EURUSD: the euro has the potential to strengthen against the US dollar

GDP growth in the eurozone and a decrease in US employment figures may give the euro a chance to recover against the US dollar. Find out more in our analysis for 30 October 2024.

EURUSD forecast: key trading points

- Eurozone Q3 GDP (y/y): previously at 0.6%, projected at 0.8%

- US ADP nonfarm employment change: previously at 143,000, projected at 110,000

- Speech by the President of the Deutsche Bundesbank Joachim Nagel

- EURUSD forecast for 30 October 2024: 1.0830 and 1.0880

Fundamental analysis

GDP is the total value of all goods and services produced in a country; it applies only to final products and does not include the cost of raw materials.

Fundamental analysis for 30 October 2024 shows that the eurozone’s GDP may rise by 0.2% from the previous period and reach 0.8%, with actual data potentially supporting the euro.

The ADP National Employment Report tracks changes in nonfarm jobs based on data from more than 400,000 business sources. Published two days before official US employment data, it is a helpful indicator for US nonfarm employment forecasts. The release of this data may cause significant market volatility.

Higher-than-forecasted results support USD growth, while figures below expectations negatively impact the US dollar. The forecast for 30 October 2024 suggests employment may fall to 110,000, which could be negative for the US dollar and supportive of the euro. In this context, the EURUSD rate has every chance for growth.

Nagel, President of the Deutsche Bundesbank and a Member of the Governing Council of the European Central Bank, will deliver a speech at the end of the US trading session. A positive tone in the speech may also bolster the euro and help the pair initiate a correction.

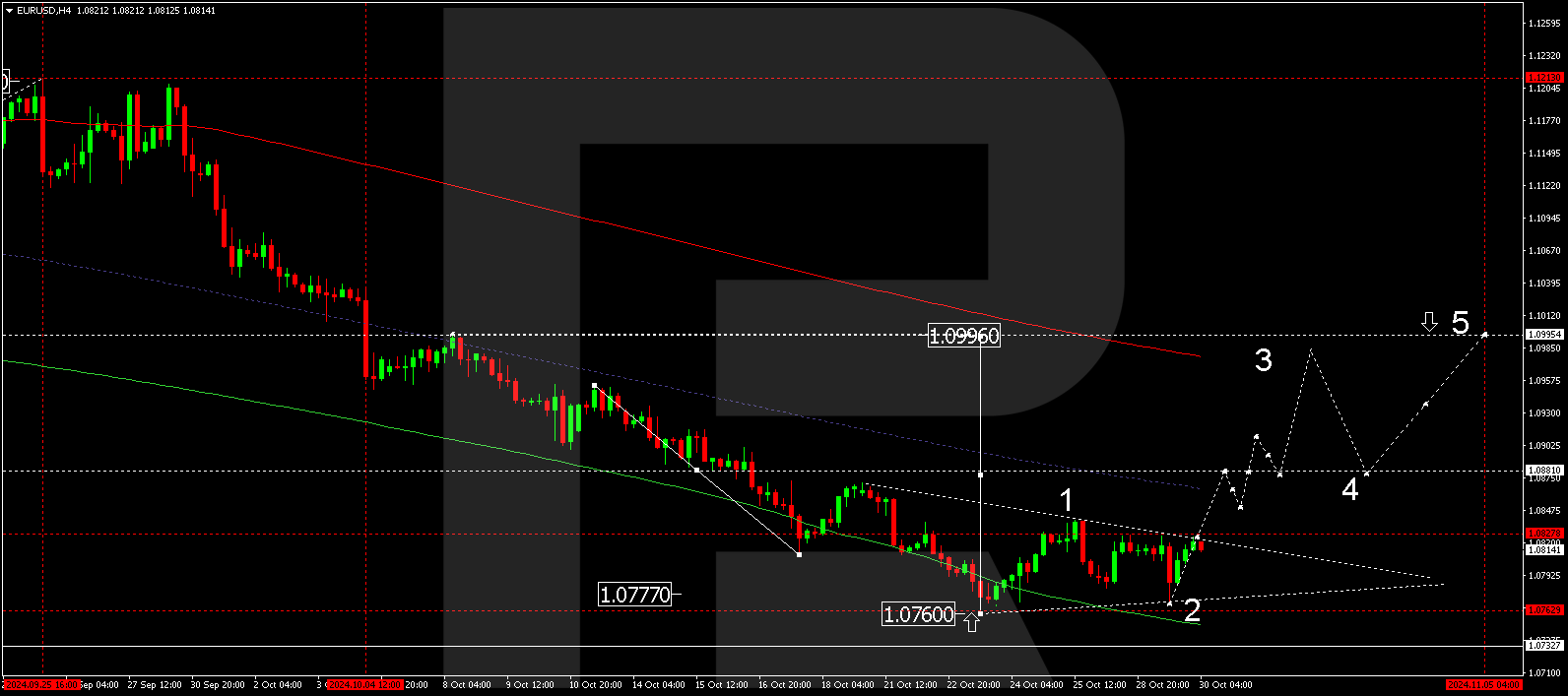

EURUSD technical analysis

The EURUSD H4 chart shows that the market has completed a correction, reaching 1.0770. A growth wave towards 1.0830 is currently forming. The price is expected to reach this target level today, 30 October 2024. Breaking above this level could lead to further growth towards 1.0880. Once the price hits this level, a new consolidation range is expected to develop around it. If the EURUSD rate breaks above the range, this will open the potential for further growth towards 1.0930 and up to the local target of 1.0980.

The Elliott Wave structure and wave matrix, with a pivot point at 1.0880, technically confirm this scenario. This level is considered pivotal for a corrective wave in the EURUSD rate. The market has found support at the lower boundary of the price envelope. The potential for further development of the growth structure should be considered. A break above the 1.0830 level may signal a continued corrective movement towards the upper boundary of the price envelope.

Summary

Alongside today’s EURUSD forecast, eurozone GDP growth and Nagel’s speech suggest a new growth structure could develop, targeting the 1.0830, 1.0880, 1.0930, and 1.0980 levels.