The EURUSD pair is experiencing a substantial rise. The market counts on weak economic signals from the US. Find out more in our analysis dated 14 August 2024.

EURUSD forecast: key trading points

- The EURUSD pair has reached a new high in seven trading sessions

- The market is increasingly confident about a substantial Federal Reserve interest rate cut in September

- EURUSD forecast for 14 August 2024: 1.1000 and 1.1011

Fundamental analysis

The EURUSD rate has markedly increased and is hovering around 1.0994 on Wednesday.

Yesterday’s US statistics caused the instrument to surge. The Producer Price Index increased by only 2.20% y/y in July, down from 2.60% previously and the forecasted 2.40%. Month-over-month data was also weaker than expected.

A “cooler” PPI report might suggest that today’s inflation release will also be weak. The CPI statistics due later today may confirm the disinflation course in the US. If forecasts align with the reality, the likelihood of a 50-basis-point Federal Reserve interest rate cut in September will increase markedly.

The baseline scenario assumes that US inflation stood at 3.00% y/y in July. The CPI, excluding groups of volatile goods, may reach 3.20% compared to 3.30% in June. The EURUSD forecast will depend on these indicators.

EURUSD technical analysis

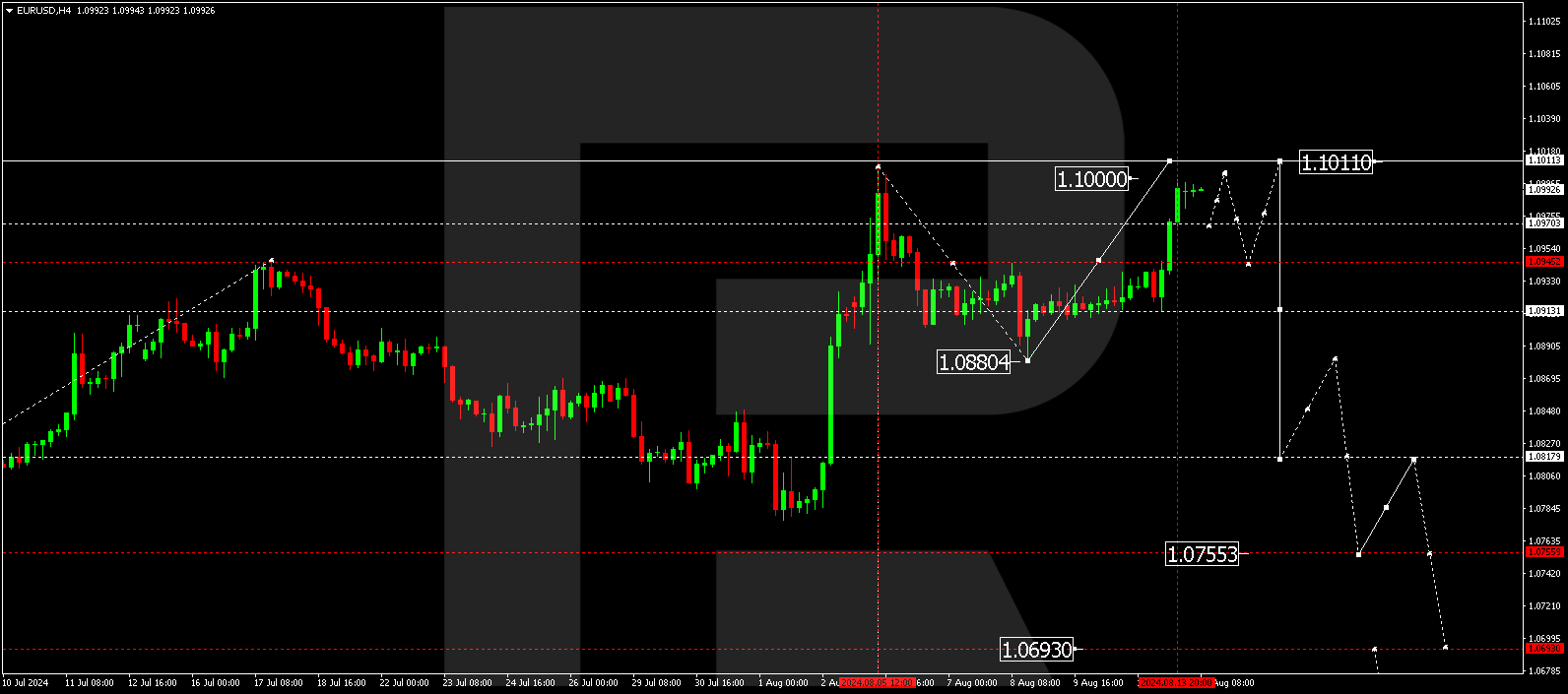

The H4 EURUSD chart shows that the market has reached the growth wave target of 1.0945. A consolidation range has formed around this level. With an upward breakout, the EURUSD rate could rise to 1.1000. The price is expected to reach this level today, 14 August 2024, and then decline to 1.0974. Subsequently, another growth structure may develop, targeting 1.1011, marking the completion of the growth potential. A new decline wave is expected to begin, aiming for 1.0880 as the initial target.

Summary

The EURUSD pair is steadily rising. Technical indicators in today’s EURUSD forecast suggest a continued growth wave towards the 1.1000 and 1.1011 levels.