The EURUSD pair is hovering around 1.1440 on Friday. Market participants are awaiting key US labour market reports for May. Discover more in our analysis for 6 June 2025.

EURUSD forecast: key trading points

- The EURUSD pair rose ahead of crucial US employment data

- Trump’s tariffs increasingly impact the economy

- EURUSD forecast for 6 June 2025: 1.1495

Fundamental analysis

The EURUSD rate reached 1.1440 by the end of the week. Traders are closely watching the upcoming Nonfarm Payrolls (NFP) report for May, which could provide fresh insights into the state of the US economy.

Earlier this week, the US dollar came under pressure following a series of disappointing macroeconomic releases. These have intensified concerns that President Donald Trump’s tariffs are starting to affect economic growth.

Recent data showed a rise in jobless claims, weak private sector employment, and an unexpected decline in the services PMI. Despite Trump's push for lower interest rates, Federal Reserve officials continue to take a cautious stance, pointing to the high level of uncertainty in trade policy.

Overall, the US dollar has recorded broad losses over the week.

The EURUSD forecast is moderately positive.

EURUSD technical analysis

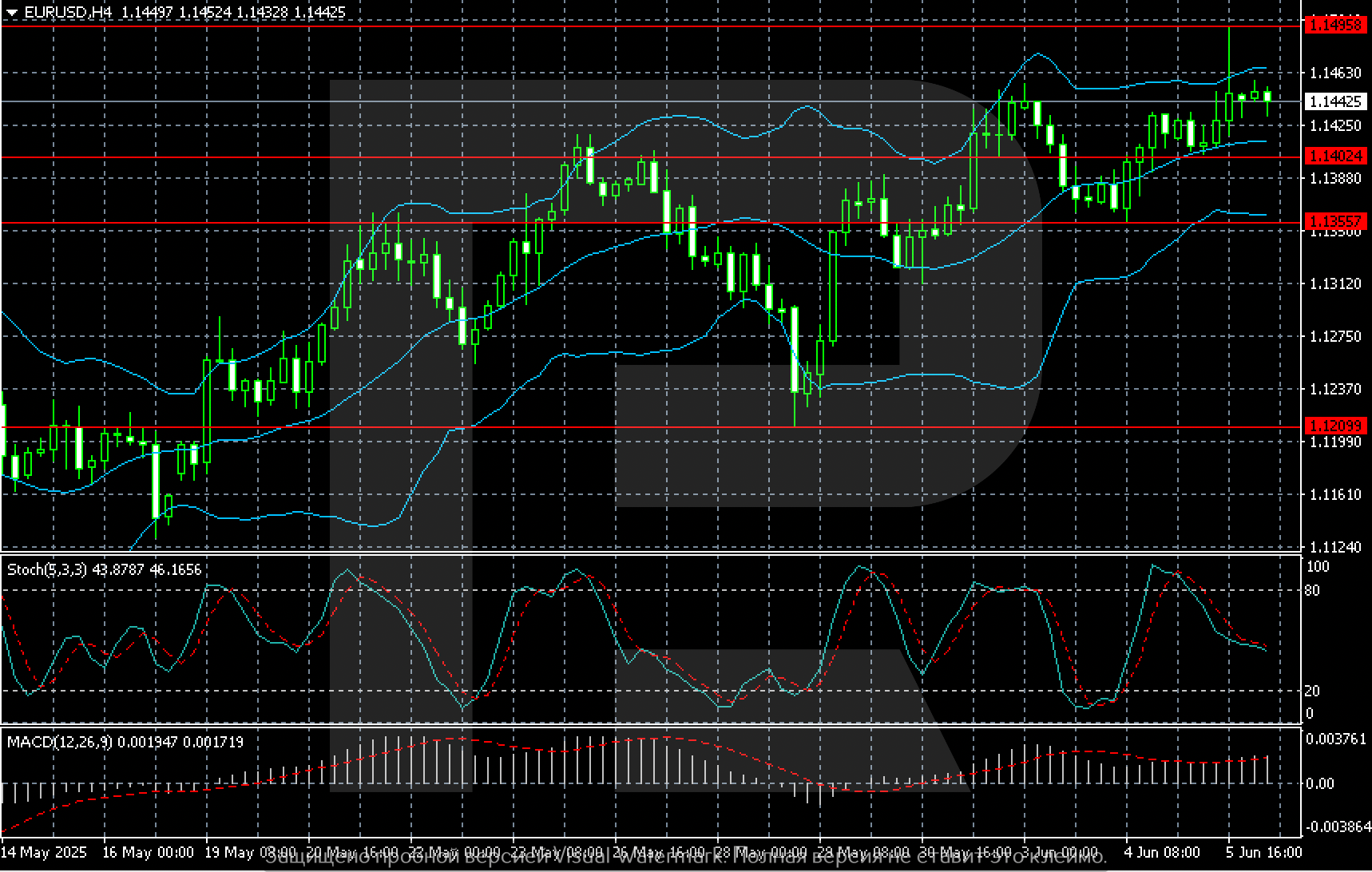

The EURUSD H4 chart shows conditions forming for a climb towards 1.1495.

However, if bullish momentum fades, the pair may test the 1.1402 support level before declining towards 1.1355.

Summary

The EURUSD pair continues its upward trajectory and could extend gains, particularly if today’s US data proves weak. The EURUSD forecast for 6 June 2025 suggests a sustained bullish impulse, with the price potentially retesting the 1.1495 level.