EURUSD recovers but remains under technical pressure. Current quote: 1.1188. Full breakdown for 14 May 2025 below.

EURUSD forecast: key trading points

- US consumer price index (CPI) rose 2.3% YoY in April

- Core inflation (Core CPI) increased by 2.8%

- Slower inflation supports short-term EURUSD strength

- EURUSD forecast for 14 May 2025: 1.1060

Fundamental analysis

The EURUSD pair is climbing for a second session in a row, with buyers testing the critical 1.1200 resistance level. The US dollar came under pressure after the US Labor Department published data showing a deceleration in annual inflation.

Consumer prices rose 2.3% year-on-year in April, down from 2.4% in March. Core inflation, which excludes food and energy, increased 2.8%, in line with forecasts.

Despite easing inflationary pressures, most traders do not expect the Federal Reserve to begin monetary policy easing before September. However, markets still price in two rate cuts of 25 basis points each for the remainder of 2025.

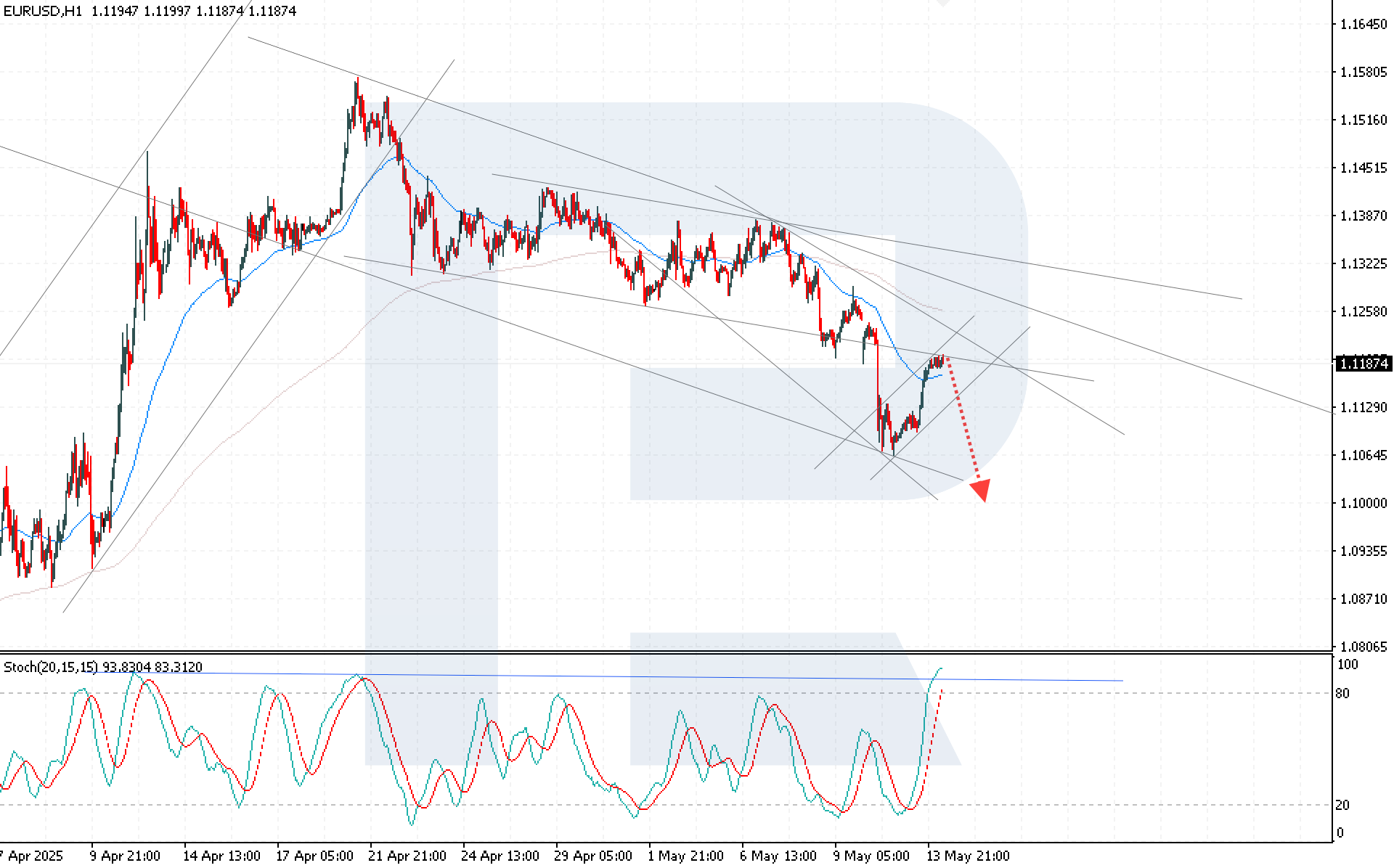

EURUSD technical analysis

EURUSD is testing the upper boundary of a descending channel. Today’s forecast expects a resumption of downward movement with a target of 1.1060.

Technical indicators confirm the bearish scenario: moving averages remain downward-sloping, reflecting a persistent downtrend. The Stochastic Oscillator has entered the overbought zone and is turning lower after a sharp bullish impulse.

A break below the lower boundary of the correction channel and a close beneath 1.1130 would confirm the start of another downside wave.

Summary

The EURUSD pair is recovering amid softer US inflation data, which supports hopes of a more dovish Fed policy later this year. However, technical analysis signals persistent bearish momentum, with the next downside target near 1.1060.