EURUSD rose: the market awaits US employment market statistics

Supported by expectations regarding the Federal Reserve’s policy, the EURUSD pair returned above 1.1100, rising for the third consecutive session. Find out more in our analysis for 6 September 2024.

EURUSD forecast: key trading points

- The EURUSD pair has resumed steady growth

- Today, investors are awaiting the crucial US employment sector releases for August

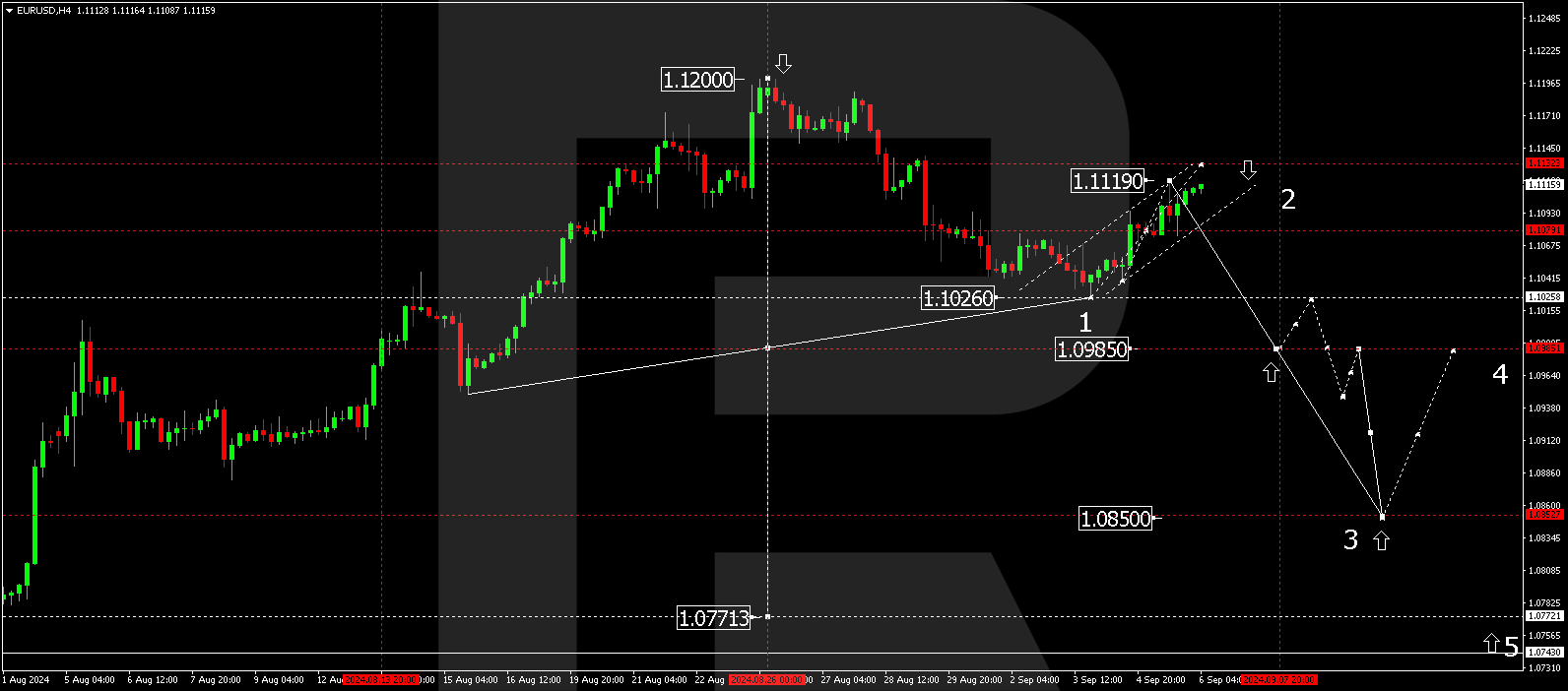

- EURUSD forecast for 6 September 2024: 1.1133, 1.1026, and 1.0985

Fundamental analysis

The EURUSD rate climbed to 1.1115.

The first release of US employment market data for August surprised the market yesterday. ADP private sector jobs increased by only 99,000, missing the forecast of 144,000 and falling short of the previous increase of 122,000. While there is no direct correlation between these figures and nonfarm payrolls, the sentiment is clear: the employment market is losing jobs.

This may prompt the US Federal Reserve to act even more swiftly than planned. In this context, today’s statistics are crucial, with the US unemployment rate report for August scheduled for release this evening. The main forecast suggests a decrease to 4.2% from 4.3%. Nonfarm payrolls could expand by 164,000 following previous growth of 114,000. However, statistics may bring surprises.

The EURUSD forecast suggests an increase in volatility later this afternoon.

EURUSD technical analysis

The EURUSD H4 chart shows that the market continues to develop a correction. It rose to 1.1119 before declining to 1.1076. Another rise is expected today, 6 September 2024, aiming for 1.1133. This upward movement is considered a correction to the previous downward wave. Once the correction is complete, another downward wave is expected to begin, targeting 1.1026. A breakout below this level may signal further downward movement towards the 1.0985 and 1.0850 levels.

Summary

The EURUSD pair has been rising for the third consecutive day. The market speculates that the Federal Reserve will have to act more aggressively on interest rates than originally planned. Technical indicators in today’s EURUSD forecast suggest a potential correction towards 1.1133, followed by a decline to the 1.1026, 1.0985, and 1.0850 levels.