EURUSD: the euro attempts to regain ground against the US dollar

A speech by ECB official Elizabeth McCaul, the IMF meeting, and rising inflation in the US could support the euro. Discover more in our analysis for 25 October 2024.

EURUSD forecast: key trading points

- A speech by a member of the Supervisory Board (ECB representative), Elizabeth McCaul

- The International Monetary Fund meeting

- The expected University of Michigan US inflation: previously at 2.7%, projected at 2.9%

- EURUSD forecast for 25 October 2024: 1.0835

Fundamental analysis

Member of the European Central Bank Supervisory Board Elizabeth McCaul will deliver a speech today, which may shed light on current aspects of financial regulation in the eurozone. ECB representatives’ statements often guide potential monetary policy changes, including evaluations and development prospects.

The Supervisory Board, which is responsible for planning and implementing the ECB’s supervisory functions, meets approximately every three weeks. Its responsibilities include setting financial limits, issuing or cancelling banking licences, and imposing remedial and penalty measures on large financial institutions.

All Supervisory Board decisions are binding upon banks that are part of the unified supervisory mechanism and aim to support the banking system’s stability. Fundamental analysis for 25 October 2024 suggests that the news may be positive for the euro, creating a platform for strengthening the European currency against the US dollar.

The International Monetary Fund meeting will follow McCaul’s speech. The meetings typically address global and regional economic issues supporting economic stability and financial resilience. The main problems include:

- Economic growth and recovery

- Monetary policy and inflation

- Financial reforms and regulation

- Global risks

- Development aid

The University of Michigan’s US inflation data will be released at the beginning of the US trading session. The previous reading was 2.7%, and the forecast for 25 October 2024 suggests that inflation will rise to 2.9%. This increase can be considered marginal. Nevertheless, the release of actual data may impact the EURUSD rate.

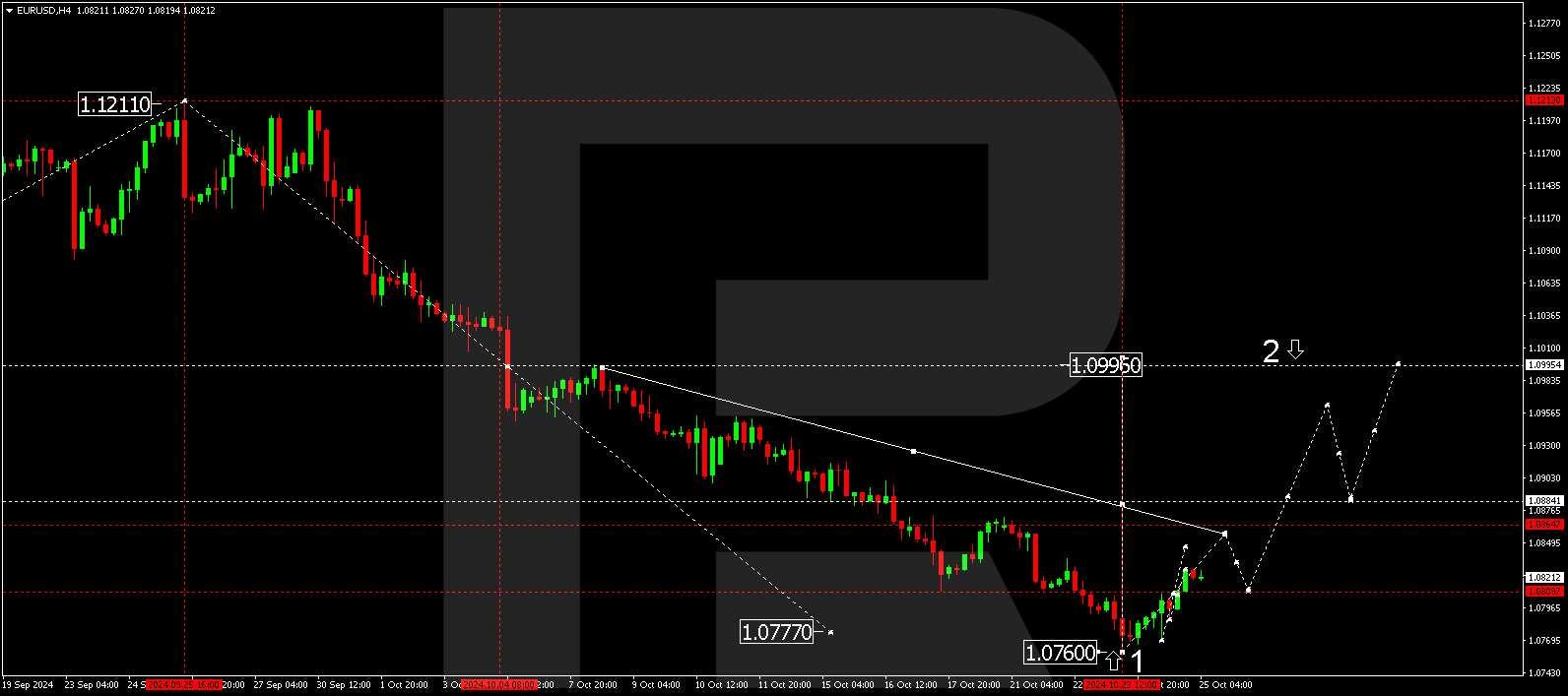

EURUSD technical analysis

The EURUSD H4 chart shows that the market continues its upward momentum towards 1.0835, reaching the local momentum target of 1.0829. A decline to 1.0800 (testing from above) is possible today, 25 October 2024, followed by potential growth to 1.0835. After reaching this level, the price could correct towards 1.0800. A consolidation range in the EURUSD rate has formed around 1.0800. A breakout above the range will open the potential for further growth to 1.0885, with the trend potentially continuing towards the local target of 1.0960.

Summary

With technical analysis for today’s EURUSD forecast, McCaul’s speech and the IMF meeting suggest a potential growth wave towards 1.0835.