The EURUSD pair rises after a correction, with external factors that may affect risk appetite. Find out more in our analysis dated 27 August 2024.

EURUSD forecast: key trading points

- The EURUSD pair resumed growth

- The market anticipates a 25-basis-point interest rate cut in September

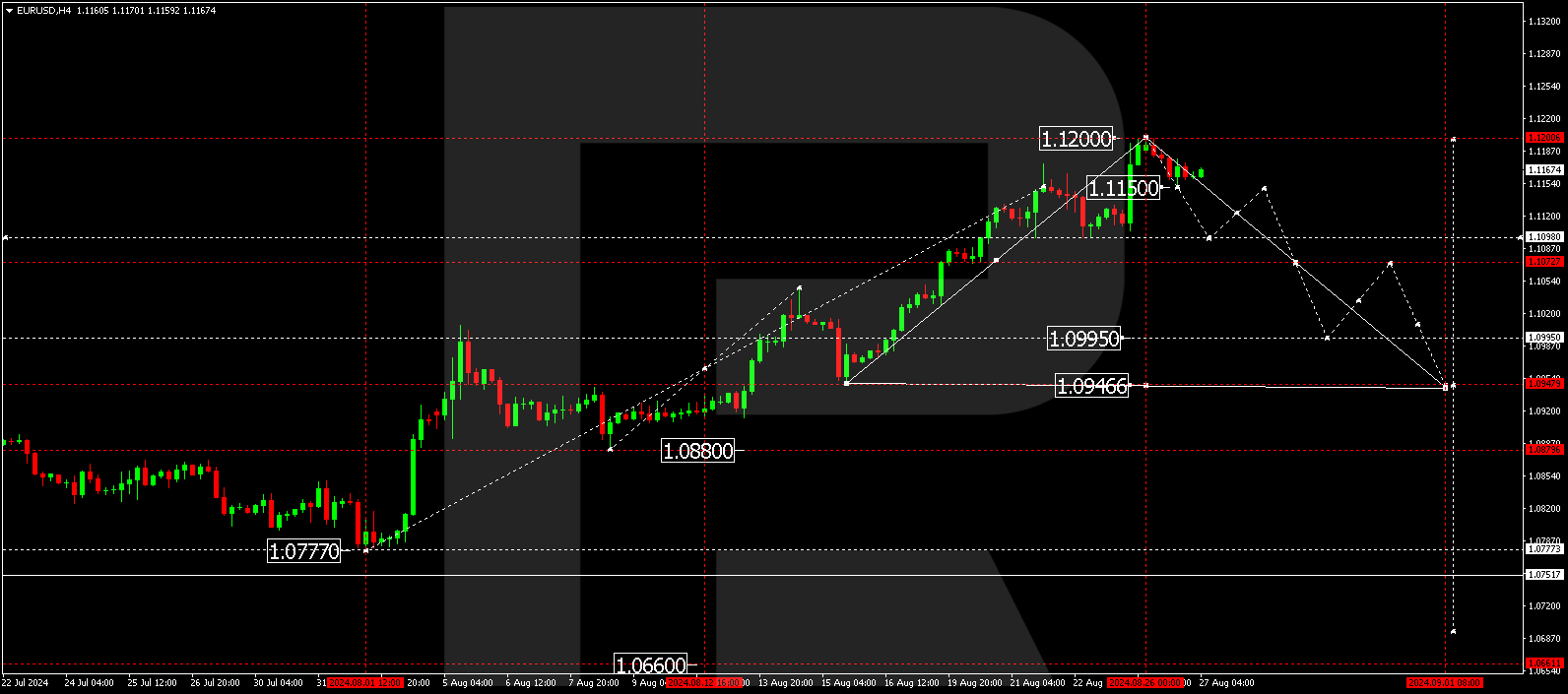

- EURUSD forecast for 27 August 2024: 1.1150, 1.1118, and 1.1098

Fundamental analysis

The EURUSD rate has resumed growth following a correction, with the main movements around 1.1168. Concerns about the Middle East have dampened investor optimism about an imminent Federal Reserve interest rate cut.

Geopolitical risk has re-emerged, and the currency market must factor it into prices. Nevertheless, the US dollar remains near an annual low against the euro. At the Jackson Hole Symposium, Federal Reserve Chair Jerome Powell said the time had come to ease monetary conditions, meaning everything was in place for a September decision to lower interest rates. The question remains whether rates will be reduced by 25 or 50 basis points.

San Francisco Fed President Mary Daly noted yesterday that borrowing costs would be reduced by a quarter percentage point. Most investors are now factoring this possibility into their expectations.

Today’s EURUSD forecast is mixed: all eyes will be on external factors.

EURUSD technical analysis

The EURUSD H4 chart shows that the market has declined to 1.1150 and corrected towards 1.1178. Another corrective movement is possible today, 27 August 2024, aiming for 1.1181. A consolidation range is developing at the top of the growth wave. Following this correction, the EURUSD rate is expected to decline to 1.1150. A breakout of this level would be considered a downward exit from the consolidation range. This could signal that the wave might continue to 1.1118, potentially extending to 1.1098, the first target.

Summary

Although the EURUSD pair returns to an annual high, market sentiment could depend on external factors. Technical indicators in today’s EURUSD forecast suggest a potential decline to 1.1150, possibly continuing to 1.0980.