The EURUSD pair is poised for a correction. The strain level has subsided. Find out more in our analysis dated 6 August 2024.

EURUSD trading key points

- The EURUSD pair has reached a new peak and declined

- Easing speculation about interest rates will support the US dollar

- EURUSD forecast for 6 August 2024: 1.0903, 1.0820, and 1.0800

Fundamental analysis

The EURUSD pair retreated to 1.0951 on Tuesday. The market slightly cooled after the price reached a new multi-week high of 1.1010 yesterday.

Investors had previously positioned themselves against the US dollar in response to Friday’s US employment market statistics and their concerns about a potential recession, with a subsequent weak ISM manufacturing report adding to these fears. In this context, investors expected the Federal Reserve to lower interest rates immediately to prevent a recession. Such actions by the Fed could undermine confidence in the regulator and adversely impact inflation expectations.

The market is gradually stabilising now. The Federal Reserve did not take any significant action or make notable announcements, which reassured the market. In the short term, reduced speculation about an imminent interest rate cut should support the US dollar, pushing the EURUSD rate down.

EURUSD technical analysis

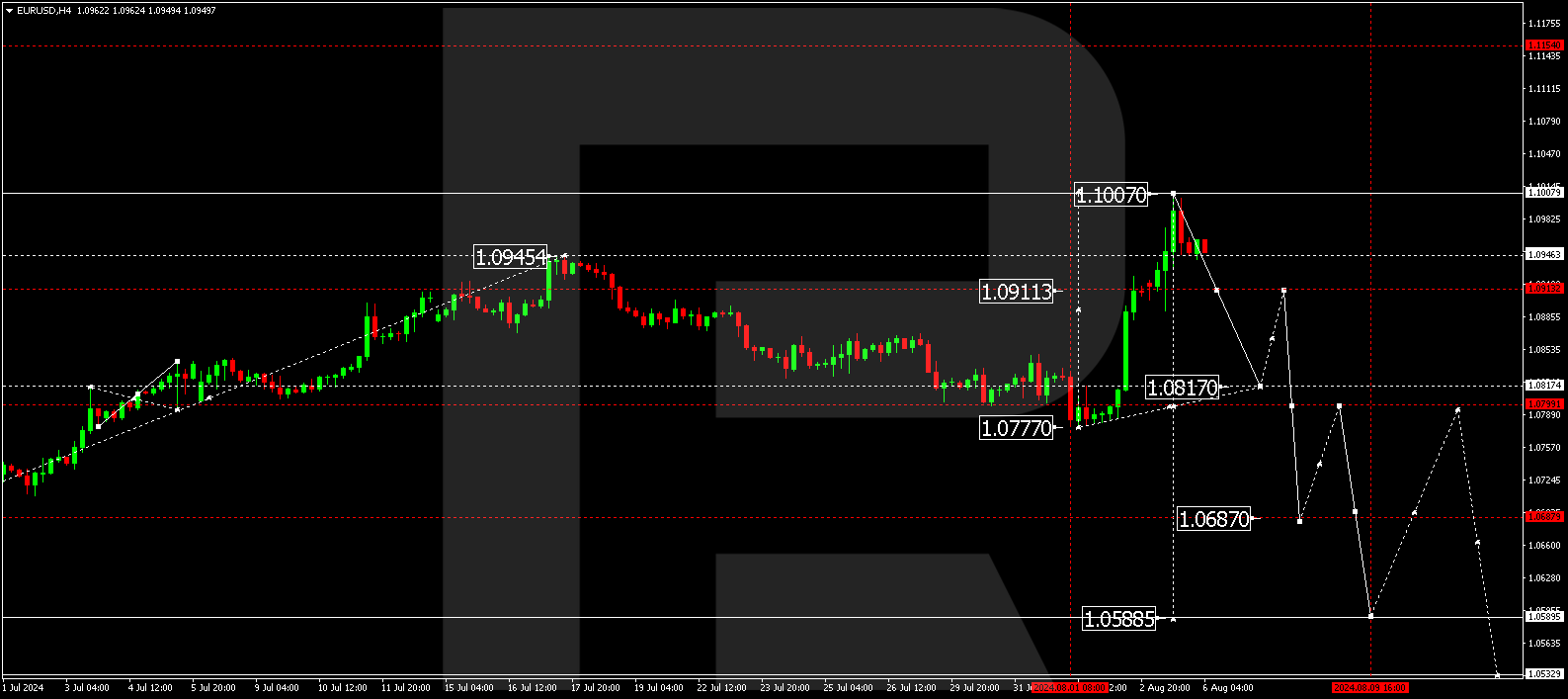

The H4 chart shows that the EURUSD pair has completed a downward wave, reaching 1.1000. The initial phase of this downward wave could develop today, 6 August 2024, aiming for 1.0820. The EURUSD rate declined to 1.0955 and corrected this downward impulse, reaching 1.0985. Subsequently, the market returned to 1.0955, forming a narrow consolidation range around this level. A break below this range is expected, targeting 1.0924 and potentially extending the decline towards 1.0903.

Summary

The EURUSD pair corrected towards a local high. Technical indicators in today’s EURUSD forecast suggest that the downward wave could extend to 1.0903, potentially continuing the trend towards 1.0820 and 1.0800 levels.