EURUSD: the euro has a chance to regain ground

The main news today is the release of the US nonfarm payrolls. Can the EURUSD pair rise to 1.0628? Find more details in our analysis for 6 December 2024.

EURUSD forecast: key trading points

- Eurozone Q3 GDP: previously at 0.4%, projected at 0.4%

- US unemployment rate: previously at 4.1%, projected at 4.2%

- US nonfarm payrolls: previously at 12 thousand, projected at 200 thousand

- EURUSD forecast for 6 December 2024: 1.0628

Fundamental analysis

GDP is the total value of all goods and services produced in a country, calculated based solely on end products, excluding raw material costs.

The forecast for 6 December 2024 appears somewhat optimistic, suggesting that the eurozone’s GDP will remain flat at 0.4%. Given that the indicator has shown the same value for the last two quarters, the actual figure for the previous quarter may also remain unchanged.

The US unemployment rate shows the percentage of unemployed people actively seeking jobs and ready to start immediately. The actual data shows the number of unemployed people relative to the total working population. Fundamental analysis for 6 December 2024 suggests that the US unemployment rate could rise to 4.2%. The change is not critical, but the actual data could significantly impact the EURUSD rate.

US nonfarm payrolls from the last period disappointed investors, coming in below expectations. The reading is currently projected to be 200 thousand. If the reading matches the forecast, the market could see increased volatility. The release of nonfarm payrolls almost always triggers excitement in financial markets, which could either support the US dollar or cause it to lose ground.

EURUSD technical analysis

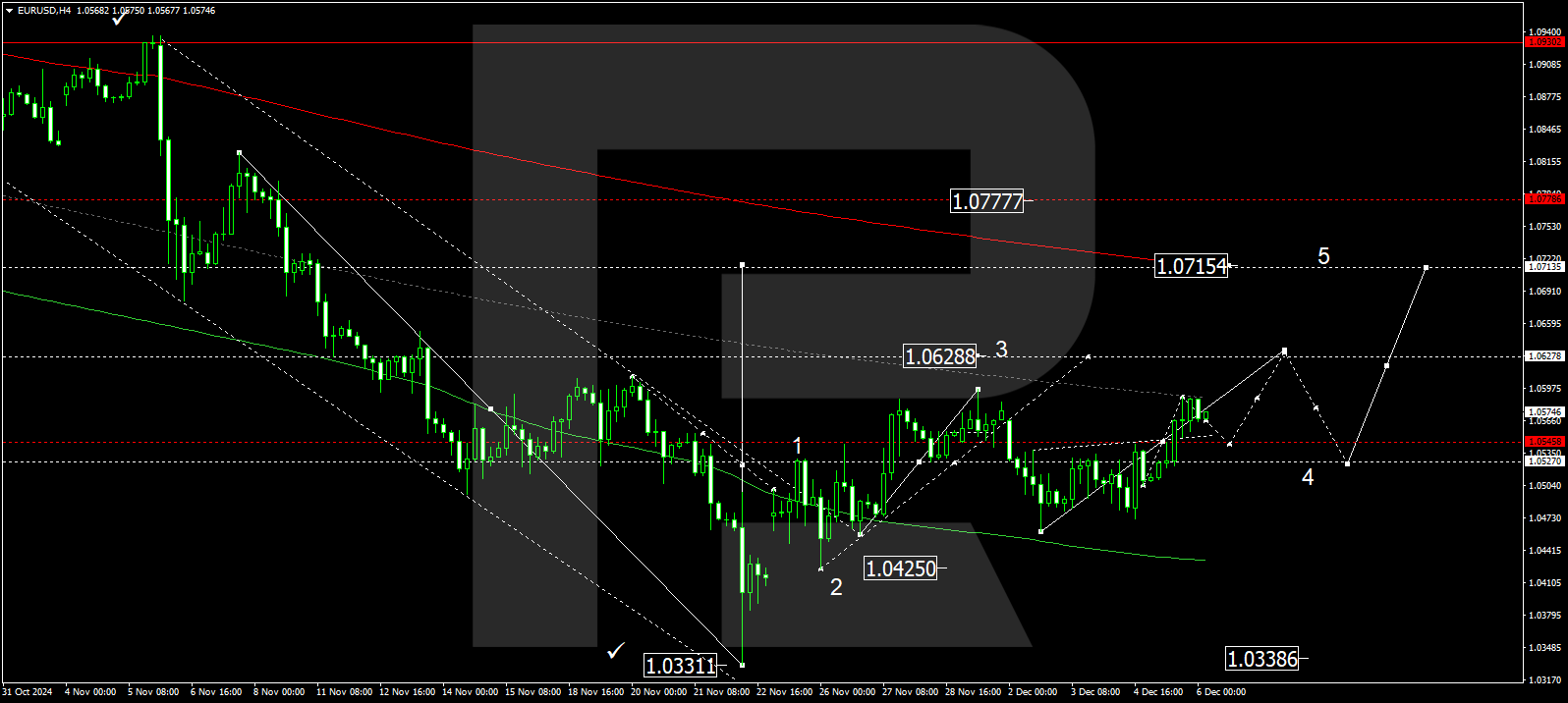

The EURUSD H4 chart shows that the market has broken above the 1.0545 level and risen to 1.0588. A downward structure towards 1.0545 (testing from above) could develop today, 6 December 2024. Subsequently, the price might rise to the local target of 1.0628. A downward wave could start once this level is reached, aiming for 1.0525.

The Elliott Wave structure and growth wave matrix, with a pivot point at 1.0500, technically support this scenario. This level is considered crucial for the EURUSD rate. The market has reached the central line of a price envelope at 1.0588, and a consolidation range could form around this level. An upward breakout might extend the wave to 1.0628, potentially continuing to the envelope’s upper boundary at 1.0715.

Summary

Together with technical analysis for today’s EURUSD forecast, the release of the eurozone’s GDP data and the US employment parameters suggests a potential growth wave towards the 1.0628 level.