EURUSD strengthens amid US commercial property issues

The EURUSD rate falls after rising for two consecutive trading sessions. More details in our analysis for 19 November 2024.

EURUSD forecast: key trading points

- The likelihood of a December Federal Reserve rate cut has decreased to 58% from 65% a week ago

- The share of overdue commercial property loans in the US exceeded 1% in Q2 2024, marking the highest level since 2014

- Investors await news about key economic appointments in Donald Trump’s new administration

- EURUSD forecast for 19 November 2024: 1.0450

Fundamental analysis

The EURUSD rate is slightly correcting on Tuesday morning. After the price rebounded from the key 1.0505 support level, pressure on the European currency eased. This level is at the lower boundary of a long-term sideways range, where the pair has been trading since the beginning of 2023. Sellers need to make significant efforts to break below the key support level, as securing a position below 1.0505 could signal the beginning of a new bearish trend.

Investors continue closely monitoring the prospects for a Federal Reserve interest rate change. Fed Chair Jerome Powell’s comments last week that the regulator was in no rush to lower the interest rate despite robust economic data and a steady labour market remain a crucial factor for the markets. However, traders believe further increases in hawkish market expectations have limited potential.

Alongside projected inflation acceleration amid high tariffs and the tightening of the immigration policy under Trump’s new administration, robust US macroeconomic indicators have reduced the odds of a December rate cut. According to the CME FedWatch Tool, the likelihood of this scenario decreased to 58% from over 65% a week ago.

Meanwhile, increased risks in the US commercial property sector raise concerns. The share of overdue loans in Q2 2024 exceeded 1%, marking the highest level since 2014. Loans secured with office property in large cities are especially vulnerable. The share of overdue loans with leading banks in April-June reached 11%. According to today’s EURUSD forecast, these data exert pressure on the US dollar.

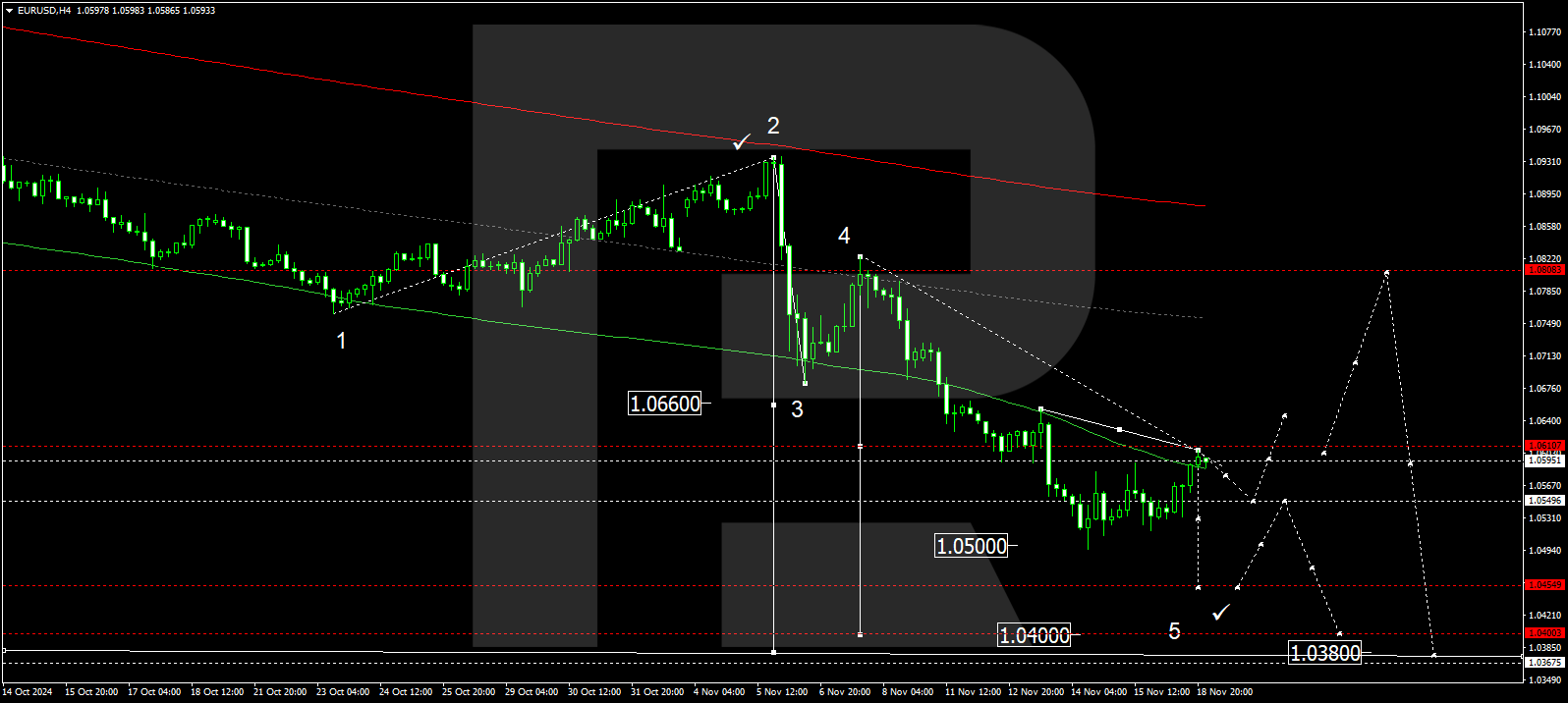

EURUSD technical analysis

The EURUSD H4 chart indicates that the market has completed a corrective wave, reaching 1.0606. The price is expected to fall to 1.0550 today, 19 November 2024, with a consolidation range forming around 1.0550. An upward breakout could extend the corrective wave towards 1.0660. Conversely, a breakout below the range and the 1.0530 level will open the potential for further movement to 1.0450 and possibly to 1.0400, the main target.

The Elliott Wave structure and matrix of the downward wave’s second half, with a pivot point at 1.0660, technically support this scenario. This level is considered crucial for the downward wave structure in the EURUSD rate. The market is forming a consolidation range above the lower boundary of a price envelope at 1.0550. An upward breakout could lead to a correction towards the envelope’s central line at 1.0660. Conversely, a downward breakout could extend the range, with the wave continuing to the envelope’s lower boundary at 1.0400, the first target.

Summary

Investors remain cautious, assessing the prospects for a Federal Reserve interest rate cut amid robust economic data. Increased risks in the commercial property sector and expectations of news about appointments in Trump’s administration put additional pressure on the US dollar. Technical indicators for today’s EURUSD forecast suggest that the correction could be complete, with a downward wave continuing towards the 1.0450 level.