EURUSD may decline further

The EURUSD rate corrected on Tuesday following an aggressive decline a day earlier. Why does the market remain cautious? Find out more in the analysis dated 30 July 2024.

EURUSD trading key points

- The market awaits the Federal Reserve meeting on Wednesday for potential interest rate cut signals

- Today, traders will focus on the June job openings and July Consumer Confidence Index

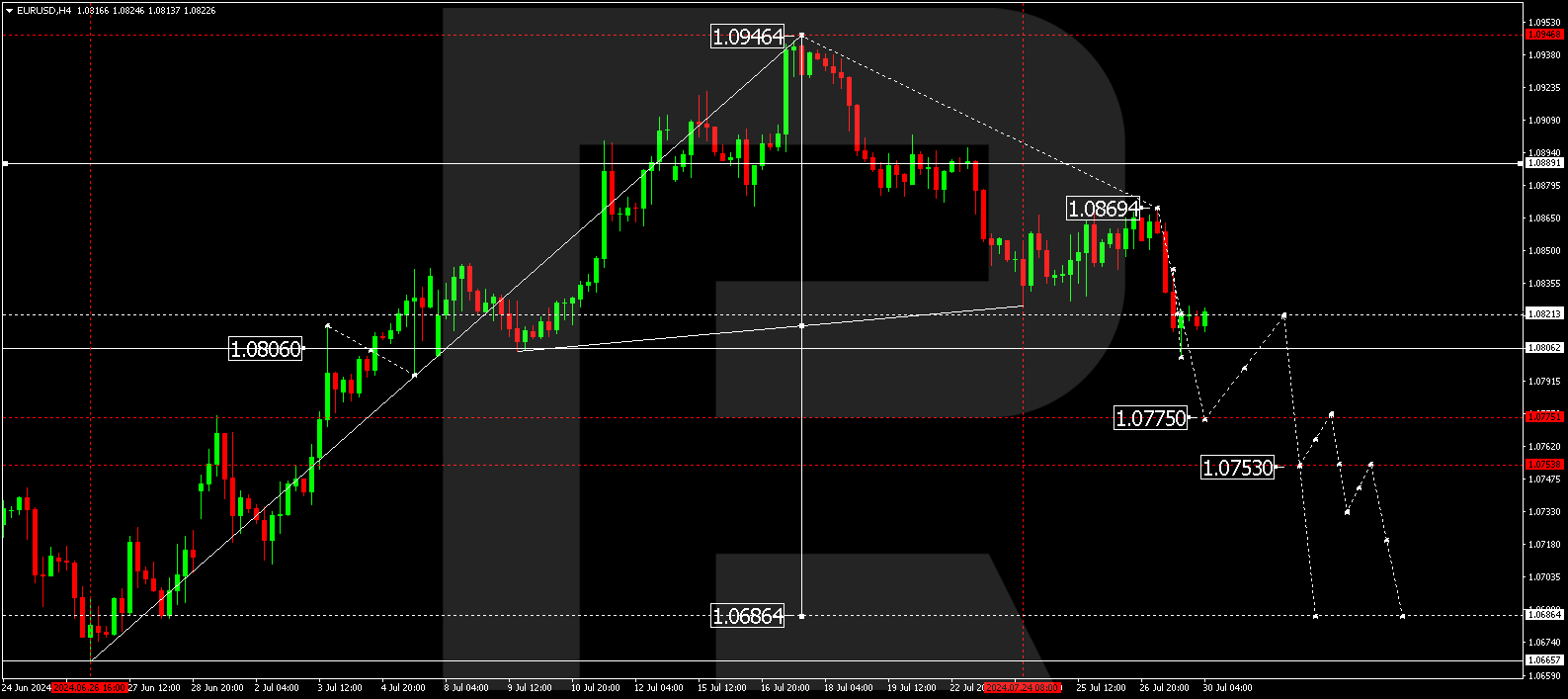

- EURUSD forecast for 30 July 2024: 1.0800 and 1.0775

Fundamental analysis

The EURUSD pair remains under pressure, trading around 1.0815. The market is awaiting the Federal Reserve meeting on Wednesday, following which the base rate will likely remain unchanged but may provide hints about a rate reduction in September. Traders believe that if no clear signal is given about a rate cut, this may help strengthen the US dollar.

Despite higher-than-expected US GDP growth rates in Q2, the likelihood of monetary policy easing remains high. Although inflation has slowed, it continues to be the regulator’s concern.

Today, investors will focus on June’s job openings data and July’s Consumer Confidence Index. The long-awaited July employment report will be released on Friday, significantly impacting traders’ expectations about the Federal Reserve’s future policy.

Overall, market participants are not inclined to take active action as they await the central bank’s dovish decision. In this situation, the EURUSD rate may decline further.

EURUSD technical analysis

On the H4 chart, the EURUSD pair has completed a decline wave, reaching 1.0802. A consolidation range could develop above this level today, 30 July 2024. An upward breakout could lead to a correction targeting 1.0835. Conversely, a downward breakout would open the potential for a decline wave towards 1.0800, potentially continuing the trend to the local target of 1.0775.

Summary

The EURUSD pair remains under pressure as the market awaits the Federal Reserve meeting and signals about a potential interest rate cut. EURUSD forecast for today aligns with technical indicators, suggesting that a decline wave could continue to (at least) 1.0775.