EURUSD rose and paused: crucial statistics are ahead

The EURUSD pair has strengthened markedly. The market appears stable. Find out more in our analysis for 31 October 2024.

EURUSD forecast: key trading points

- The EURUSD pair rose and paused

- Investors price in expectations regarding the ECB and US statistics

- EURUSD forecast for 31 October 2024: 1.0880 and 1.0818

Fundamental analysis

The EURUSD rate is hovering around 1.0849 on Thursday.

Yesterday’s release of strong eurozone GDP and German inflation data tempered expectations for the European Central Bank’s next interest rate move. Key ECB monetary policymakers advocate for gradual interest rate cuts.

The US dollar declined in response to falling yields on the US government bonds following the Treasury’s refinancing announcement and US Q3 GDP data.

The economy grew more slowly than expected, at only 2.8%. The ADP private employment change data showed an increase of 233,000 while pending home sales surged to a four-year high.

The market will continue to receive employment statistics today, but the main releases are scheduled for Friday.

The EURUSD forecast appears moderate.

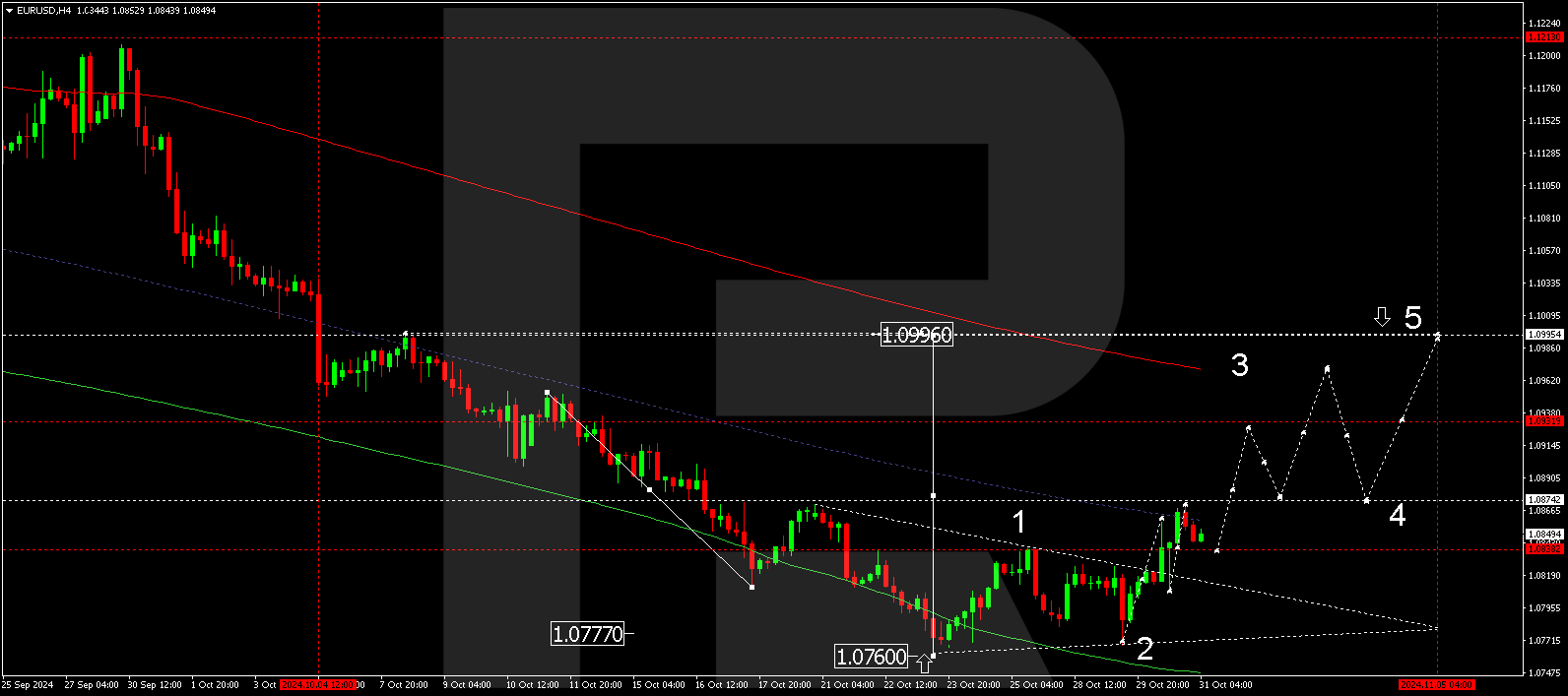

EURUSD technical analysis

The EURUSD H4 chart shows that the market has broken above 1.0830. A consolidation range is expected to form around this level today, 31 October 2024. An upward breakout will open the potential for a growth wave towards 1.0880. Once the price hits this level, a new consolidation range will develop. If the price breaks below the range, the correction in the EURUSD rate can be considered complete. In this case, a structure is expected to form for a downward wave to extend to 1.0690.

The Elliott Wave structure and wave matrix, with a pivot point at 1.0830, technically confirm this scenario. This level is considered crucial for a corrective wave in the EURUSD rate, with the market finding support at the lower boundary of the price envelope. Monitoring the potential for further consolidation around 1.0830 remains relevant. A breakout above the 1.0880 level could indicate a continued correction towards the upper boundary of the price envelope. Conversely, a move below the 1.0800 level may signal a renewed downward movement towards 1.0690, likely triggering another technical test of the price envelope’s lower boundary.

Summary

The EURUSD pair has recovered strongly from previous intense pressure. Technical indicators in today’s EURUSD forecast suggest that the consolidation range could extend up to 1.0880 and down to 1.0818.