EURUSD under pressure: Fed confidence stronger than expected

The EURUSD pair slipped below 1.1730 as investors grew cautious ahead of a wave of comments from Federal Reserve officials. Find more details in our analysis for 22 September 2025.

EURUSD forecast: key trading points

- The EURUSD pair is falling and may extend losses under current market conditions

- Market focus remains on the tone of the Fed and its policymakers

- EURUSD forecast for 22 September 2025: 1.1725 and 1.1660

Fundamental analysis

The EURUSD rate retreated towards 1.1730, with the USD supported by expectations of fresh signals from Fed officials and key US inflation data later this week.

In the coming days, Federal Reserve Chairman Jerome Powell and about nine other officials are scheduled to speak. Markets will be closely watching their comments for clues on rate policy. Fed Governor Stephen Miran is expected to deliver a detailed statement on his independent stance after dissenting last week and calling for a deeper 50-basis-point cut instead of the 25-basis-point move that was adopted.

On Friday, the PCE price index – the Fed’s preferred inflation gauge – will be released, with expectations pointing to moderate price pressures.

Last week, the Federal Reserve lowered interest rates by 25 basis points, for the first time since December and in line with forecasts. Policymakers also signalled room for two more cuts before the end of the year.

The EURUSD forecast is still cautious.

EURUSD technical analysis

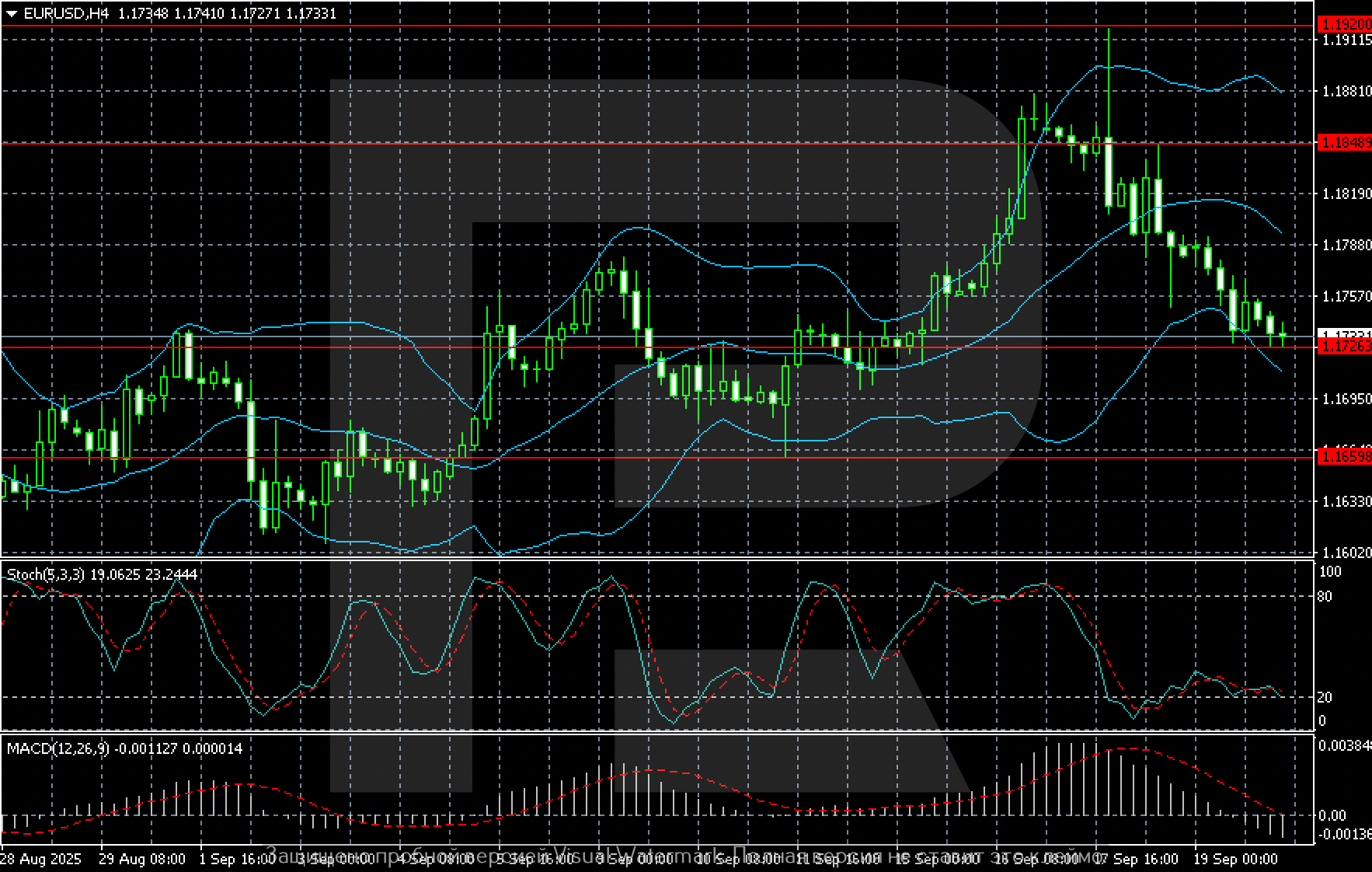

On the H4 chart, the EURUSD rate has returned to 1.1730. Resistance levels are located near 1.1848 and 1.1920, with support at 1.1728 and 1.1659. Currently, the price is testing the lower boundary of the local range at 1.1725.

Indicators show weakening bullish momentum. Bollinger Bands, which had widened during the rally, are now contracting, reflecting lower volatility. The Stochastic Oscillator is in oversold territory but has yet to confirm a reversal. MACD remains negative: the histogram is declining, and indicator lines are below zero, confirming bearish control.

Thus, the near-term scenario for EURUSD suggests testing the 1.1725 support level. A breakdown below it may push the pair lower towards 1.1660. If the level holds, a short-term rebound towards 1.1780–1.1800 is possible.

Summary

The EURUSD pair is moving lower as markets await signals from Fed officials. The EURUSD forecast for today, 22 September 2025, suggests further downside with targets at 1.1725 initially and then 1.1660.