EURUSD: the euro declines for the second consecutive week

A slight increase in the eurozone’s economic indicators could further weaken the euro against the US dollar. Discover more in our analysis for 12 November 2024.

EURUSD forecast: key trading points

- Germany’s Consumer Price Index (CPI) (m/m): previously at 0.4%, projected at 0.4%

- The ZEW Economic Sentiment Index for the eurozone: previously at 20.1, projected at 20.5

- A speech by Fed’s Christopher Waller

- EURUSD forecast for 12 November 2024: 1.0540

Fundamental analysis

Germany’s CPI reflects changes in the cost of goods and services for consumers, which helps assess shifts in buying trends and economic stagnation. A higher-than-forecast reading typically has a positive impact on the national currency.

The forecast for 12 November 2024 suggests that the index could remain flat at the previous level of 0.4%, with the projected value being identical. Fundamental analysis for 12 November 2024 shows that the CPI could remain unchanged, thereby adding to negative factors for the euro.

The ZEW Economic Sentiment Index for the eurozone measures expectations among Germany’s institutional investors. A reading above zero indicates an optimistic outlook, while a negative reading points to pessimism among investors. Although the index is above zero, today’s expectations for the euro are not very promising, with a forecasted increase of just 0.4% to 20.5. If the actual reading is below the forecast, the EURUSD rate may decline further.

Christopher Waller has been a member of the Federal Reserve Board of Governors since 2020 and has the right to vote on decisions to change US monetary policy. His speech could provide insights into the future direction of the Federal Reserve's monetary policy.

EURUSD technical analysis

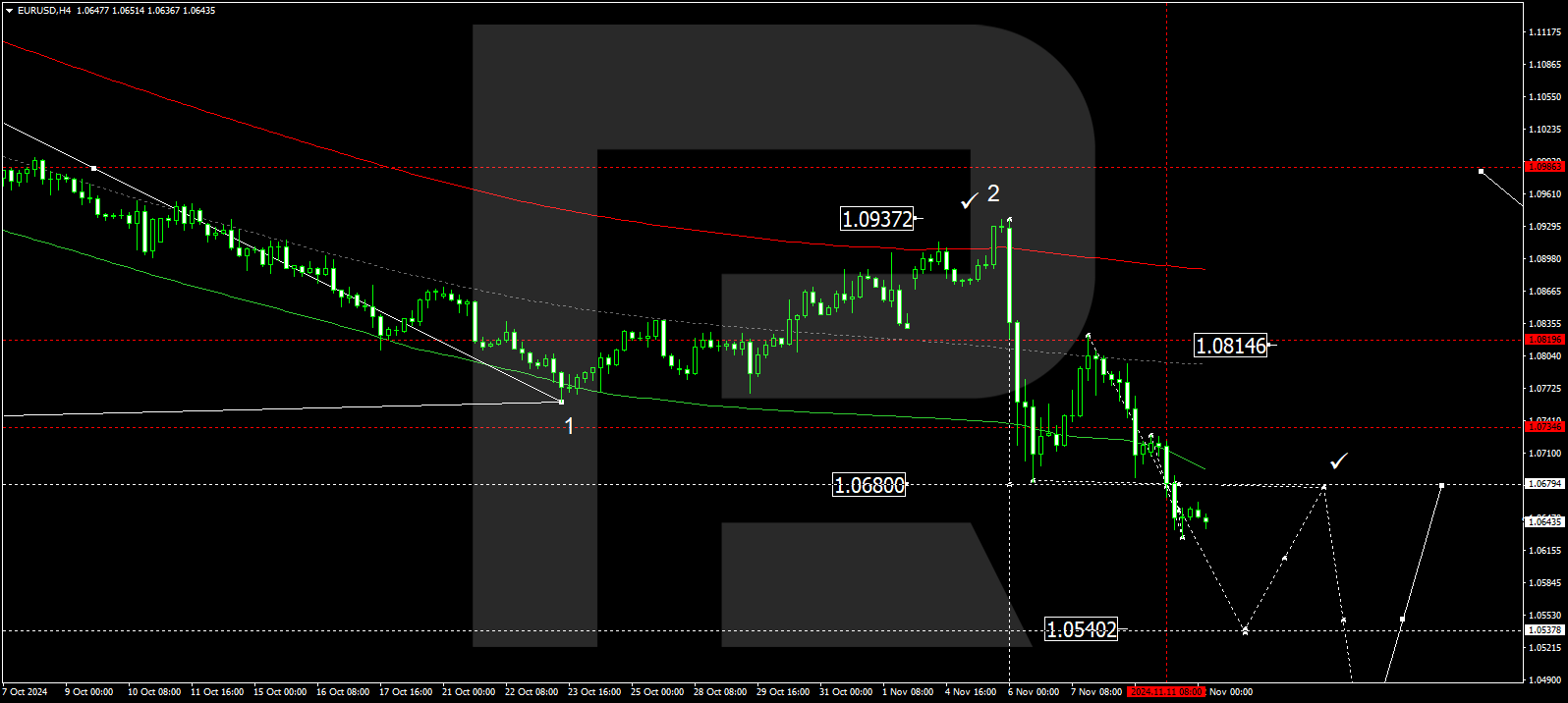

The EURUSD H4 chart shows that the market has breached the 1.0680 level and declined to 1.0628. A consolidation range could form around 1.0680. Today, 12 November 2024, the price could technically return to 1.0680 before declining to the local target of 1.0540. A corrective wave could begin once the price hits this level, aiming for 1.0680 (testing from below). Subsequently, the trend might continue to 1.0420.

The Elliott Wave structure and matrix of the third downward wave, with a pivot point at 1.0680, technically confirm this scenario. This level is considered crucial within the consolidation range for the EURUSD rate. Breaking below it opened the potential for continuing the trend towards 1.0540. After reaching this level, the price is expected to rise to the central line of a price envelope. Subsequently, the wave might continue to the envelope’s lower boundary at 1.0420.

Summary

Alongside the technical analysis for today’s EURUSD forecast, the eurozone’s low economic indicators suggest that the downward wave could continue towards the 1.0540 level.