EURUSD: the euro gains hope for strengthening

The Eurogroup’s meeting and weaker US retail sales may give the euro hope of regaining ground against the US dollar. More details in our analysis for 15 November 2024.

EURUSD forecast: key trading points

- The Eurogroup’s meeting

- The European Union’s economic outlook

- US retail sales (m/m): previously at 0.4%, projected at 0.3%

- The core US retail sales index (m/m): previously at 0.5%, projected at 0.3%

- EURUSD forecast for 15 November 2024: 1.0420 and 1.0385

Fundamental analysis

The Eurogroup will meet today to release the European Union’s economic outlook. The Eurogroup is an informal body in the European Union, bringing together finance ministers from eurozone member states, the EU Commissioner for Economy, and a representative from the European Central Bank.

The meetings are held monthly, a day before the Economic and Financial Affairs Council (ECOFIN) meets. The Eurogroup’s primary goal is to coordinate the economic policies of eurozone countries and contribute to the stability of the single currency – the euro.

The Eurogroup’s main functions are:

- Coordinating economic policy: discussing measures to strengthen the financial stability of the eurozone and stimulate economic growth

- Drafting decisions for the EU supreme authorities: the Eurogroup prepares proposals that are later voted on at ECOFIN

- Analysing and adjusting euro policy: participants make recommendations on issues related to the single currency and the financial stability of the eurozone

- Preparing top-level meetings: drafting decisions for EU summits and other key events

The US retail sales (m/m) indicator reflects the change in the total value of goods sold in the retail sector over a month. The indicator shows how much consumer demand has changed compared to the previous month. The calculation of retail sales includes all sales in stores, catering outlets, online trading, and others, excluding spending on services. The last reading was 0.4%, and the forecast for 15 November 2024 suggests that the indicator could decline to 0.3%. Overall, such a decrease is not critical but indicates lower consumer activity, which may signal an economic slowdown.

Fundamental analysis for 15 November 2024 suggests that the core US retail sales index may fall to 0.3% from the previous reading. A drop in retail sales may serve as an additional signal for a future decline in US GDP.

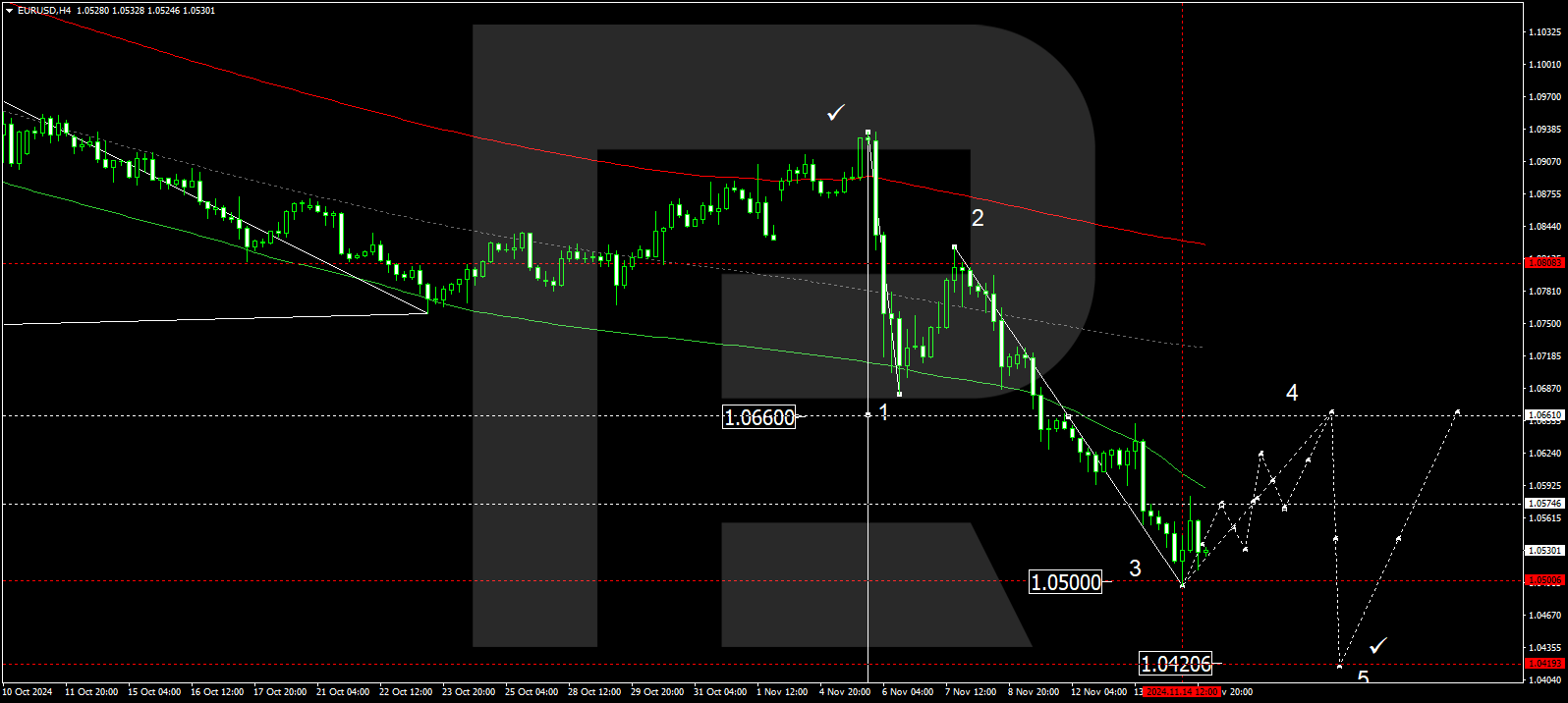

EURUSD technical analysis

The EURUSD H4 chart shows that the market has completed a downward wave, reaching 1.0500. A consolidation range is expected to form at the current lows today, 15 November 2024. If there is an upward breakout, a correction towards 1.0660 is possible. Conversely, a downward breakout could extend the wave towards 1.0420, reaching 1.0385. A correction may begin after the price hits this level, aiming for 1.0660.

The Elliott Wave structure and the downward wave matrix, with a pivot point at 1.0660, technically support this scenario. This level is considered crucial for the downward wave in the EURUSD rate. The market has advanced to the lower boundary of a price envelope at 1.0500, with a consolidation range expected to form above this level. An upward breakout could push the price to the envelope’s central line at 1.0660. A downward breakout might extend the wave towards 1.0420 and potentially further to 1.0385.

Summary

The Eurogroup’s meeting and weak forecasts for US economic indicators could weaken the US dollar. Technical analysis for today’s EURUSD forecast suggests that the downward wave could progress to the 1.0420 and 1.0385 levels.