EURUSD rose: the Fed must be decisive

The EURUSD pair has been rising for the third consecutive trading day. Investors are awaiting a 50-basis-point Federal Reserve interest rate cut. Find out more in our analysis for 16 September 2024.

EURUSD forecast: key trading points

- The EURUSD pair rose steadily

- The US Federal Reserve meeting will be the main event of the week

- EURUSD forecast for 16 September 2024: 1.1106, 1.1108, and 1.1128

Fundamental analysis

The EURUSD rate started the new week of September at 1.1088.

The University of Michigan sentiment index in the US rose to 69.0 points in September from the previous 67.9. Although the indicator appears positive, the market did not appreciate it: everyone believes the economic situation is far from being stable. For this reason, bets are growing that the Federal Reserve will be forced to act more decisively on 17-18 September.

Expectations for a 50-basis-point interest rate cut nearly doubled from last week’s readings, with market pressure on the Federal Reserve mounting rapidly. It is interesting to see how the regulator will cope with it.

The upcoming Federal Reserve meeting will be the main event of the week, with stock market volatility potentially decreasing before it and rising sharply after the decision is announced.

The EURUSD forecast suggests short-term growth followed by high-amplitude fluctuations.

EURUSD technical analysis

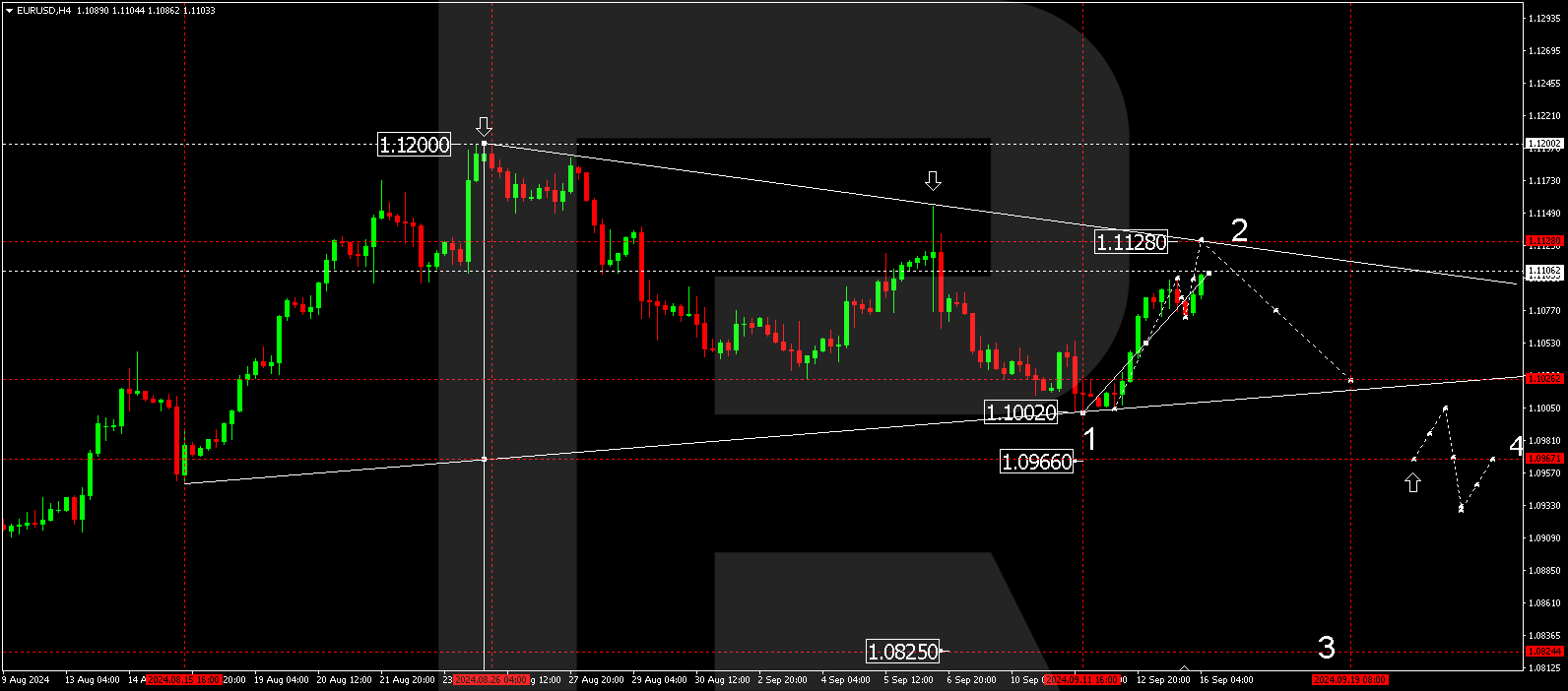

The EURUSD H4 chart shows that the market is forming a consolidation range around 1.1086. The market extended the range down to 1.1073 and up to 1.1104. The price could decline to 1.1055 today, 16 September 2024. After reaching this level, it might rise to 1.1128. A triangle technical pattern continues to form at the top of the growth wave. It will be relevant to view the current rise as a correction of the previous downward wave. Once the correction is complete, a new downward wave could start towards the lower boundary of the triangle pattern at 1.1026.

Summary

The EURUSD pair strengthened its position, with further volatility expected amid the September Federal Reserve meeting. Technical indicators in today’s EURUSD forecast suggest that the growth wave could continue towards the 1.1106, 1.1108, and 1.1128 levels.