EURUSD: Strong US economy and expectations of Trump’s victory exert pressure on the euro

The EURUSD rate slightly declines, remaining within the range. More details in our analysis for 29 October 2024.

EURUSD forecast: key trading points

- Positive US economic indicators continue to exert pressure on the euro

- The increasing likelihood of Donald Trump’s victory in the presidential election supports the US dollar

- Traders are focused on the upcoming releases of crucial economic data, such as US GDP, CPI, and the employment report

- EURUSD forecast for 29 October 2024: 1.0780

Fundamental analysis

The EURUSD rate continues to correct for the fifth consecutive trading session. Buyers have so far managed to maintain the 1.0775 level. In addition to positive economic data supporting the strength of the US economy, the US dollar is bolstered by rising expectations of Donald Trump’s victory in the upcoming US presidential election.

Traders now focus on preliminary US Q3 GDP data due on Wednesday and the core PCE price index for September, a crucial inflation gauge for the Federal Reserve, scheduled for release on Thursday. The US nonfarm payrolls report is due on Friday, potentially increasing market volatility.

Overall, the US dollar remains stable as signs of steady economic growth have reduced expectations of a sharp Federal Reserve interest rate cut. Market participants now believe that after starting the easing cycle with a sizeable 50-basis-point cut in September, the regulator will limit itself to a more moderate 25-basis-point move in November. The market estimates the likelihood of such a reduction at 95%, which, as part of today’s EURUSD forecast, continues to weigh on the euro.

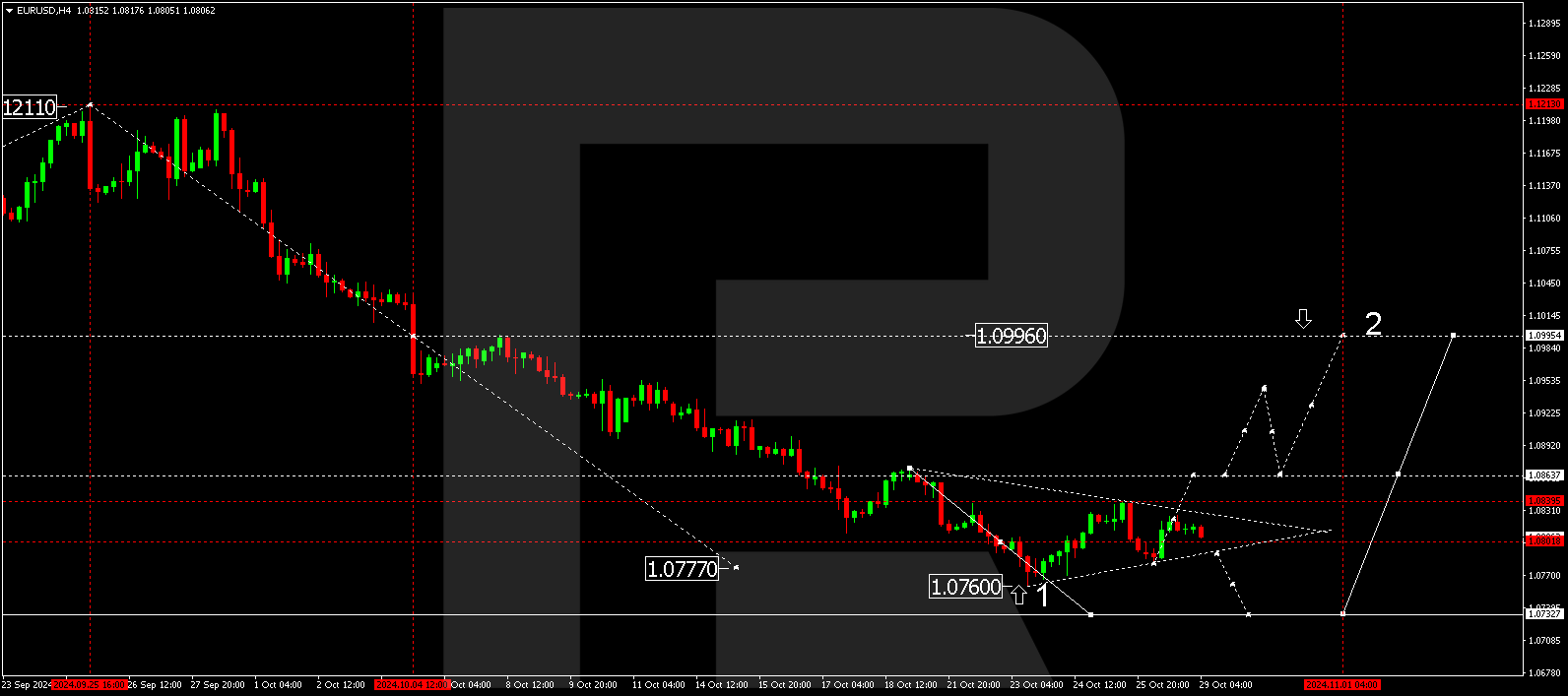

EURUSD technical analysis

The EURUSD H4 chart shows that the market has completed a correction to 1.0782. A consolidation range continues to develop around the 1.0798 level, with a decline to 1.0780 possible today, 29 October 2024. After reaching this level, the price could rise to 1.0811. A new consolidation range is expected to develop around this level. If the EURUSD rate breaks above the range, this will open the potential for a further growth wave towards 1.0860 with the prospect of a trend towards the local target of 1.0940. With a breakout below the consolidation range, a downward wave might extend to 1.0733.

Summary

The US dollar remains strong due to robust economic data and growing expectations of Donald Trump’s election victory. The market estimates the likelihood of a 25-basis-point Federal Reserve rate cut in November at 95%, providing additional support to the US currency. Technical indicators in today’s EURUSD forecast suggest that a corrective wave could continue towards 1.0780.