EURUSD: the euro has little chance of strengthening

The positive news flow from the US may exert additional downward pressure on the EURUSD rate, with the target set at the 1.0433 level. More details in our analysis for 3 December 2024.

EURUSD forecast: key trading points

- Member of the ECB’s Executive Board, Piero Cipollone, will deliver a speech

- US JOLTS job openings: previously at 7.443 million, projected at 7.490 million

- The IBD/TIPP US Economic Optimism Index: previously at 53.2, projected at 54.1

- EURUSD forecast for 3 December 2024: 1.0433

Fundamental analysis

The speech by Piero Cipollone, a member of the ECB’s Executive Board, may influence the eurozone’s monetary policy.

Cipollone is expected to take an analytical approach based on economic data and the current macroeconomic situation. His speech often reflects the ECB’s strategy on monetary policy changes, potentially impacting currency, bond, and stock markets. Special attention is paid to signals about future actions – rate increases or monetary policy easing – critical for assessing the eurozone’s economic trajectory.

US job openings (JOLTS) are an economic indicator that shows the number of unfilled jobs across the country at the end of each month.

Published by the US Bureau of Labor Statistics, the report offers insight into workforce demand, economic activity, and the balance between employers and job seekers. JOLTS helps assess labour market dynamics: a higher number of vacancies suggests economic activity and rising personnel needs. In contrast, fewer vacancies indicate emerging business challenges and slowing economic growth. Analysts, investors, and the government rely on this data to make decisions.

The forecast for 3 December 2024 suggests that vacancies may increase to 7.490 million. A stronger-than-expected reading could positively affect the US dollar.

The IBD/TIPP US Economic Optimism Index, based on a survey of approximately 900 consumers, reflects consumer confidence in the economy. An index reading above 50.0 indicates optimistic sentiment among consumers.

Fundamental analysis for 3 December 2024 considers that the actual reading could be above the previous one, reaching 54.1 points, which would be a positive factor for the US dollar.

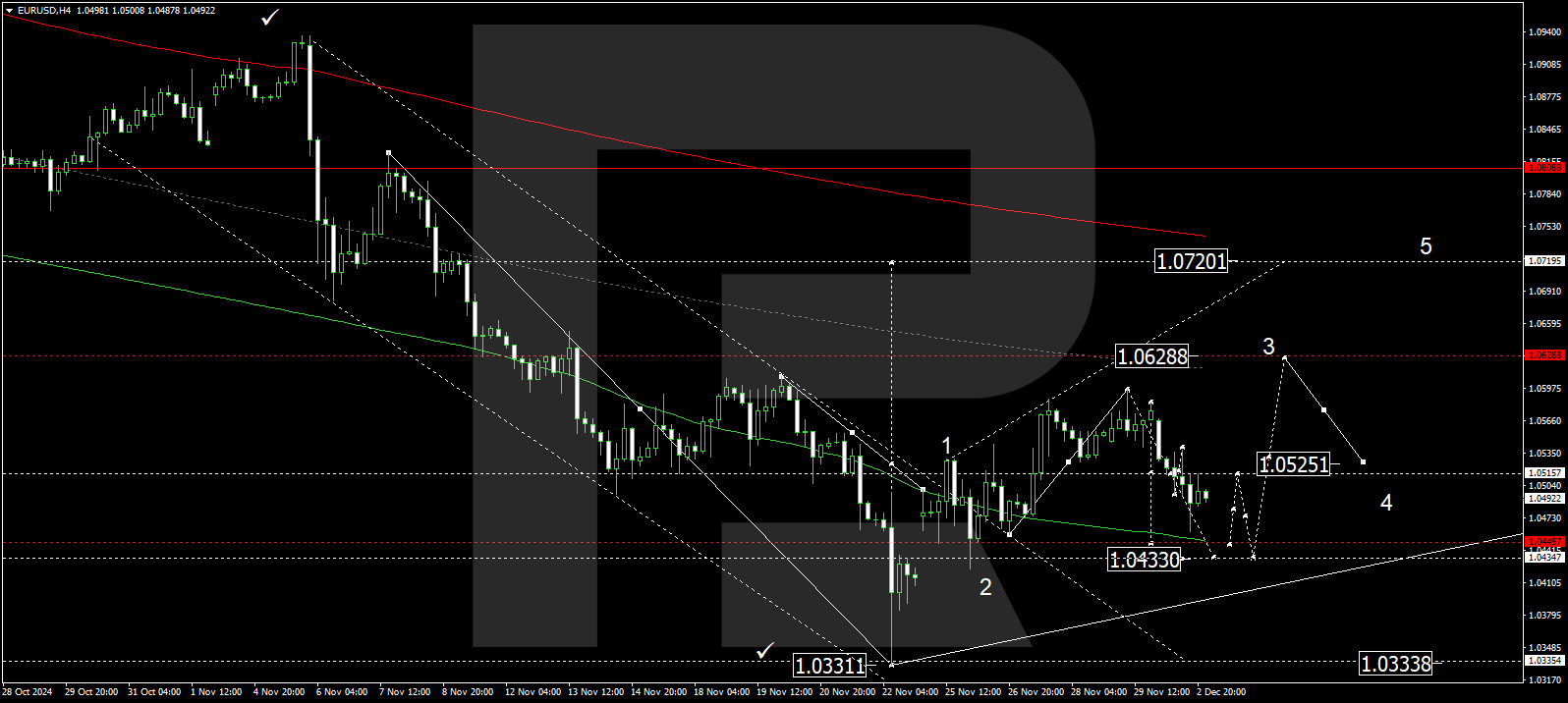

EURUSD technical analysis

The EURUSD H4 chart shows that the market has completed a downward wave towards 1.0460, followed by a correction towards 1.0500. A downward structure towards 1.0445 could develop today, 3 December 2024. Subsequently, the price might rise to 1.0500 before declining to 1.0433. The market continues to develop a consolidation range around 1.0500. A breakout below this range could extend the downward wave to 1.0333, while an upward breakout would open the potential for a growth wave targeting the local high of 1.0628.

The Elliott Wave structure and downward wave matrix, with a pivot point at 1.0500, technically support this scenario. This level is considered crucial for the EURUSD rate. Another downward wave is expected to form, targeting the lower boundary of a price envelope at 1.0433. Once this level is reached, a growth wave is expected to develop, aiming for the envelope’s central line at 1.0628 and potentially continuing the trend to its upper boundary at 1.0720.

Summary

Coupled with technical analysis for today’s EURUSD forecast, the positive US news flow suggests the development of a downward wave towards the 1.0433 level.