EURUSD is under pressure amid ECB statements

The EURUSD rate has declined slightly, with the current price at 1.0397. More details in our analysis for 24 December 2024.

EURUSD forecast: key trading points

- Christine Lagarde stated that progress is being made in the fight against inflation as it approaches the 2.0% target in the eurozone

- The US Consumer Confidence Index fell to 104.7 points in December, significantly below forecasts

- US new home sales rose by 5.9% in November, exceeding expectations and reaching 664 thousand homes year-on-year

- EURUSD forecast for 24 December 2024: 1.0340 and 1.0305

Fundamental analysis

The EURUSD rate is declining for the second consecutive trading session despite ECB President Christine Lagarde’s statements on significant progress in controlling inflation within the eurozone. The head of the regulator noted that inflation is approaching the 2.0% target. However, she emphasised the need for caution due to the persistent growth in consumer prices in the services sector, which nearly doubles expectations. This suggests a negative inflationary impact on specific sectors of the economy and necessitates close monitoring by the ECB. According to today’s EURUSD forecast, this may put downward pressure on the European currency’s value.

The US Consumer Confidence Index unexpectedly fell to 104.7 points in December, well below the revised November figure and analysts’ forecasts of 113.0. This decline may signal growing concerns among Americans regarding the economy and its future outlook.

Meanwhile, US new home sales in November exceeded expectations, rising by 5.9% compared to October and reaching 664 thousand homes year-on-year. The Department of Commerce data indicates that the figure outpaced analysts’ forecasts, who predicted growth to 650 thousand homes.

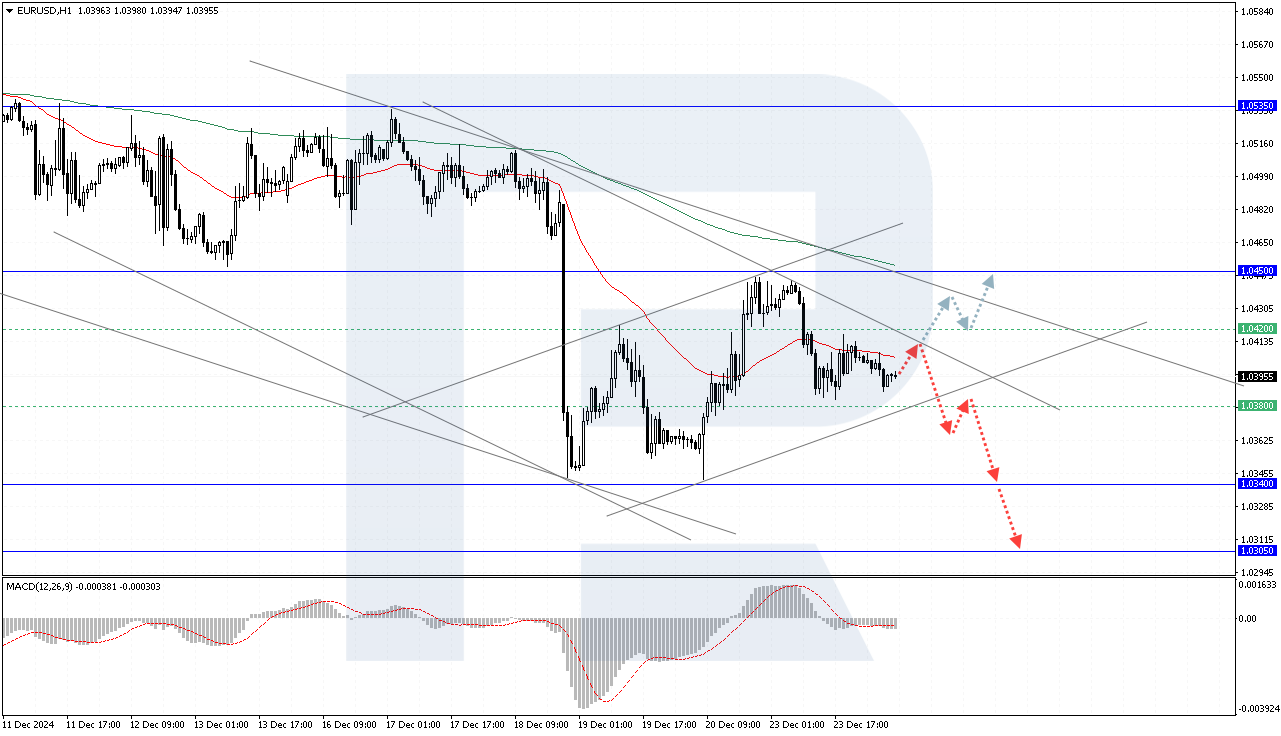

EURUSD technical analysis

The EURUSD quotes declined after rebounding from the EMA-45, indicating persistent seller pressure. According to today’s EURUSD forecast, a minor bullish correction is expected, with the price testing the 1.0410 level before falling to 1.0340. A breakout below this level will allow sellers to target 1.0305.

A breakout below the lower boundary of a corrective channel, with the price securing below 1.0380, will further support the bearish scenario. An alternative scenario suggests consolidation above the 1.0420 resistance level. In this case, the price will potentially move upward towards 1.0450. A breakout above this level will propel the EURUSD pair towards 1.0535.

Summary

The ECB is making progress in fighting inflation. However, the regulator must monitor high service cost growth rates. The decrease in consumer confidence in the US contrasts with the growth in new home sales, indicating mixed signals in the economy. The EURUSD technical analysis suggests that the main scenario is a decline in the pair to the 1.0340 and 1.0305 levels. An alternative scenario suggests corrective growth, provided the price secures above the 1.0420 resistance level.