The EURUSD pair is strengthening amid the eurozone’s news. US negative data will drive a further rise.

EURUSD trading key points

- The eurozone’s core consumer price index (y/y): previously at 2.9%, forecasted at 2.9%

- The eurozone’s consumer price index (y/y): previously at 2.6%, forecasted at 2.5%

- US industrial production (m/m): previously at 0.9%, forecasted at 0.3%

- A speech by Federal Reserve’s Christopher Waller

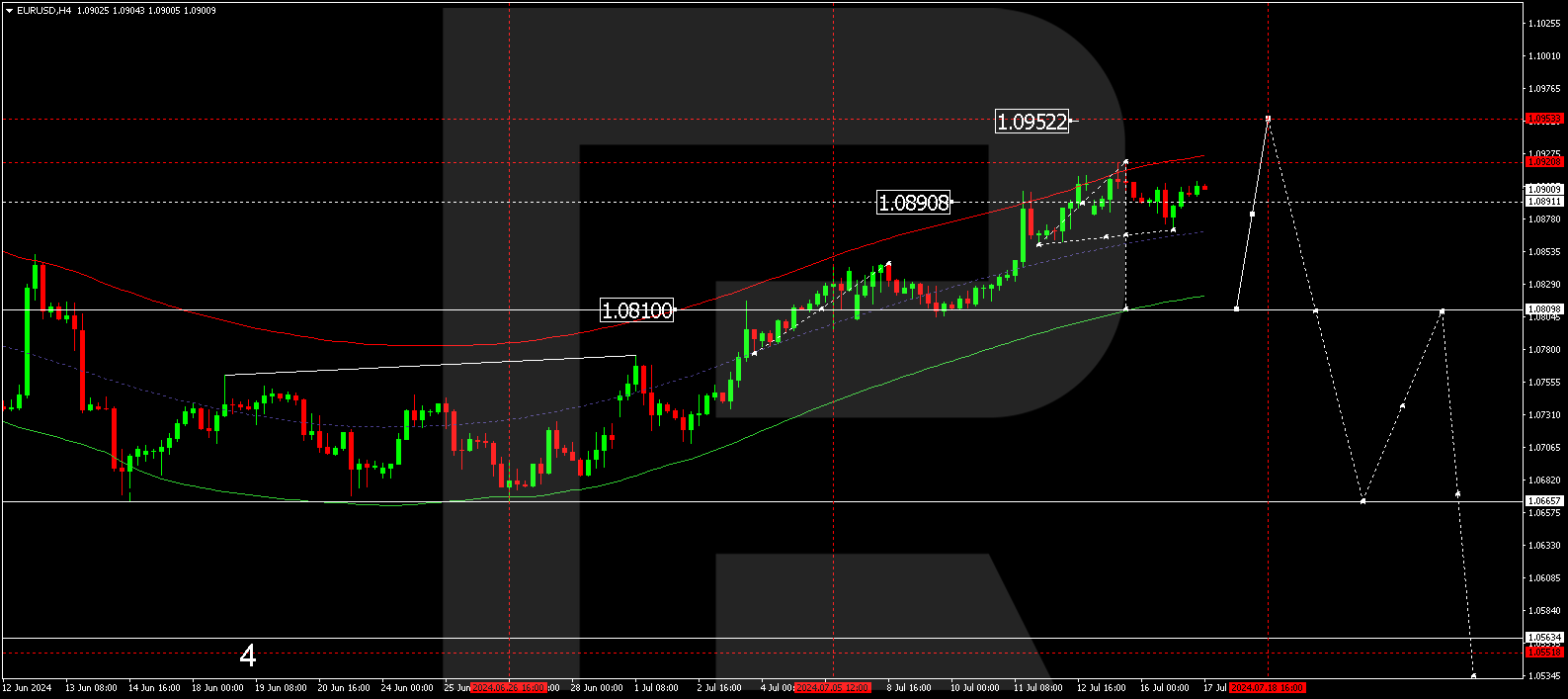

- EURUSD price targets: 1.0809 and 1.0950

Fundamental analysis

The eurozone’s core consumer price index is projected at 2.9%; the indicator may remain at the previous level, which could be a positive factor for the euro.

The eurozone’s consumer price index (y/y) is projected to decline slightly to 2.5%, which could help strengthen the euro against the US dollar.

US industrial production (m/m) is forecasted to decrease to -0.3%, with Christopher Waller’s speech potentially contributing to the weakening of the US dollar and a further rise in the EURUSD rate following a correction.

EURUSD technical analysis

On the EURUSD H4 chart, a consolidation range continues to develop around 1.0880 without any clear trend. The price declined to 1.0870, with a growth link towards 1.0906 formed today, 17 July 2024. An upward breakout of the range will open the potential for a growth wave towards 1.0950. A downward breakout will enable a fall to 1.0809.

Summary

Technical indicators align with the eurozone’s data and Christopher Waller’s speech, suggesting a further correction towards the 1.0809 target. Once the correction is complete, a growth wave could start, targeting 1.0950.