EURUSD: risks of a correction are increasing

The EURUSD rate declined after unsuccessful attempts to rise above 1.1200. Find out more in our analysis dated 28 August 2024.

EURUSD forecast: key trading points

- Investor confidence in a 50-basis-point Federal Reserve interest rate cut grows

- The preliminary Q2 US GDP estimate is expected to show an increase of 2.8%

- The core Personal Consumption Expenditures price index is projected to rise by 2.7%

- EURUSD forecast for 28 August 2024: 1.1150 and 1.0980

Fundamental analysis

The EURUSD rate fell below 1.1150 on Wednesday morning, potentially signalling a downward correction. However, as part of today’s EURUSD forecast, the US dollar remains under pressure due to growing expectations of a Federal Reserve interest rate cut and concerns about US recession risks.

Investors are confident that the Federal Reserve will lower interest rates as early as next month after Chair Jerome Powell’s dovish comments last week. Now, the focus is on whether this will be a 50-basis-point rate cut. According to the FedWatch tool from CME Group, the likelihood of such a significant interest rate reduction has increased to 36% from 29% a week ago.

At the end of the trading week, traders will focus on economic indicators. The preliminary Q2 US GDP estimate is due tomorrow, with the economy expected to grow by 2.8%. The core PCE price index, the Federal Reserve’s preferred inflation gauge, will be released on Friday. It is projected to increase to 2.7% from the previous 2.5%. According to analysts, the inflation rate would need to significantly exceed expectations to change forecasts for several interest rate cuts by the regulator.

EURUSD technical analysis

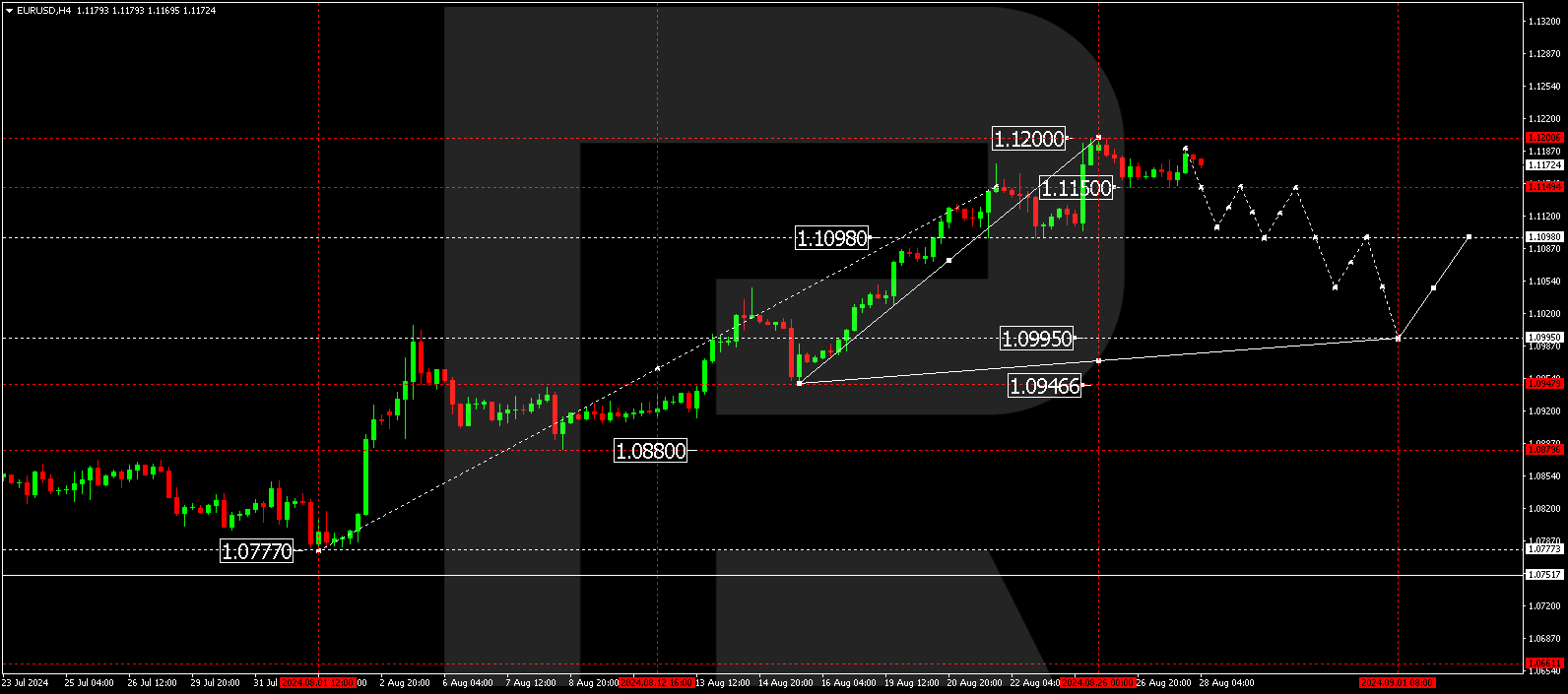

On the EURUSD H4 chart, the market has completed a corrective structure, reaching 1.1190. Today, 28 August 2024, the downward wave continues towards 1.1150. The price is expected to break below this level, potentially signalling a further movement towards 1.1098, the first target. Once the price reaches this level, a correction could start, aiming for 1.1150 (testing from below).

Summary

Current EURUSD rate movements indicate increased risks of a downward correction, especially amid uncertainty about future Federal Reserve actions. Economic data expected at the end of the week may be a key factor confirming a further decline in the EURUSD pair. Technical indicators in today’s EURUSD forecast suggest a potential fall to 1.1150, possibly continuing to 1.0980.