EURUSD remains under pressure amid Trump’s trade threads

The EURUSD rate is correcting within the downtrend. Discover more in our analysis for 26 November 2024.

EURUSD forecast: key trading points

- The US dollar is strengthening amid Donald Trump’s threats, including his intention to introduce import tariffs

- The euro remains under pressure due to concerns about the eurozone’s economic slowdown and political instability in Germany and France

- Markets expect a 25-basis-point ECB interest rate cut, with the likelihood of a 50-basis-point reduction increasing to 58%

- EURUSD forecast for 26 November 2024: 1.0555 and 1.0680

Fundamental analysis

The EURUSD rate resumed its decline on Tuesday morning. The US dollar is strengthening amid Donald Trump’s trade threats. He announced his intention to raise tariffs, particularly targeting Canada, China, and Mexico. The President also pledged to impose an additional 10% duty on all imports from China and a 25% tariff on goods from Mexico and Canada, bolstering demand for the US dollar as a safe-haven asset.

The euro remains under pressure due to growing concerns about the eurozone’s economic slowdown and political instability in Germany and France. Market participants have already priced in a 25-basis-point ECB rate reduction next month, with the probability of a more aggressive 50-basis-point move rising to 58%. According to today’s EURUSD forecast, these expectations may exert additional pressure on the European currency.

This week, traders are awaiting the release of the Federal Reserve’s latest meeting minutes and data on the key inflation gauge – the PCE. According to the CME FedWatch Tool, the likelihood of an interest rate cut is 55.9%, while the probability of a more substantial 50-basis-point reduction is estimated at 44.1%. Investors expect this data to offer greater clarity on future Federal Reserve monetary policy moves.

EURUSD technical analysis

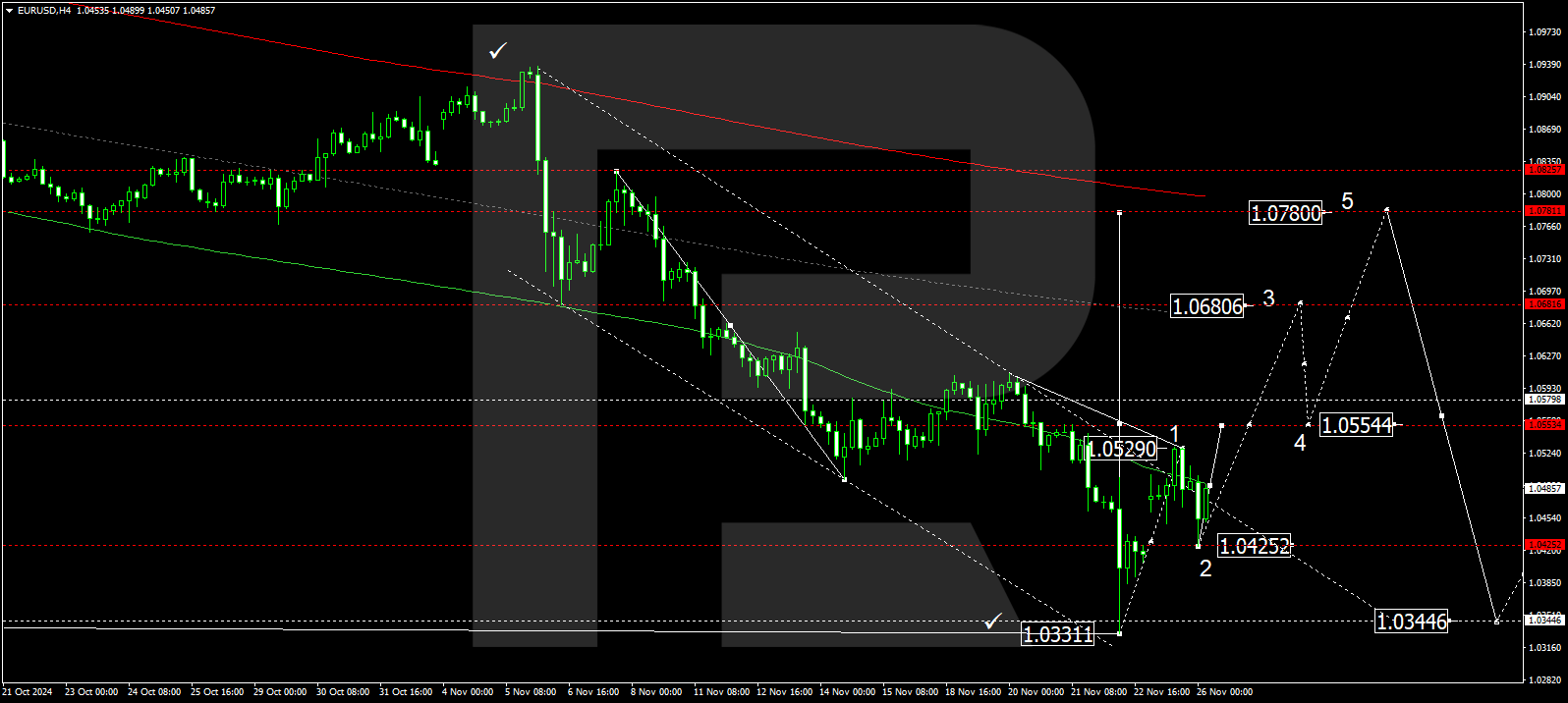

The EURUSD H4 chart shows that the market has completed a growth wave towards 1.0529, followed by a correction towards 1.0425. Today, 26 November 2024, the market is forming a growth wave structure targeting 1.0555. Once the price hits this level, a consolidation range may develop around it. The price is expected to break above the range, with the local estimated target at 1.0680. Subsequently, a correction could follow, targeting 1.0555.

The Elliott Wave structure and matrix for the second growth wave, with a pivot point at 1.0555, technically support this scenario. This level is considered crucial within the growth wave of the EURUSD rate. After declining to 1.0425, the market may initiate another growth wave, aiming for the price envelope’s central line at 1.0680. After reaching this level, the price is expected to plunge to its lower boundary at 1.0555.

Summary

The EURUSD rate is declining due to renewed trade threats from Trump, boosting demand for the US currency. This week, the market focuses on PCE inflation data and the Fed minutes, which could provide greater clarity on the regulator’s future monetary policy actions. Technical indicators for today’s EURUSD forecast suggest a potential growth wave towards the 1.0555 and 1.0680 levels.