EURUSD: investors await inflation data

The EURUSD rate is slightly rising after rebounding from the 1.0830 support level. Will the US dollar strengthen? Find out in our analysis dated 26 July 2024.

EURUSD trading key points

- US GDP rose by 2.8% year-over-year in Q2

- Germany’s Ifo Business Climate Index fell to 87 points

- Traders focus on US inflation data

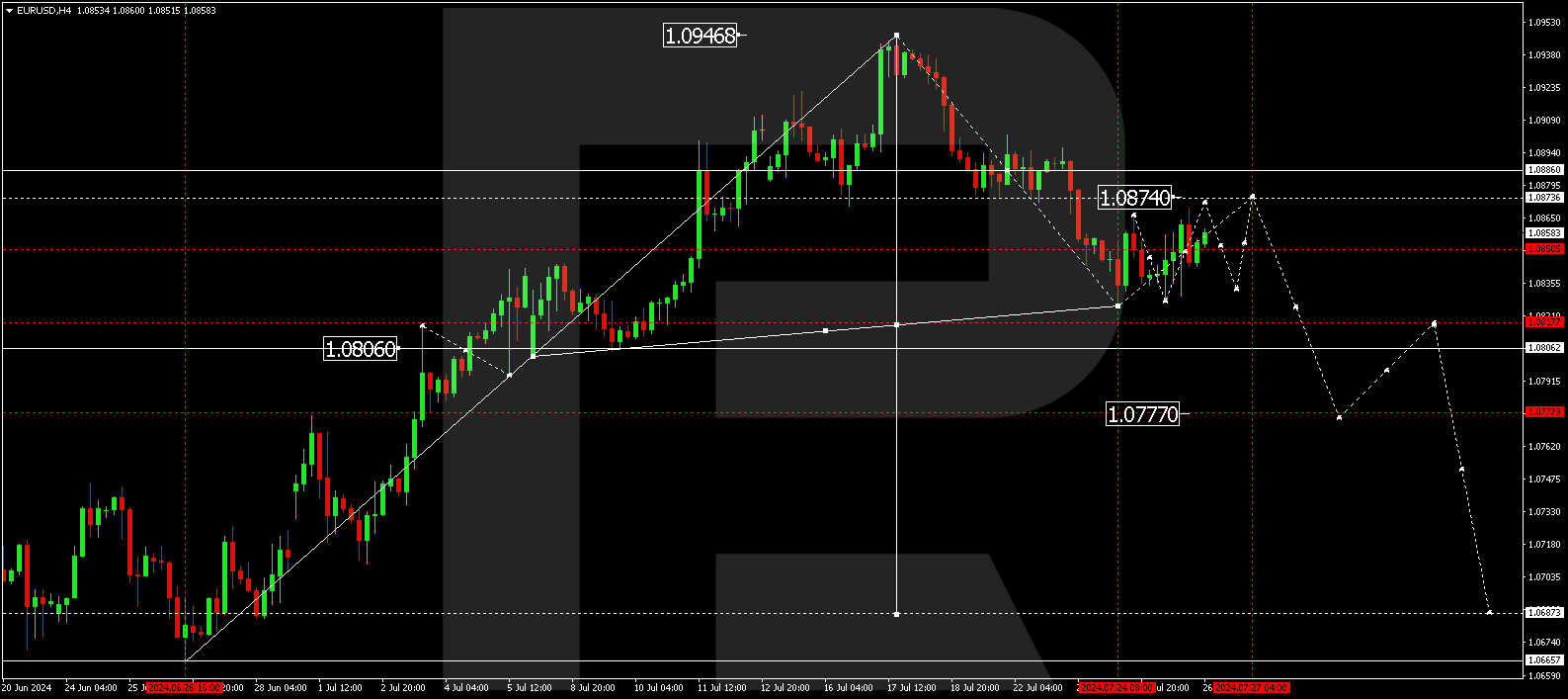

- EURUSD forecast for 26 July 2024: 1.0874, 1.0818, and 1.0777

Fundamental analysis

The forecast for 26 July 2024 shows that the US economy continues to grow in Q2 2024, albeit at a slowing pace. According to preliminary data from the US Department of Commerce, GDP increased by 2.8% year-over-year, slightly exceeding analysts’ expectations. However, this is the lowest reading in the past several quarters, indicating US economic slowdown amid tightening monetary policy. Markets continue to price in a 100% chance of a Federal Reserve cut in September, with expectations for at least one more cut by the end of the year.

Meanwhile, Germany’s Ifo Business Climate Index continues to decline, reaching 87 points in July, the lowest reading since February 2024. This reflects rising concerns of German businesses about the country’s economic outlook and exerts pressure on the euro rate.

Today, traders focus on the PCE price index report, a key inflation gauge for the Federal Reserve. Previous data showed that inflation eased in Q2 but remained elevated. The overall PCE index rose by 2.6%, while the core index, which reflects steady inflation trends, increased by 2.9%. This data indicates persisting inflationary pressure in the economy and confirms traders’ expectations of a Federal Reserve interest rate cut in September.

EURUSD technical analysis

On the EURUSD H4 chart, a consolidation range continues to develop around 1.0850. The forecast for today, 26 July 2024, suggests a rise to 1.0870, followed by a decline to 1.0833. Subsequently, the EURUSD rate could increase to 1.0874. A correction of the previous decline wave could form. Once the correction is complete, a new decline wave is expected to begin, targeting 1.0818 and potentially extending to the local target of 1.0777.

Summary

Slowing GDP growth and easing US inflation may lead to a Federal Reserve interest rate cut. However, the worsening business climate in Germany exerts pressure on the euro, preventing a significant decline in the EURUSD rate. Today’s EURUSD forecast aligns with the technical analysis of indicators, suggesting a potential corrective wave towards 1.0874 and a subsequent decline to the 1.0818 and 1.0777 targets.