EURUSD is in a consolidation phase following a sharp decline: the market is too nervous

The euro hit a new low before recovering. Investors are observing signs of a slowdown in European economies. Find out more in our analysis for 25 November 2024.

EURUSD forecast: key trading points

- The EURUSD pair reached a new low and recovered

- Investors expect a swift reduction in ECB interest rates to support weak economies

- EURUSD forecast for 25 November 2024: 1.0500 and 1.0414

Fundamental analysis

The EURUSD rate is hovering around 1.0476 on Monday after dropping to 1.0331 earlier.

A rather gloomy business survey triggered the euro’s decline, which revealed a contraction in the two largest European economies – France and Germany – in November. The market believes that the re-election of Donald Trump as US president will further weaken the already fragile European economy. Potential import duties could hurt Germany’s export-oriented economy. These risks are significant, putting substantial pressure on the EUR rate.

As a result, the market is betting that the ECB will lower interest rates more aggressively to address the economic weakness. At the same time, the Federal Reserve is expected to take a more cautious approach. An increase in the interest rate differential will make the euro less appealing, boosting demand for dollar-dominated assets.

Today’s EURUSD forecast is cautious.

EURUSD technical analysis

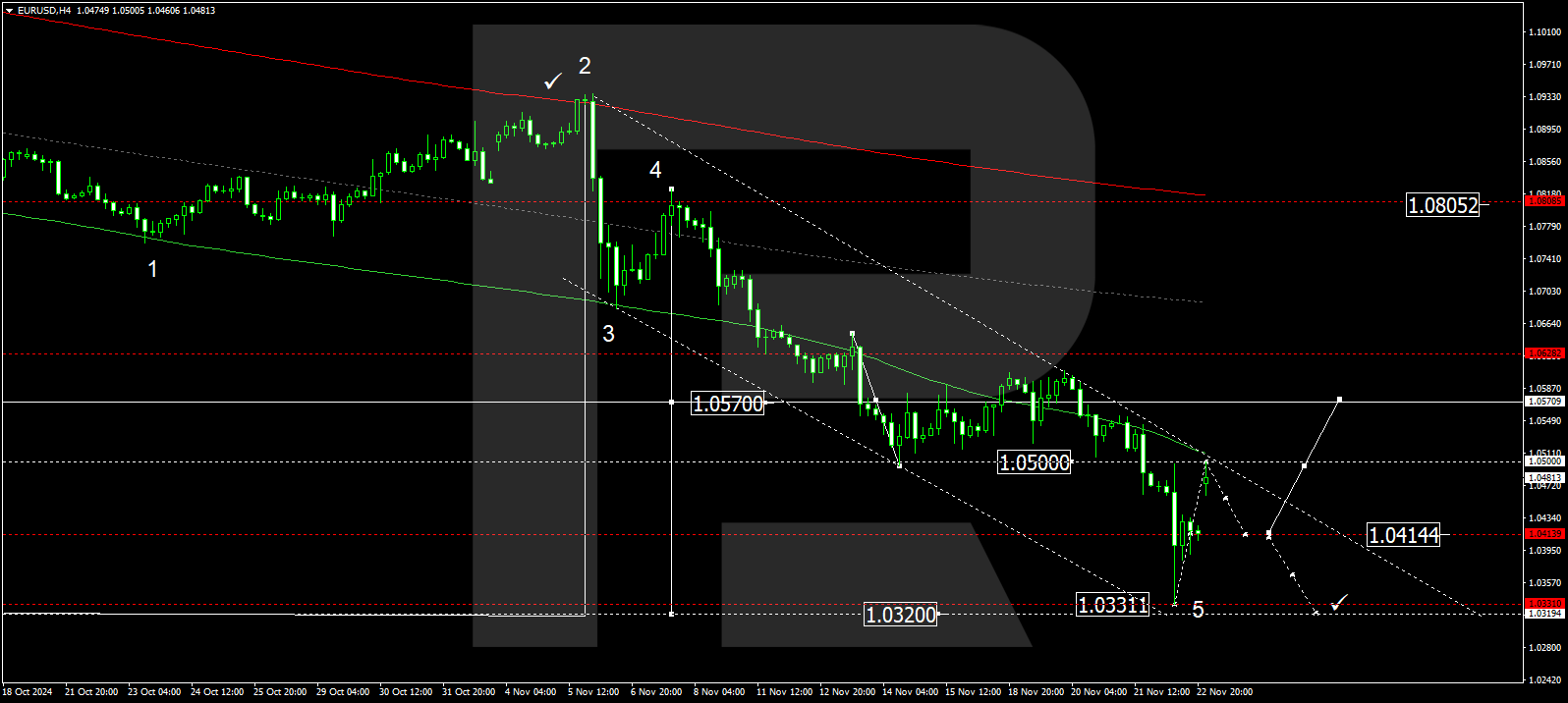

The EURUSD H4 chart shows that the market has completed a downward wave towards 1.0331 before rising to 1.0414. Today, 25 November 2024, the market broke above this level and corrected towards 1.0500. A decline towards 1.0414 is expected, with the potential of a new consolidation range to form around this level. An upward breakout would open the potential for continuing the correction towards the 1.0570 level, while a downward breakout could push the price down to 1.0320. A growth wave is expected once the price reaches this level, targeting 1.0805.

The Elliott Wave structure and matrix for the second half of the downward wave, with a pivot point at 1.0500, technically support this scenario. This level is considered crucial for the EURUSD rate in the context of the downward wave. The market has declined to the lower boundary of a price envelope at 1.0331. A correction towards the 1.0500 level is worth considering. After reaching this level, a further decline towards the envelope’s lower boundary is expected.

Summary

The EURUSD pair dropped under pressure from gloomy expectations about the European economies. This is a significant pressure factor. Technical indicators for today’s EURUSD forecast suggest a potential growth wave towards the 1.0500 level, followed by a decline to 1.0414.