EURUSD undergoes a correction ahead of a key US employment report

The EURUSD rate is falling after rebounding from the 1.0885 resistance level. Find out more in our analysis for 1 November 2024.

EURUSD forecast: key trading points

- US initial jobless claims fell to their lowest level since May, coming in at 216,000

- Traders forecast gains of 113,000 jobs in the employment report

- US personal income rose by 0.3% in September 2024, with spending increasing by 0.5%

- On an annual basis, growth in US personal consumption expenditures slowed to the lowest level since February 2021

- EURUSD forecast for 1 November 2024: 1.0922 and 1.0960

Fundamental analysis

The EURUSD rate declines after rising for four days. Investors are focused on the upcoming US employment report, which is expected to confirm the resilience of the US economy ahead of the Federal Reserve monetary policy meeting and the presidential election.

The US employment statistics for October close the current trading week, and traders expect 113,000 jobs to be created. However, recent natural disasters may affect the final reading, increasing the likelihood of deviation from forecasts. A muted market reaction to the report will help the EURUSD maintain its current trend as part of today’s forecast.

Meanwhile, US initial jobless claims unexpectedly fell to their lowest level since May. The number of Americans who first applied for unemployment benefits decreased by 12,000 to 216,000, while analysts predicted an increase to 230,000 on average.

Additionally, in September 2024, US personal income rose by 0.3% from August, while spending by Americans increased by 0.5%. Last month, the PCE index was up 0.2% compared to the previous month. The annual index growth rate slowed to 2.1%, marking the lowest since February 2021. This indicates potentially easing inflation, which may impact the Federal Reserve’s future monetary policy decisions.

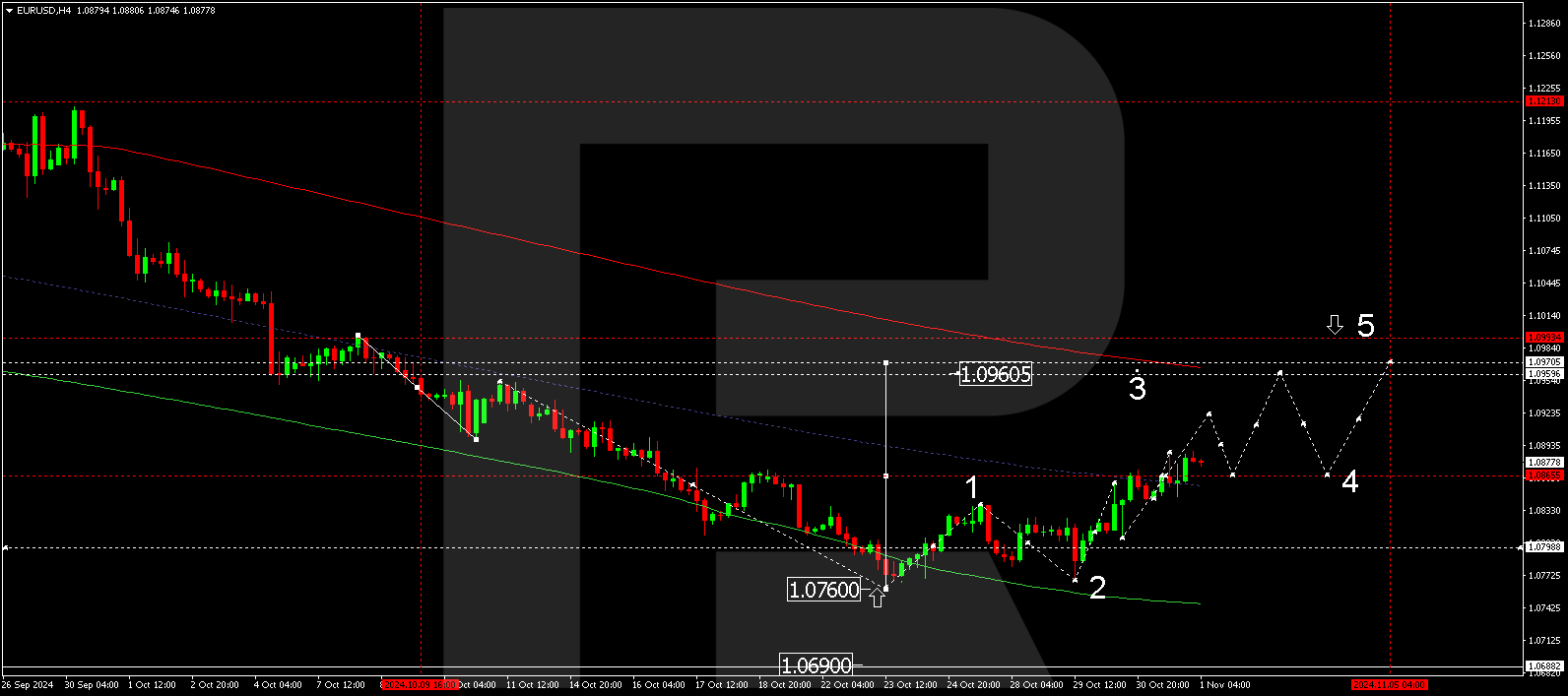

EURUSD technical analysis

The EURUSD H4 chart shows that the market is forming a consolidation range around 1.0866. The EURUSD rate is expected to break out of the consolidation range today, 1 November 2024, aiming for 1.0922 and potentially further up to the local target of 1.0960. After reaching this level, the price could undergo a correction towards 1.0866 (testing from above). Subsequently, another corrective wave might develop, aiming for 1.0970.

The Elliott Wave structure and wave matrix, with a pivot point at 1.0866, technically confirm this scenario. This level is considered crucial for a corrective wave in the EURUSD rate. The market is forming a consolidation range around the central line of a price envelope. A potential breakout above the consolidation range towards 1.0922 will be relevant today. After reaching this level, the price could decline to 1.0888 (testing from above). Subsequently, a growth wave might start, targeting the upper boundary of the price envelope.

Summary

The decline in the EURUSD rate ahead of the US employment report indicates investor caution amid uncertainty. The decrease in initial jobless claims to their lowest level since May temporarily supports the US dollar, but the focus remains on the final employment report. Technical indicators in today’s EURUSD forecast suggest that the growth wave could continue towards the 1.0922 and 1.0960 levels.