EURUSD: the euro may lose ground again after a correction

The ECB President’s speech may impact the current EURUSD forecast and push the price down to 1.0330. Discover more in our analysis for 28 January 2025.

EURUSD forecast: key trading points

- US durable goods orders in December: previously at -1.1%, projected at 0.3%

- US CB (Conference Board) Consumer Confidence Index: previously at 104.7, projected at 105.7

- ECB President Christine Lagarde will deliver a speech

- EURUSD forecast for 28 January 2025: 1.0515 and 1.0330

Fundamental analysis

The forecast for 28 January 2025 takes into account that US durable goods orders may rise to 0.3% in December, up from the previous -1.1%. The increase indicates somewhat higher purchasing power of the population and in the long term the improving US economic situation.

Fundamental analysis for 28 January 2025 indicates that the US CB Consumer Confidence Index is projected to increase to 105.7 points if the data aligns with or exceeds the forecast. This may exert downward pressure on the EURUSD rate.

ECB President Christine Lagarde is expected to deliver a speech on 28 January 2025. In her recent statements, she emphasised the progress in reducing inflation in the eurozone and expressed hope for achieving the 2% inflation target this year.

The upcoming speech will likely cover the following issues:

- Current economic situation in the eurozone: current indicators and economic growth prospects are expected to be analysed

- ECB monetary policy: there could be comments on future interest rate changes and other measures aimed at maintaining price stability

- Inflation trends: an overview of current inflation rates and expectations regarding the timing of achieving the 2% target

- Global economic trends: the impact of external factors on the eurozone’s economy, including trade relations and the general geopolitical situation

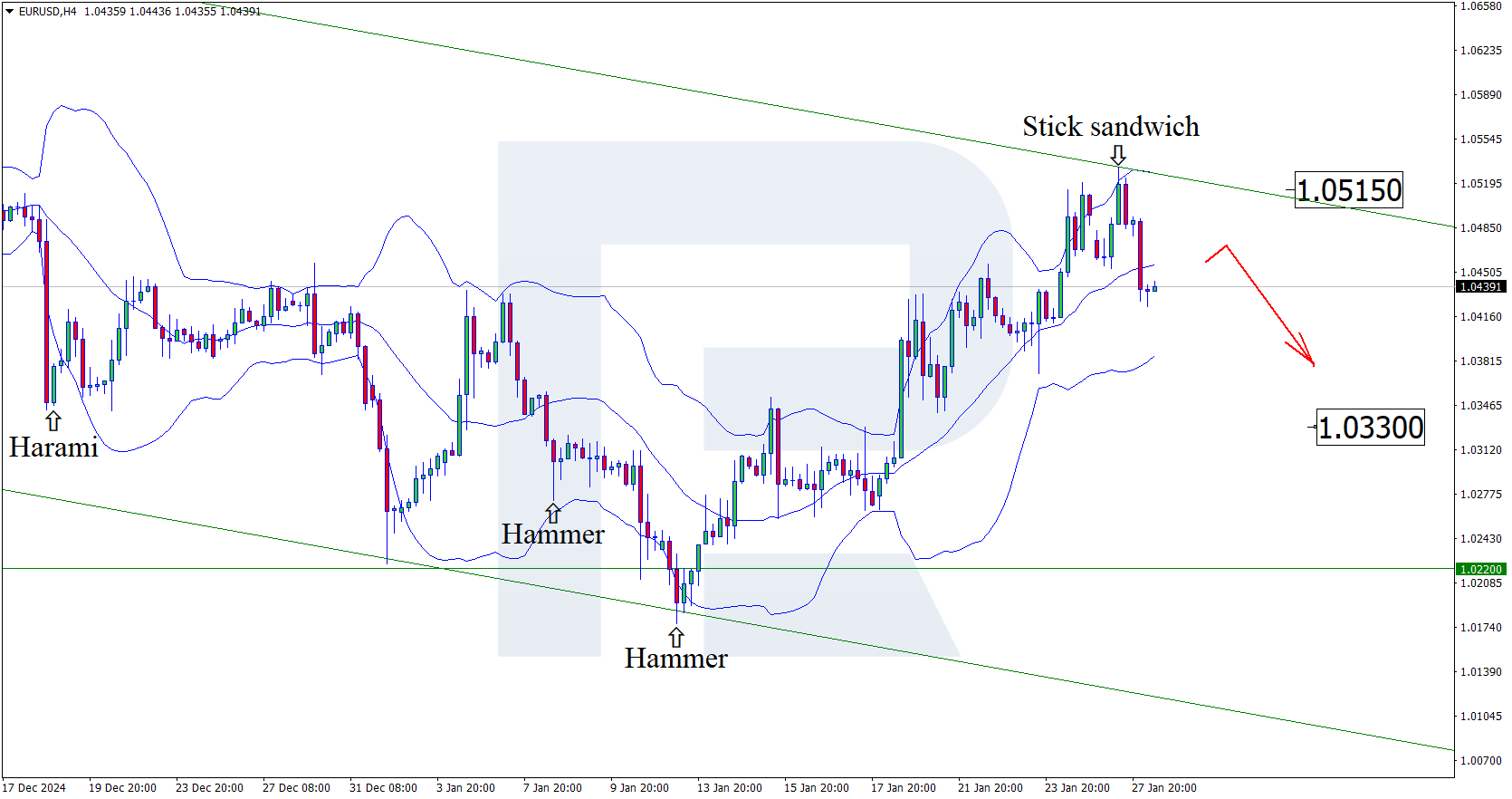

EURUSD technical analysis

Having tested the upper Bollinger band, the EURUSD price has formed a Stick Sandwich reversal pattern on the H4 chart. At this stage, it continues to develop a downward wave following the signal received. The price will likely decline further to the nearest support level at 1.0330 as it remains within a descending channel. A breakout below this level will open the potential for a more substantial downtrend.

However, an alternative scenario is possible, where the price undergoes a correction towards 1.0575 before gaining downward momentum.

Summary

Together with the EURUSD technical analysis, US fundamental data and the ECB president’s speech suggest a decline to 1.0330.