The EURUSD pair continues its ascent. However, the euro faces risks due to the French political situation.

EURUSD trading key points

- US employment market data was soft

- Political uncertainty in France becomes a risk factor for the EUR

- EURUSD price targets: 1.0900 and 1.0944

Fundamental analysis

The EURUSD pair appears relatively expensive, hovering at 1.0828 on Monday.

Although US nonfarm payrolls increased by 206,000 in June, exceeding expectations of 191,000, the data fell short of May readings. The unemployment rate remained unchanged at 7.4%. As expected, average hourly earnings in June expanded by 0.3% m/m following a 0.4% increase in May.

The market viewed the statistical data as soft, heightening expectations of a September US Federal Reserve interest rate cut, which pressured the USD position.

However, the euro also has reservations. The French election results created uncertainty about the country’s financial prospects. The left-wing alliance may have received an unexpected number of votes, creating challenging conditions for forming the French parliament.

Such political news may compel EUR investors to avoid risks until there is clarity on the issue.

EURUSD technical analysis

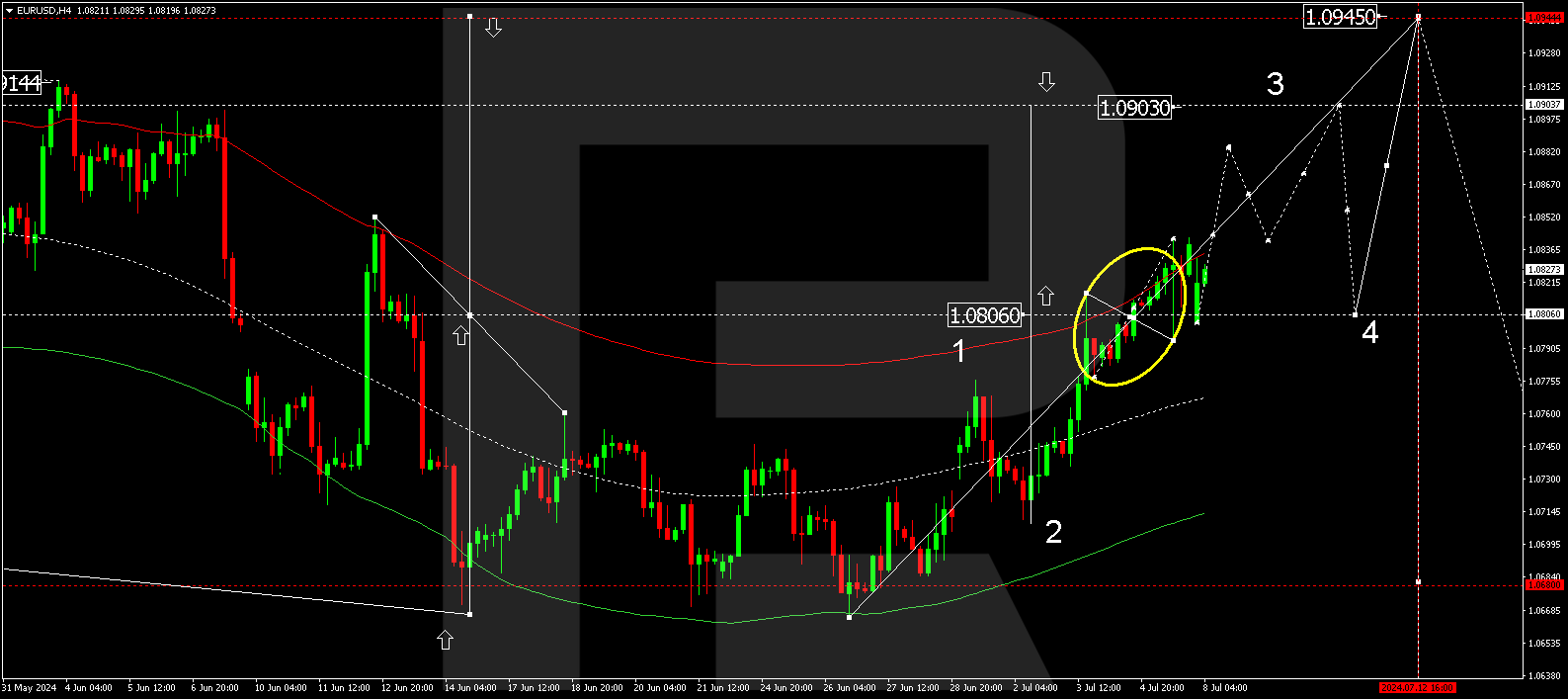

On the H4 chart, EURUSD received support at 1.0806. A consolidation range has practically formed around this level, which is considered crucial for the EURUSD pair today, 8 July 2024. Breaking above the range will open the potential for a growth wave to the local target of 1.0900. After reaching this target, the price is expected to fall to 1.0840 (testing from above). Subsequently, another growth structure could develop, aiming for 1.0944

Summary

The EURUSD pair remains elevated, but risks are mounting. Technical indicators point to a potential further correction to the 1.0840, 1.0900, and 1.0944 targets.