EURUSD: rising US core inflation has almost ruled out a 50-basis-point Fed interest rate cut

The EURUSD rate is slightly correcting following a decline caused by a rise in US inflation. Discover more in our analysis for 12 September 2024.

EURUSD forecast: key trading points

- US core inflation unexpectedly rose by 0.3% in August from July, marking the highest reading in four months

- The likelihood of a 50-basis-point Federal Reserve interest rate cut at the next meeting is virtually ruled out, while the odds of a 25-basis-point cut (market expectations) are 87%

- The European Central Bank is expected to lower the key rate by 25 basis points today

- According to analysts, the EURUSD rate may fall to 1.0200 by the end of the year amid ECB monetary policy tightening

- EURUSD forecast for 12 September 2024: 1.0986 and 1.0950

Fundamental analysis

US core inflation unexpectedly rose in August, driven by increased housing and travel prices. The core CPI, excluding food and energy costs, increased by 0.3% from July, marking the highest reading over the past four months. Headline inflation ran at 0.2% m/m and 2.5% y/y. This unexpected rise in inflation may prevent the Federal Reserve from lowering interest rates aggressively despite signs of a slowing employment market.

The current inflation data changed market expectations, pushing the EURUSD rate slightly down. The likelihood of a 50-basis-point Federal Reserve interest rate cut at the upcoming meeting is now virtually ruled out. Instead, expectations of a 25-basis-point cut are estimated at 87%, while the odds of a more significant 50-basis-point reduction have dropped to 13%. The market has already priced everything in, although analysts had expected to get clarity on interest rate issues only by Friday.

At the same time, the European Central Bank is expected to lower the key rate by 25 basis points today. This decision is due to the fact that inflation in the eurozone eased to 2.2% in August, wage growth slowed, and the GDP Q2 growth forecast was revised to 0.2%. According to analysts, the EURUSD rate may decline to 1.0200 by the end of the year amid ECB monetary policy tightening in response to the weakening economy. The current ECB meeting may directly impact today’s EURUSD forecast and become a significant catalyst for the currency market, showing that the regulator can cut rates faster than currently expected.

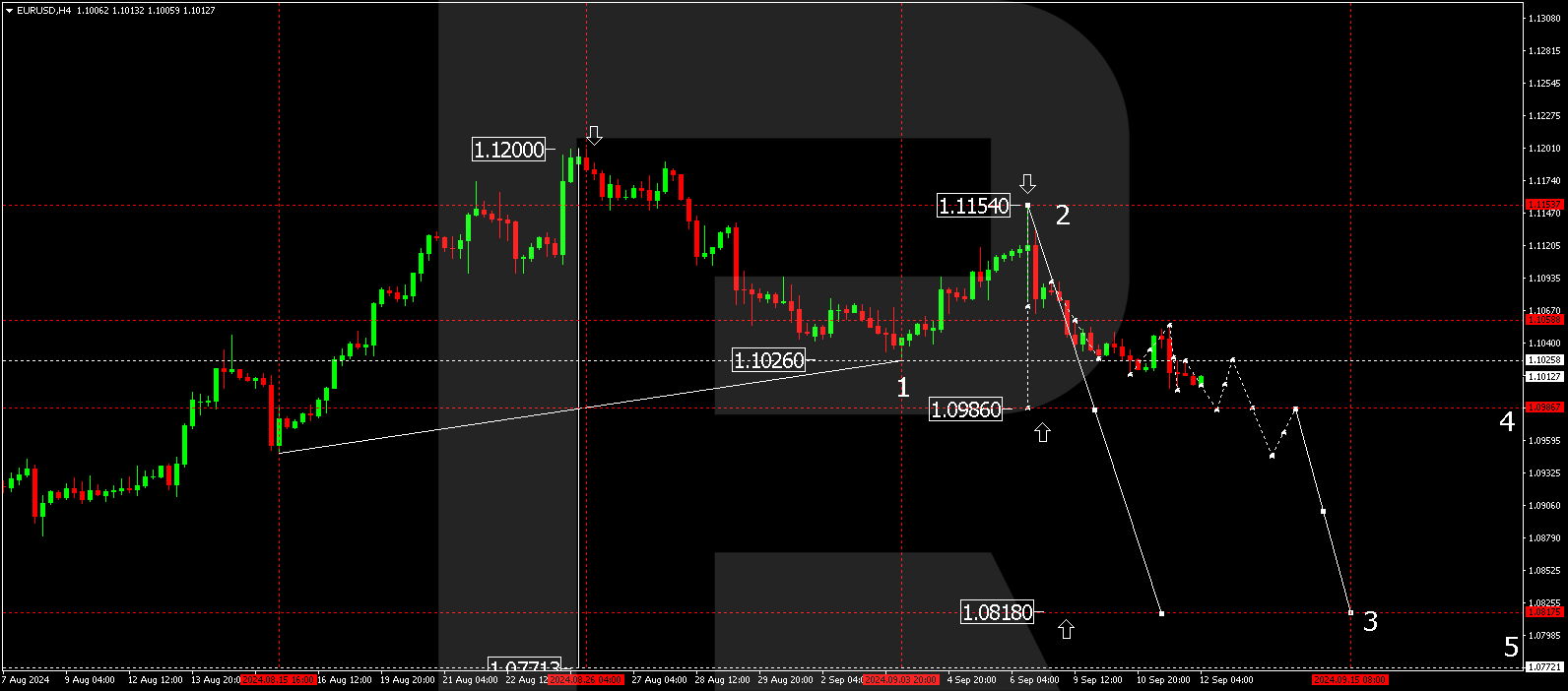

EURUSD technical analysis

The EURUSD H4 chart shows that the market has completed a downward wave, reaching 1.1002. A correction has formed today, 12 September 2024, aiming for 1.1025 (testing from below). The EURUSD rate is expected to decline to the local target of 1.0986. Once the price reaches this level, a new consolidation range could develop around it. With an upward breakout, a correction could follow, targeting 1.1050. With a downward breakout, the trend might continue towards 1.0818, the local estimated target.

Summary

US core inflation unexpectedly rose in August, which may prevent the Federal Reserve from lowering interest rates aggressively. This data changed market expectations, reducing the likelihood of a significant rate cut at the upcoming Fed meeting, while the tightening of the ECB monetary policy may send the EURUSD rate lower. Technical indicators in today’s EURUSD forecast suggest that the wave could continue towards the 1.0986 and 1.0950 levels.