The EURUSD pair strengthened to 1.0910. The market is afraid of the impact of Trump’s trade policy. Find out more in our analysis for 18 March 2025.

EURUSD forecast: key trading points

- The EURUSD pair continues its ascent but gradually

- Investors are concerned about the impact of Trump’s tariff policy and are awaiting the Federal Reserve’s rate decision

- EURUSD forecast for 18 March 2025: 1.0947

Fundamental analysis

The EURUSD rate rose to 1.0910, with economic uncertainty and trade tensions putting pressure on the US currency.

Markets remain cautious amid concerns about the US trade policy. Donald Trump’s aggressive tariff policy is fuelling fears of an economic slowdown.

Monday’s data showed that US retail sales increased less than expected in February. The previous month’s reading was revised downwards.

However, stronger-than-expected control group sales created local confidence that the economic slowdown would be limited.

Traders are now focused on the Federal Reserve’s decision, which will be announced on Wednesday. The interest rates are expected to remain unchanged. However, the baseline scenario includes about 60-basis-point Federal Reserve interest rate cuts in 2025.

The EURUSD forecast is positive.

EURUSD technical analysis

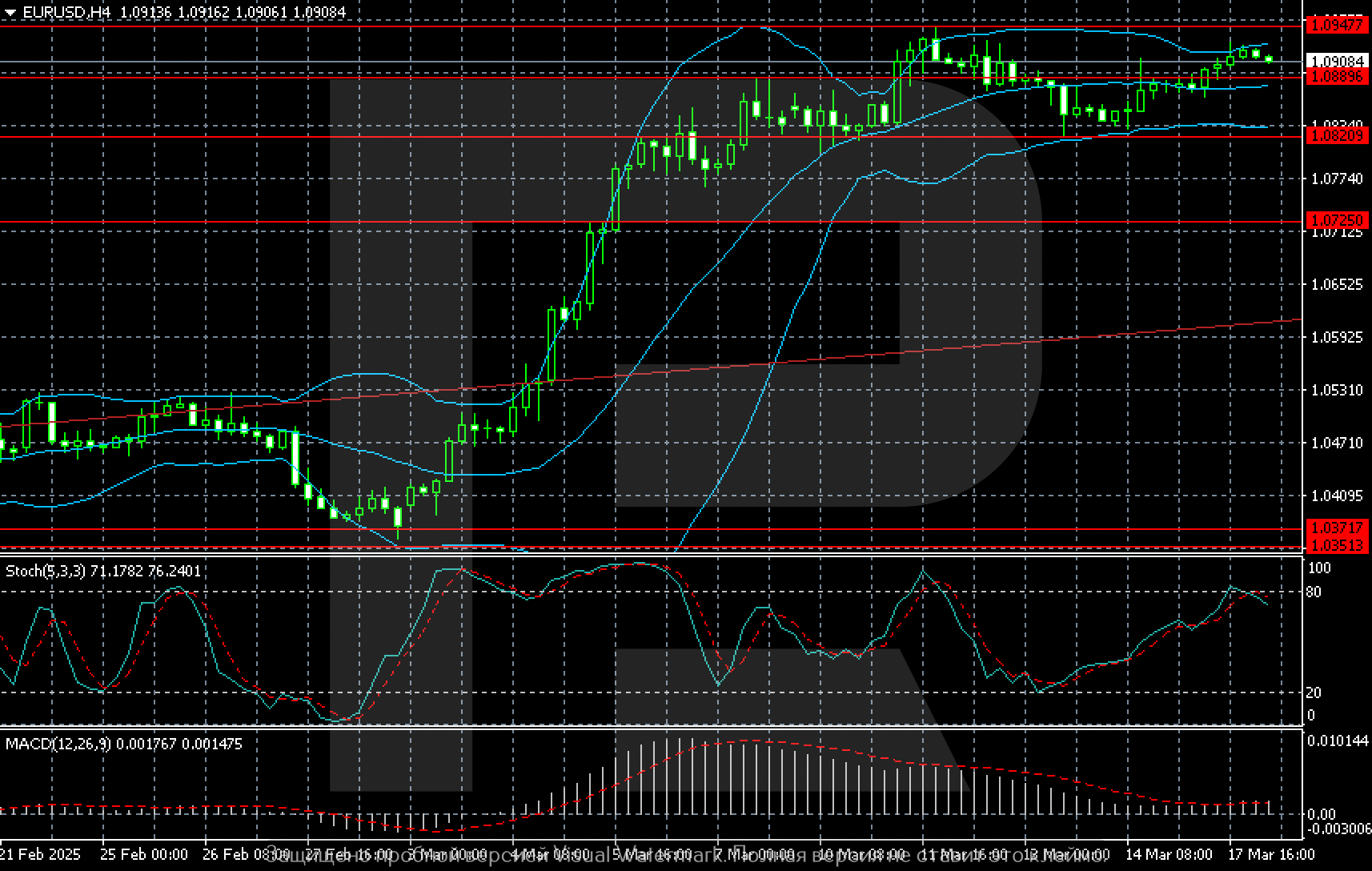

On the EURUSD H4 chart, there are still conditions for growth to 1.0947. However, if this scenario is not implemented, the market will move to 1.0889 and then to 1.0820.

Overall, the EURUSD pair is entering a sideways trading channel between 1.0725 and 1.0947, so it is crucial to pay attention to a test of the range’s upper boundary.

Summary

The EURUSD pair continues to rise and appears consistently strong. The EURUSD forecast for today, 18 March 2025, expects smooth growth to the target of 1.0947.