are due for release. All the published data is already factored into prices.

The President of the Federal Reserve Bank of Chicago, Austan Goolsbee, clarified market expectations yesterday, stating that it is not the Fed’s role to react to stock market crashes. According to Goolsbee, the primary goals of the Federal Reserve are to stabilise price pressure and improve employment. Additionally, he noted that the Federal Reserve has clear criteria for deciding whether to lower interest rates or maintain them at their current level.

The market, which had previously attempted to place greater responsibility on the Fed, needed such clear comments. With no crucial data being released, investors are compelled to search for reasons for market movement within the information landscape.

EURUSD technical analysis

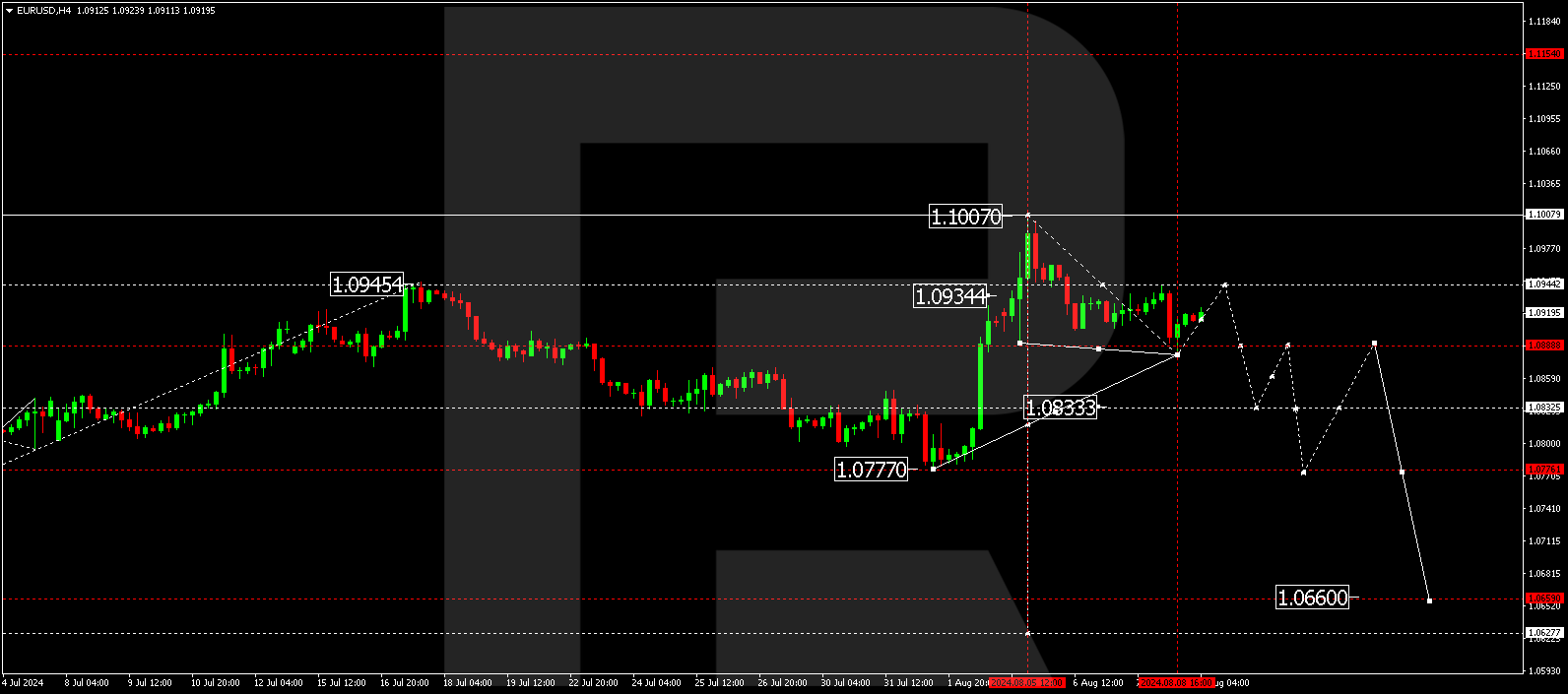

The EURUSD H4 chart indicates that the market has formed an initial downward wave towards 1.0880. A corrective wave is forming today, 9 August 2024, aiming for 1.0944. Once this correction is complete, a new downward wave could begin, targeting 1.0888. A breakout below this level will open the potential for a decline to the local target of 1.0833, which aligns with the trend.

Summary

Volatility in the EURUSD pair is gradually subsiding. Technical indicators in today’s EURUSD forecast suggest a correction towards 1.0944, followed by a decline to the 1.0888 and 10833 levels.