The EURUSD rate has stopped falling and is attempting to reverse upwards from the area near 1.1600, with the euro supported by yesterday’s EU inflation data. Discover more in our analysis for 3 September 2025.

EURUSD forecast: key trading points

- Market focus: core inflation in the eurozone rose by 2.3% y/y in August

- Current trend: trading within a broad range

- EURUSD forecast for 3 September 2025: 1.1735 or 1.1580

Fundamental analysis

The EURUSD pair gained support from EU inflation data. According to the preliminary estimate, the annual core inflation rate in the eurozone stood at 2.3% in August 2025, marking the fourth consecutive month at this level. This result slightly exceeded market expectations of a decline to 2.2%.

Although inflation remains at its lowest level since October 2021, it continues to hold firmly above the regulator’s 2.0% target. This could lead to a split among ECB Governing Council members between dovish and hawkish positions on further monetary policy adjustments.

EURUSD technical analysis

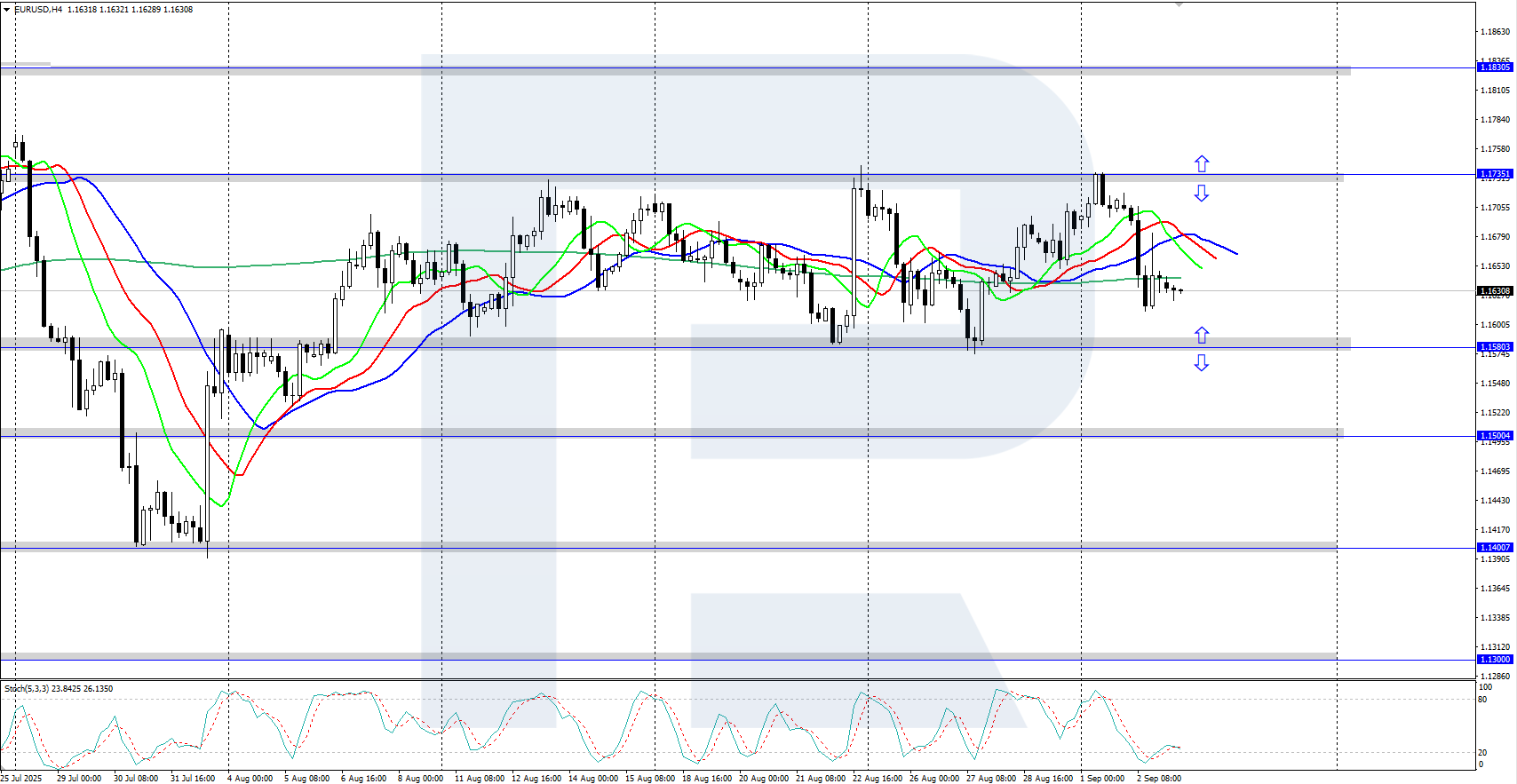

On the H4 chart, the EURUSD pair is declining after rebounding from the 1.1735 resistance level. The pair is currently undergoing a local downward correction, which could be followed by renewed growth. The key support level is at 1.1580.

The short-term EURUSD forecast suggests growth towards 1.1735 and higher if the bulls hold above 1.1580. However, if the bears break below 1.1580, the decline may extend to the support area around 1.1500.

Summary

The EURUSD rate has halted its decline and is attempting to reverse upwards from the area near 1.1600. According to published statistics, core inflation in the EU remains firmly at 2.3%.

Open Account