The EURUSD pair stays still in anticipation of news, with the focus on US inflation today. Find more details in our analysis for 12 February 2025.

EURUSD forecast: key trading points

- The EURUSD pair has risen over the last 24 hours and is currently on hold

- The market is conserving its strength ahead of a new stream of crucial statistics

- EURUSD forecast for 12 February 2025: 1.0412 and 1.0444

Fundamental analysis

The EURUSD rate stopped at 1.0356 on Wednesday.

Investors will receive a lot of crucial statistics on the US and the eurozone by the end of this week. The short-term trajectory of the primary currency pair will depend on this data as the Federal Reserve and the ECB will make their monetary policy decisions based on these figures.

On Wednesday, the focus will be on US inflation reports, including both headline and core indicators. In the former case, the CPI is expected to be 2.9% year-on-year in January and in the latter case, it is projected to decline to 3.1% year-on-year from 3.2% earlier. Easing inflationary pressures in the core case could be an argument for the Federal Reserve when it is necessary to decide on an interest rate cut. The US dollar may come under pressure in this case.

The EURUSD forecast is neutral for now.

EURUSD technical analysis

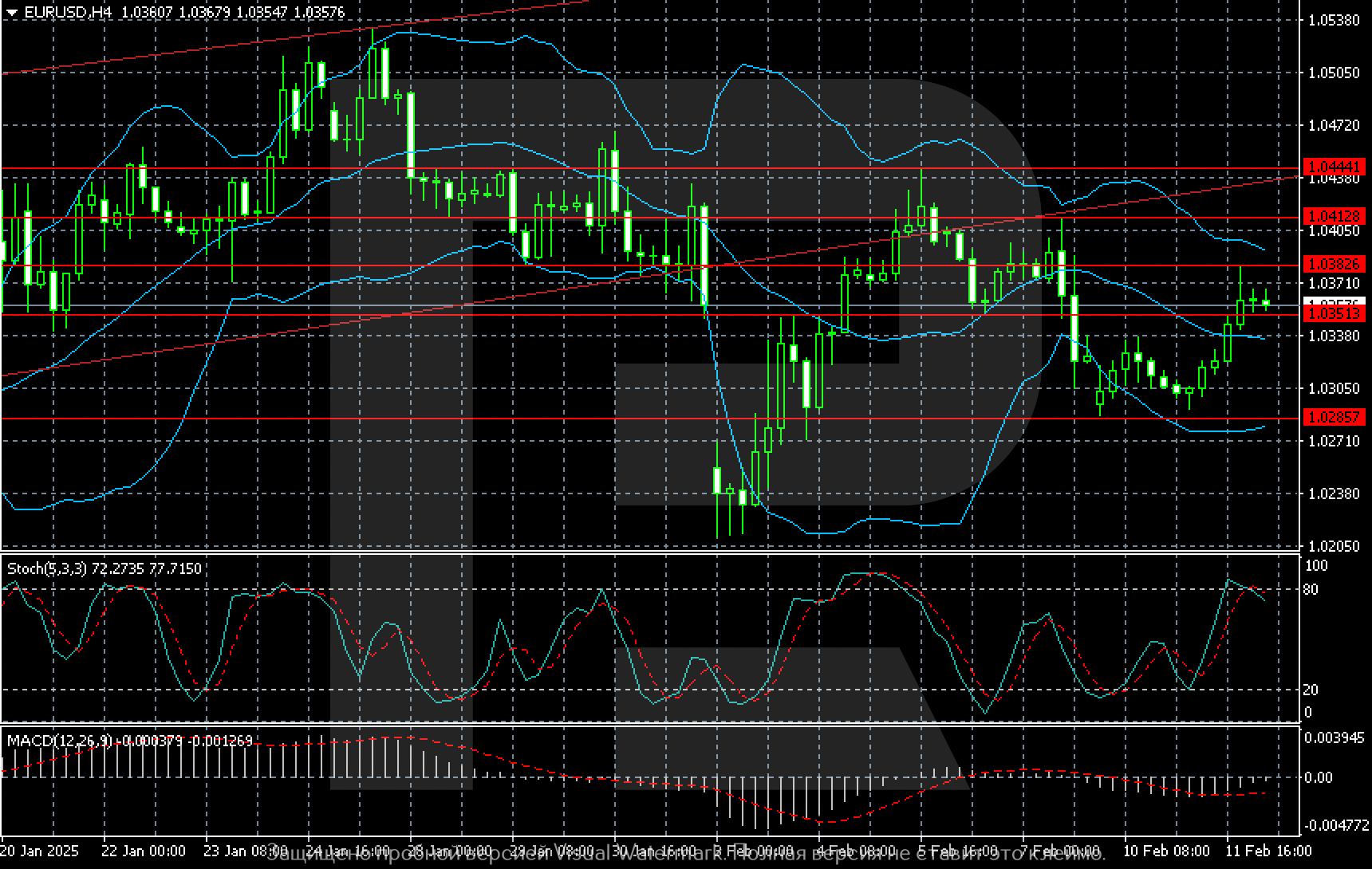

On the EURUSD H4 chart, there are grounds for a rise to 1.0382. If the price breaks above the resistance level, the new target for local growth could be 1.0412. Subsequently, the market might rise to 1.0444.

If the upward momentum is not implemented, the market interest will shift to 1.0285 through a breakout of 1.0350.

Summary

The EURUSD pair has risen well over the last trading day but halted its ascent on Wednesday morning. The forecast for today, 12 February 2025, suggests that the buying wave could develop to the 1.0412 and 1.0444 levels.