EURUSD: New York manufacturing activity fell to its lowest level since May

The EURUSD rate has been declining for the third consecutive trading session. More details are available in our analysis for 16 October 2024.

EURUSD forecast: key trading points

- Atlanta Fed President Raphael Bostic stated that only one interest rate cut of 25 basis points is planned this year

- The Empire State Manufacturing Index dropped to -11.9 points in October, marking the lowest level since May

- Traders are focusing on the upcoming US retail sales and production reports

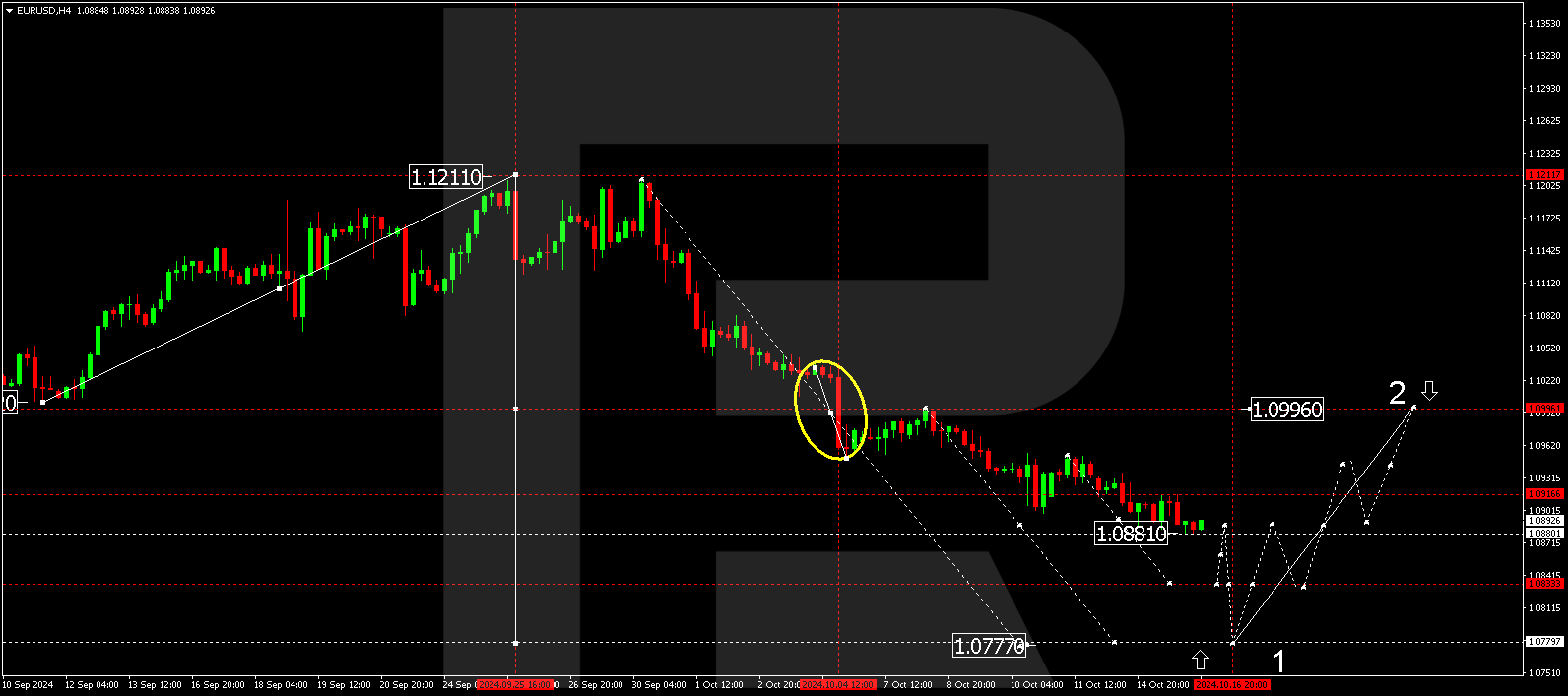

- EURUSD forecast for 16 October 2024: 1.0833 and 1.0777

Fundamental analysis

The EURUSD rate has gained a foothold below the EMA-200 and continues to edge down. Federal Reserve Bank of Atlanta President Raphael Bostic stated on Tuesday that he expects only one interest rate cut of 25 basis points this year despite forecasts suggesting a 50-basis-point reduction. However, Federal Reserve officials underscored that the approach to monetary policy easing will depend on changes in the economic situation.

Meanwhile, the NY Empire State Manufacturing Index fell to -11.9 points in October, down from 11.5, marking the lowest since May. A reading above zero indicates improving regional business conditions, while a below zero indicates deterioration. Analysts expected the index to remain positive, coming in at 3.8 points. This data may slow down further declines in the pair within today’s EURUSD forecast.

Traders are now focusing on crucial economic reports on retail sales, industrial production, and the Philadelphia Fed Manufacturing Index, which will provide better insight into the state of the US consumer sector and manufacturing industry.

EURUSD technical analysis

The EURUSD H4 chart shows that the market has completed a downward wave towards 1.0881, extending the boundaries of the consolidation range around 1.0916. The price could rise to 1.0916 (testing from below) today, 16 October 2024. After reaching this level, the EURUSD rate is expected to plunge to 1.0833. A decline and a breakout below the 1.0833 level will open the potential for continuing the trend towards 1.0777, the first target. Subsequently, a correction could start, aiming for 1.0966.

Summary

The data on declining manufacturing activity in New York may deter further declines in the EURUSD rate. This week’s crucial economic reports, including US retail sales and industrial production, may determine the pair's future direction. Technical indicators in today’s EURUSD forecast suggest a potential decline to the 1.0833 and 1.0777 levels.