The EURUSD rate edged down to 1.0300 following Friday’s release of mixed US employment data. Discover more in our analysis for 10 February 2025.

EURUSD forecast: key trading points

- Market focus: ECB President Christine Lagarde will deliver a speech today

- Current trend: the downtrend

- EURUSD forecast for 10 February 2025: 1.0200 and 1.0350

Fundamental analysis

The US labour market statistics for January became available last Friday, including Nonfarm Payrolls and the unemployment rate. The Nonfarm Payrolls data came in slightly worse than expected at 143 thousand jobs, below the forecast of 170 thousand. Conversely, the unemployment rate data exceeded expectations, showing a decline to 4.0% (previously at 4.1%).

The EURUSD pair reacted to the US data release with a moderate decline, falling to the price area around 1.0300. Today, market participants will focus on ECB President Christine Lagarde’s speech, which could shed light on the outlook for the regulator’s monetary policy.

EURUSD technical analysis

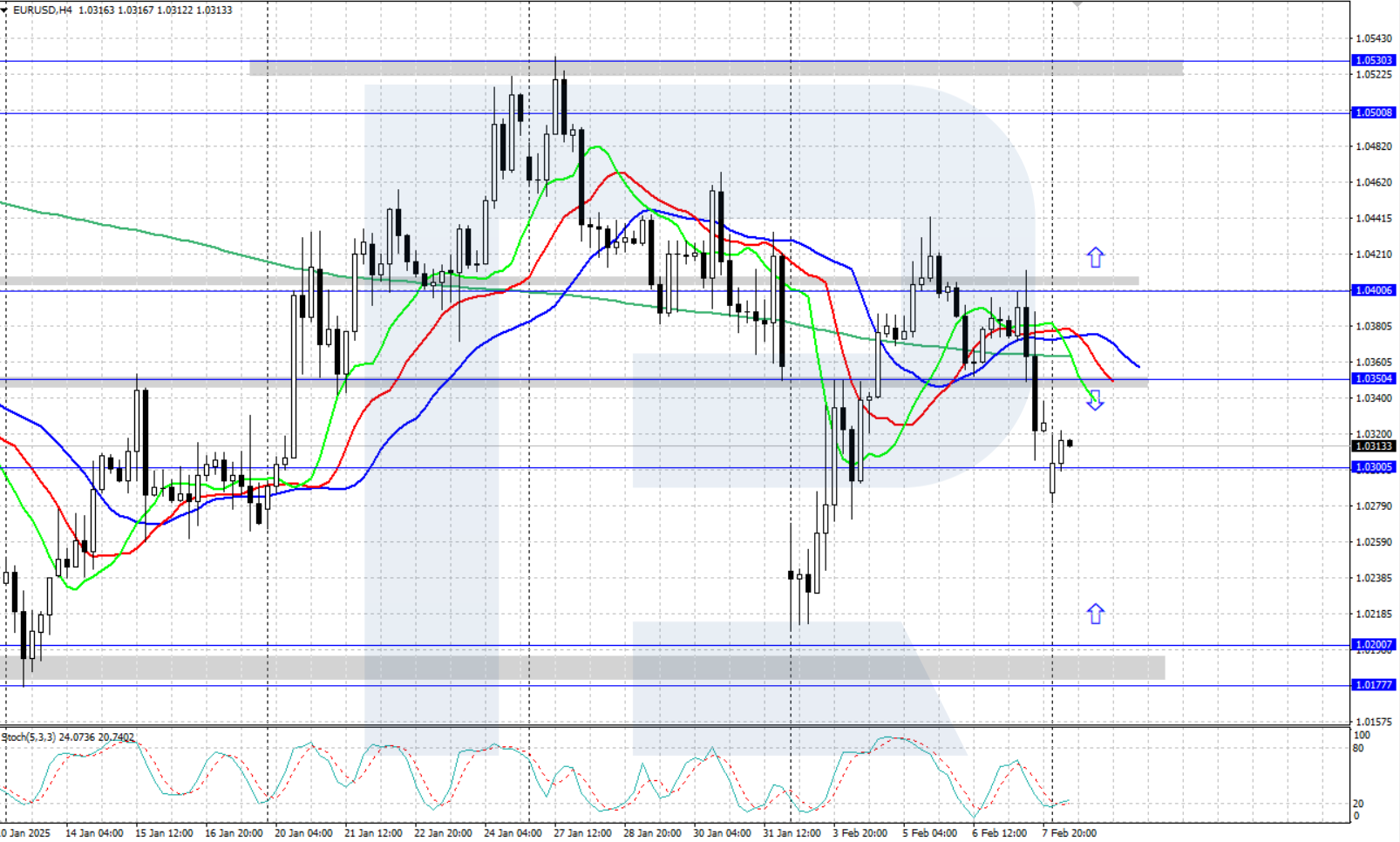

On the H4 chart, the EURUSD rate is declining within the downtrend, with the Alligator indicator confirming the downward momentum. Last week, the bulls failed to break above the 1.0530 resistance level and retreated, with the price currently consolidating in the sideways range between 1.0200 and 1.0530.

Today’s EURUSD forecast suggests that the pair will have the potential for growth to the next resistance at 1.0530 if the bulls overcome the 1.0350 resistance level. Conversely, if the bears keep the quotes below 1.0350, the price could plunge further to the 1.0177-1.0200 support area.

Summary

The EURUSD quotes tumbled to the 1.0300 level within the current downtrend. Market participants are awaiting ECB President Christine Lagarde’s speech today.