Today’s speech by Fed official Christopher J. Waller could trigger a fresh rally in the EURUSD pair towards 1.1550. Discover more in our analysis for 14 April 2025.

EURUSD forecast: key trading points

- US consumer inflation expectations: previously at 3.1%

- Speech by Federal Reserve Governor Christopher J. Waller

- EURUSD forecast for 14 April 2025: 1.1550 and 1.1320

Fundamental analysis

Fundamental analysis for 14 April 2025 takes into account that Christopher J. Waller, a key voice in the FOMC, will deliver a speech today. His comments often shape rate expectations, and given the current inflation backdrop and monetary policy uncertainty, any hints from Waller about tightening or easing could immediately impact the EURUSD rate.

Markets will be watching closely for his view on inflation persistence and the Fed's willingness to adjust its course. Even neutral remarks could spark short-term volatility in the currency market and influence the EURUSD forecast.

The EURUSD forecast for today takes into account the release of data on US consumer inflation expectations. The previous figure stood at 3.1%. A reading unchanged from the previous period may support the US dollar.

Overall, the EURUSD outlook appears optimistic for the euro, with further gains likely.

EURUSD technical analysis

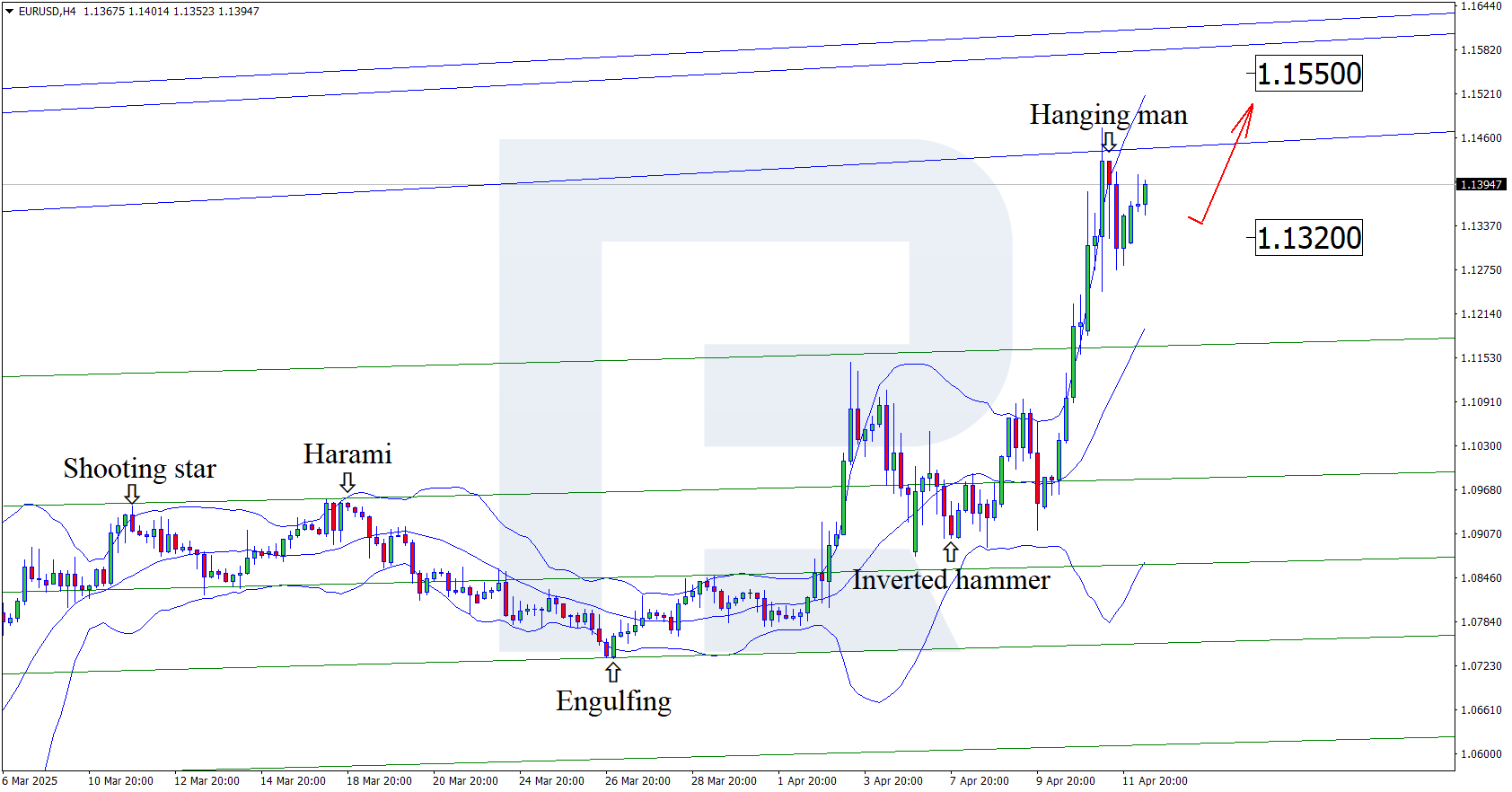

On the H4 chart, the EURUSD price has formed a Hanging Man reversal pattern near the upper Bollinger band. The pair is currently completing a correction following the received signal. Since the price remains within an ascending channel, a rebound is expected, with an upside target at the 1.1550 resistance level. A breakout above this level would signal further upside.

However, the EURUSD rate could correct towards 1.1320 and gain upward momentum after testing the support level.

Summary

Waller’s speech today may serve as a key catalyst for EURUSD movement. Even subtle hints about the Federal Reserve’s future policy could trigger heightened volatility. The EURUSD technical analysis suggests growth towards 1.1550.