EURUSD: Trump’s statement supports US dollar gains

The EURUSD rate is poised to test a key support level at 1.0495. Discover more in our analysis for 2 December 2024.

EURUSD forecast: key trading points

- The US dollar has strengthened following Donald Trump’s announcement to BRICS countries about sanctions for creating currencies intended to rival the US dollar

- Analysts anticipate US job growth of 195,000 in November, while the unemployment rate is expected to rise to 4.2%

- Markets estimate a 67.1% probability of a 25-basis-point Federal Reserve interest rate cut in December

- EURUSD forecast for 2 December 2024: 1.0490 and 1.0430

Fundamental analysis

The EURUSD rate tumbled on Monday after gaining over 1.65% last week. The US dollar received support from Donald Trump’s demand that BRICS countries refrain from creating a new currency or supporting an alternative to the US dollar in international settlements. Otherwise, they risk facing tariffs of 100% on their exports to the US.

Traders believe that the US dollar’s decline last week will unlikely mark the start of a more profound fall, given the resilience of the US economy and deteriorating conditions in other countries. Significant economic developments would be necessary to shift Federal Reserve interest rate expectations. According to today’s EURUSD forecast, this lowers the likelihood of a prolonged US dollar decline in the near term.

The crucial factor for the US regulator could be the November US employment report, due on Friday. Analysts forecast job growth of 195,000 after a weak October report, with the unemployment rate expected to rise to 4.2% from 4.1%. Markets currently assign a 67.1% probability to a 25-basis-point Federal Reserve interest rate cut.

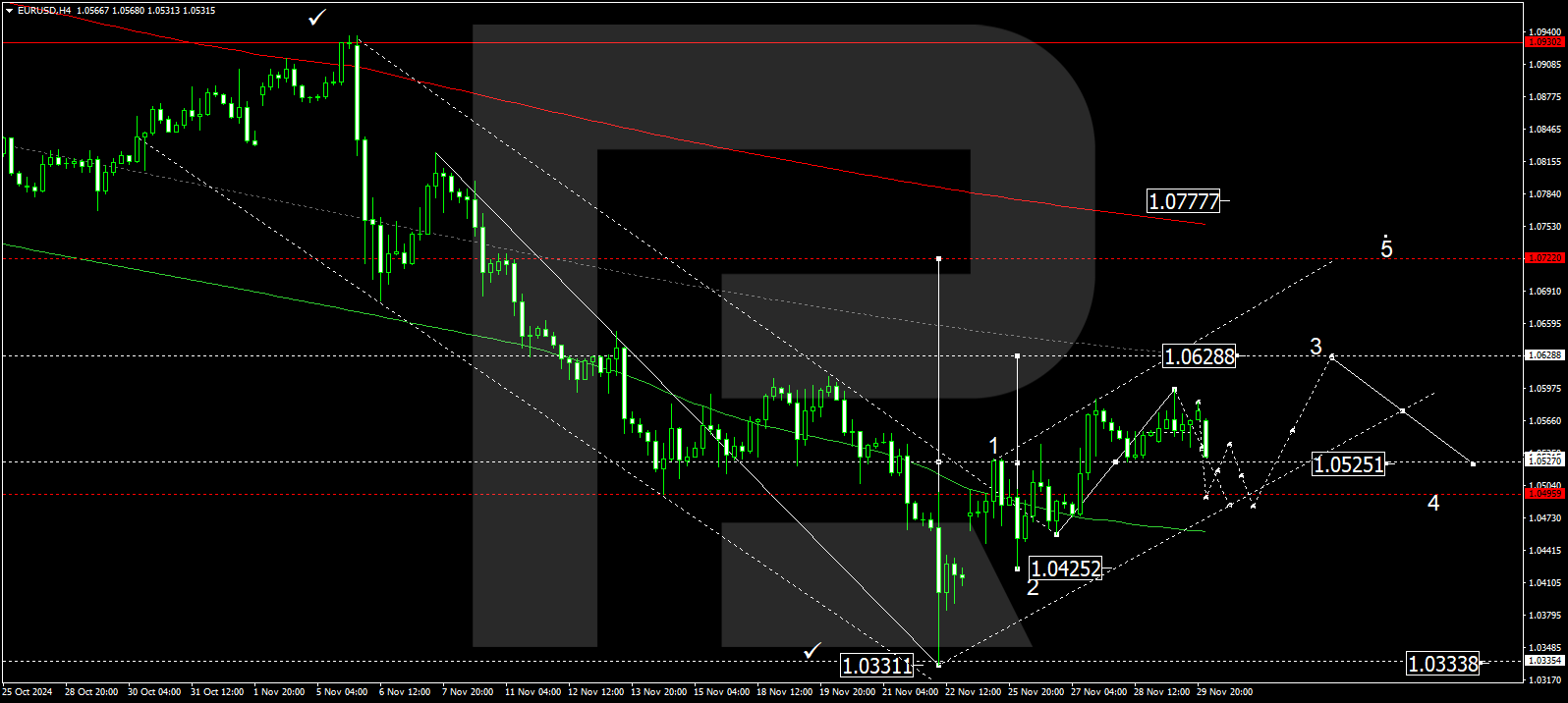

EURUSD technical analysis

The EURUSD H4 chart shows that the market has completed a growth wave, reaching 1.0596. A downward structure towards 1.0490 could develop today, 2 December 2024. Subsequently, the price might rise to 1.0530 before declining further to 1.0430. The market remains within a consolidation range near 1.0525. A breakout below this range could extend the downward wave to 1.0400, while an upward breakout would open the potential for a growth wave towards the local target of 1.0628.

The Elliott Wave structure and growth wave matrix, with a pivot point at 1.0525, technically support this scenario. This level is considered crucial for the EURUSD rate. Another growth wave could target the central line of the price envelope at 1.0628. Once this level is reached, a downward wave may develop, moving towards the envelope’s lower boundary at 1.0525, with a subsequent potential rise to its upper boundary at 1.0720.

Summary

The EURUSD rate remains under pressure following Donald Trump’s statements on safeguarding the US dollar. However, Friday’s US employment report results could significantly impact EURUSD price movements. Technical indicators for today’s EURUSD forecast suggest a potential downward wave towards the 1.0490 and 1.0430 levels.