EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, XAUUSD, and Brent technical analysis and forecast for 04 April 2025

Here is a detailed daily technical analysis and forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, XAUUSD, and Brent for 4 April 2025.

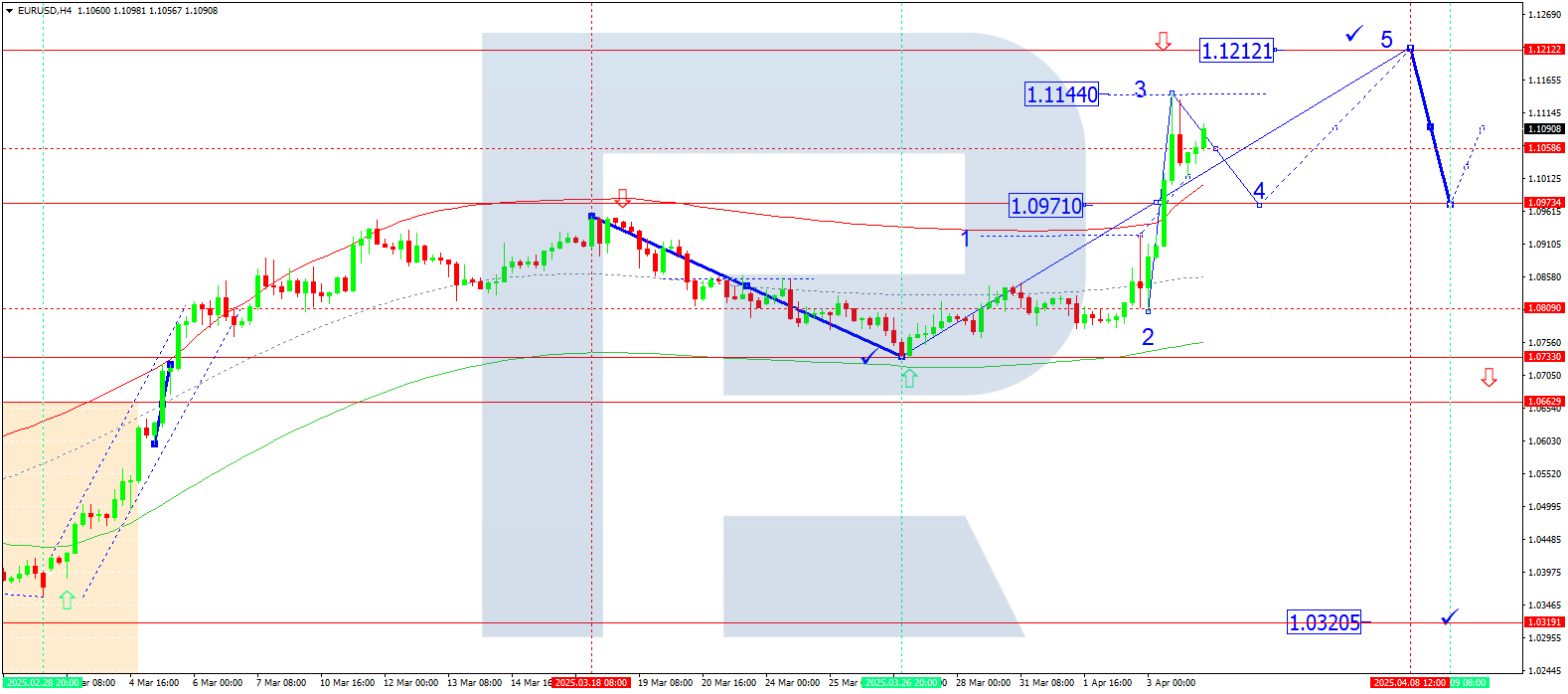

EURUSD forecast

On the H4 chart of EURUSD, the market completed a growth wave to 1.0970. A consolidation range formed around this level, and with an upward breakout, the wave extended to 1.1144. This suggests a possible third wave of growth. Today, 4 April 2025, a new consolidation range is forming around 1.1058. If the market breaks downwards, a correction to 1.0970 (testing from above) is possible. An upward breakout opens potential for a trend continuation to 1.1212.

Technically, this scenario is confirmed by the Elliott wave structure and the growth wave matrix with a pivot at 1.0970, which is considered key for EURUSD. The wave reached the upper boundary of the price Envelope at 1.1144. Today, a correction to the central line at 1.0970 is possible, followed by growth to the upper boundary at 1.1212.

Technical indicators for today’s EURUSD forecast suggest a possible correction towards 1.0970.

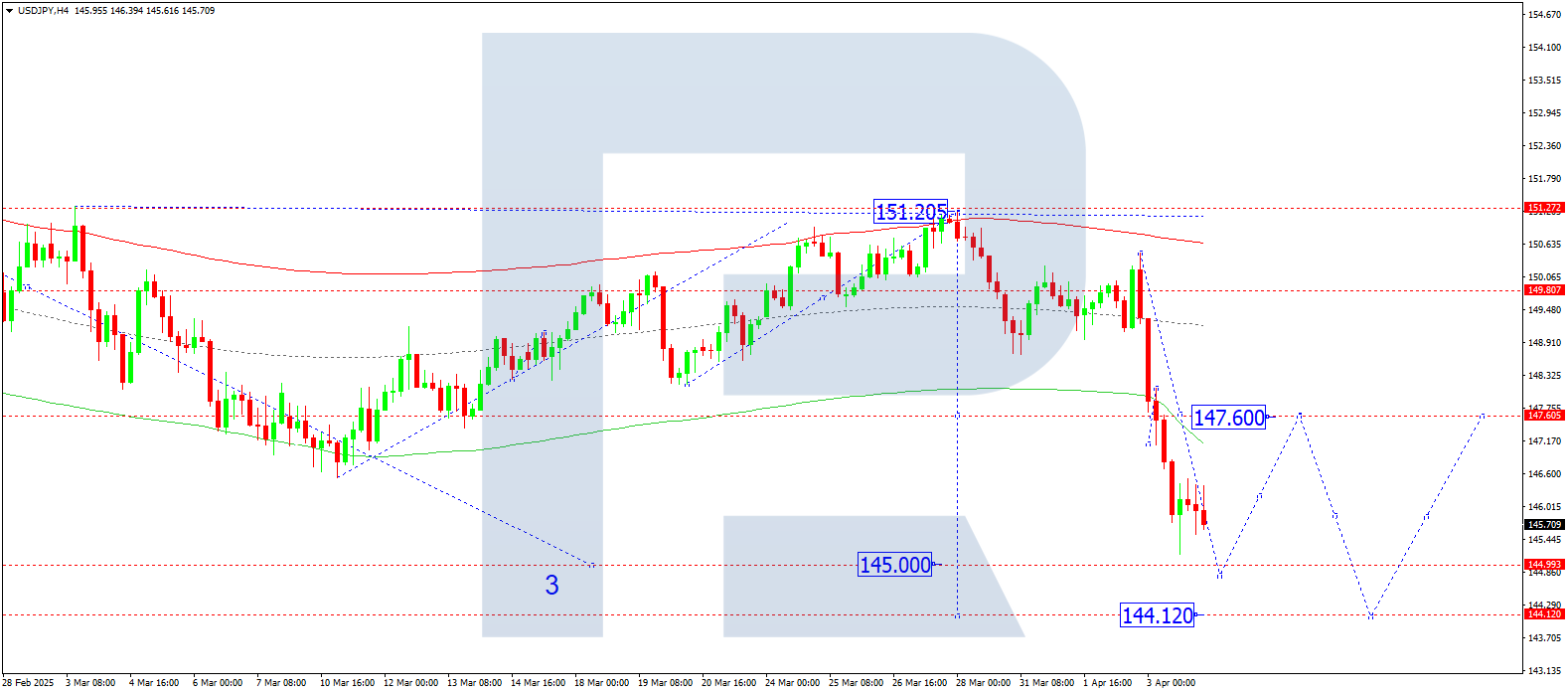

USDJPY forecast

On the H4 chart of USDJPY, the market broke below 147.60 and continues its wave towards 144.74. Today, 4 April 2025, this target is expected to be reached. Afterwards, a correction to 147.60 (testing from below) may follow, and then a drop to the local target of 144.12 is anticipated.

Technically, this scenario is confirmed by the Elliott wave structure and the decline wave matrix with a pivot at 147.60. The market is currently forming a wave towards the lower boundary of the price Envelope at 144.74.

Technical indicators for today’s USDJPY forecast suggest a drop towards 144.74.

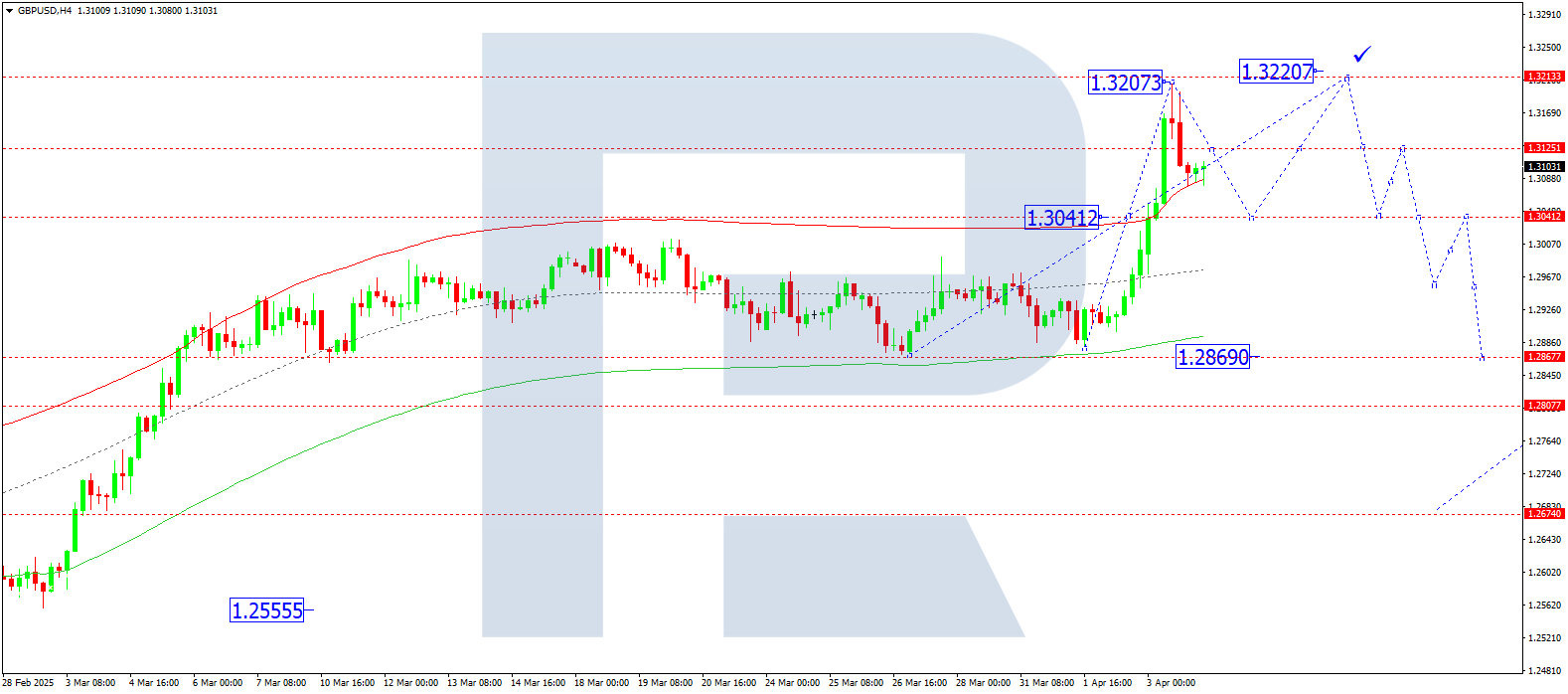

GBPUSD forecast

On the H4 chart of GBPUSD, the market broke above 1.3041 and reached the local wave target at 1.3207. Today, 4 April 2025, a correction to 1.3041 (testing from above) is possible. After this, a new growth wave to 1.3220 may unfold. Upon reaching this level, a downward wave to 1.2870 is likely to begin.

Technically, this scenario is confirmed by the Elliott wave structure and the growth wave matrix with a pivot at 1.3041. The market reached the upper boundary of the price Envelope at 1.3207. A decline to the central line at 1.3041 is expected.

Technical indicators for today’s GBPUSD forecast suggest a downward wave to 1.3041.

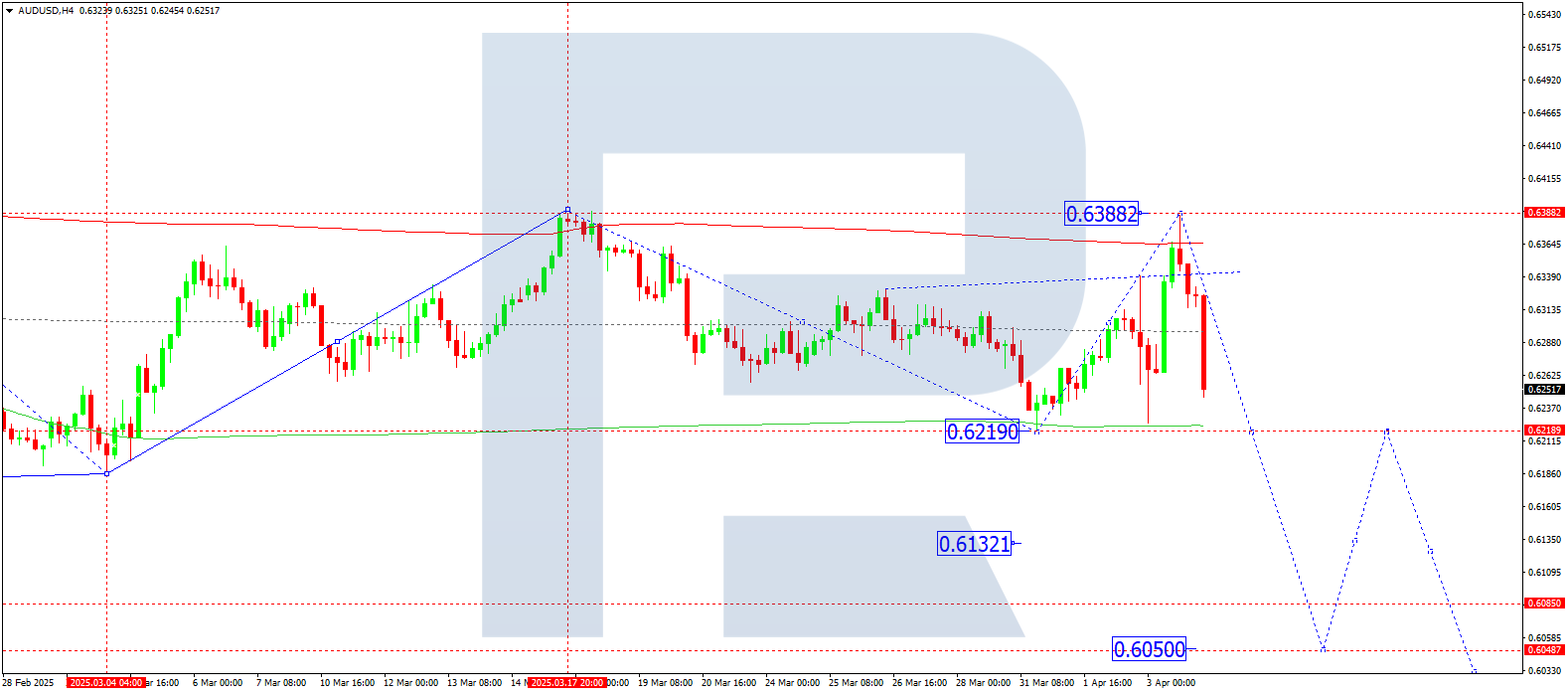

AUDUSD forecast

On the H4 chart of AUDUSD, the market completed a correction to 0.6388 and began developing a new downward wave. Today, 4 April 2025, a decline to 0.6219 is expected. A breakout below this level would open potential for a trend continuation to 0.6050, the local target.

Technically, this scenario is confirmed by the Elliott wave structure and the decline wave matrix with a pivot at 0.6219. The market is forming a wave towards the lower boundary of the price Envelope at 0.6050.

Technical indicators for today’s AUDUSD forecast suggest further decline to 0.6050.

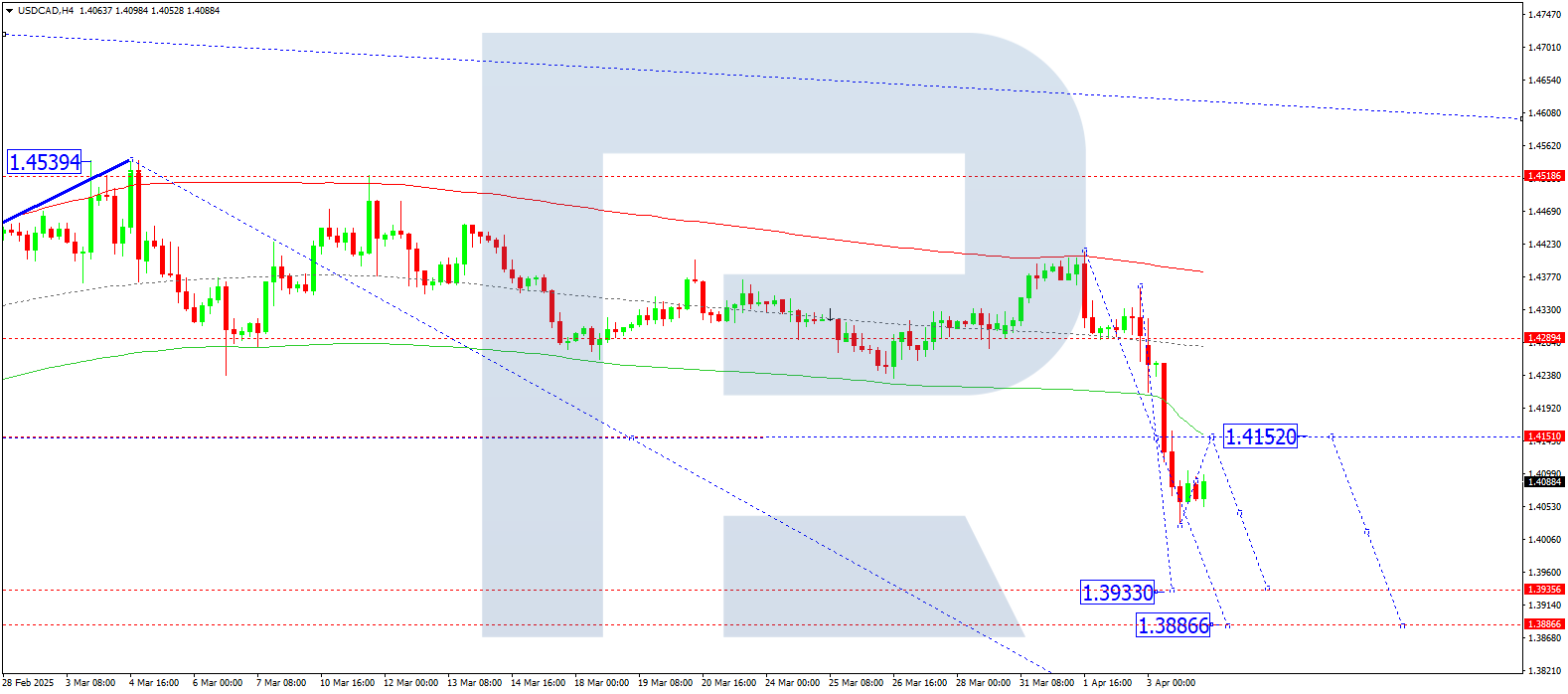

USDCAD forecast

On the H4 chart of USDCAD, the market broke below 1.4152 and continues forming a wave towards 1.3933. Today, 4 April 2025, a technical pullback to 1.4152 (testing from below) is possible. Afterwards, the wave is expected to continue to the local target of 1.3933.

Technically, this scenario is supported by the Elliott wave structure and the decline wave matrix with a pivot at 1.4152, which is key for USDCAD. The market is currently heading towards the lower boundary of the price Envelope at 1.3933. Later, a rise to the central line at 1.4152 is likely.

Technical indicators for today’s USDCAD forecast suggest a move down to 1.3933.

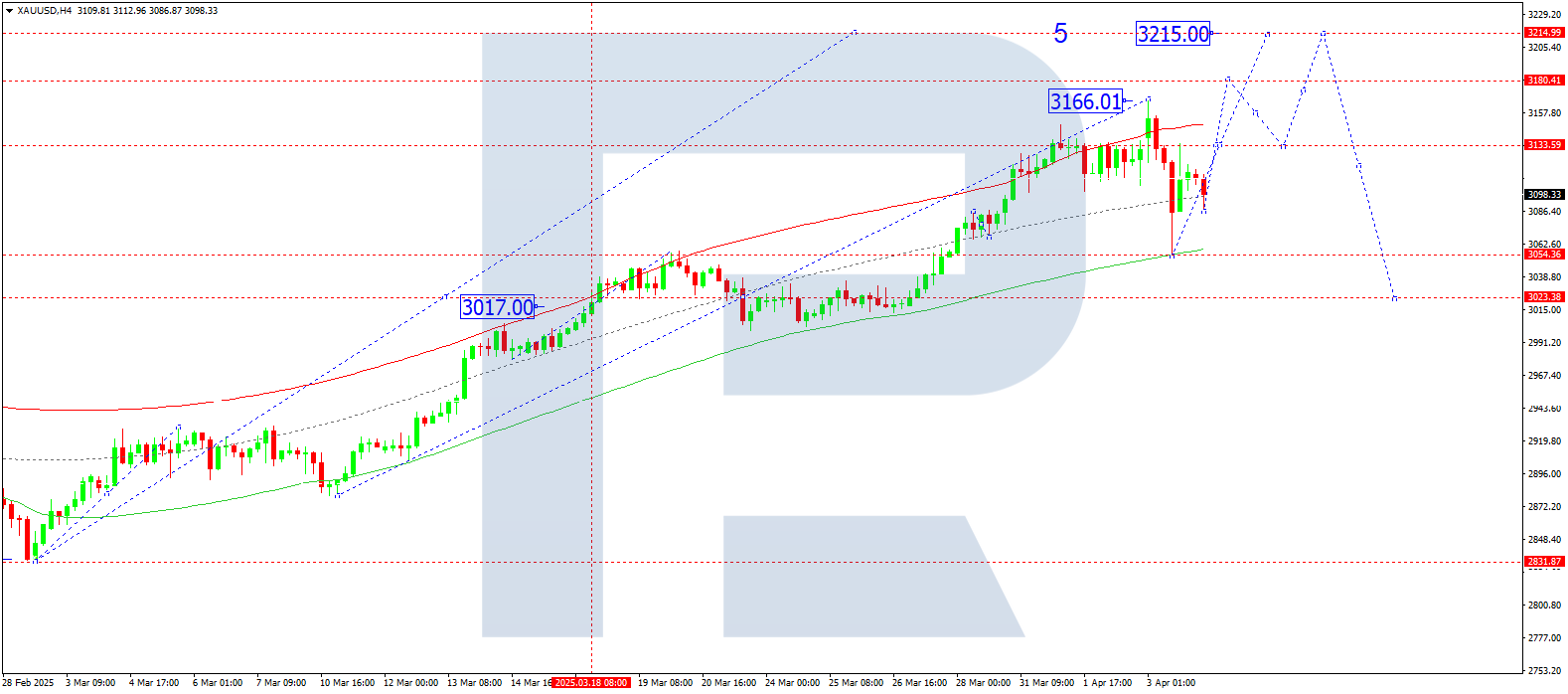

XAUUSD forecast

On the H4 chart of XAUUSD, the market broke below 3,133 and completed a correction wave to 3,055. Today, 4 April 2025, the market has made an upward impulse to 3,133. A breakout above this level opens the potential for a wave towards 3,180 and possibly a trend continuation to 3,215.

Technically, this scenario is confirmed by the Elliott wave structure and the growth wave matrix with a pivot at 3,022. This level is considered key for XAUUSD. The market completed a wave to the upper boundary of the price Envelope at 3,166 and corrected to the lower boundary at 3,055. Today, another growth wave to the upper boundary at 3,215 is possible.

Technical indicators for today’s XAUUSD forecast suggest growth potential to 3,215.

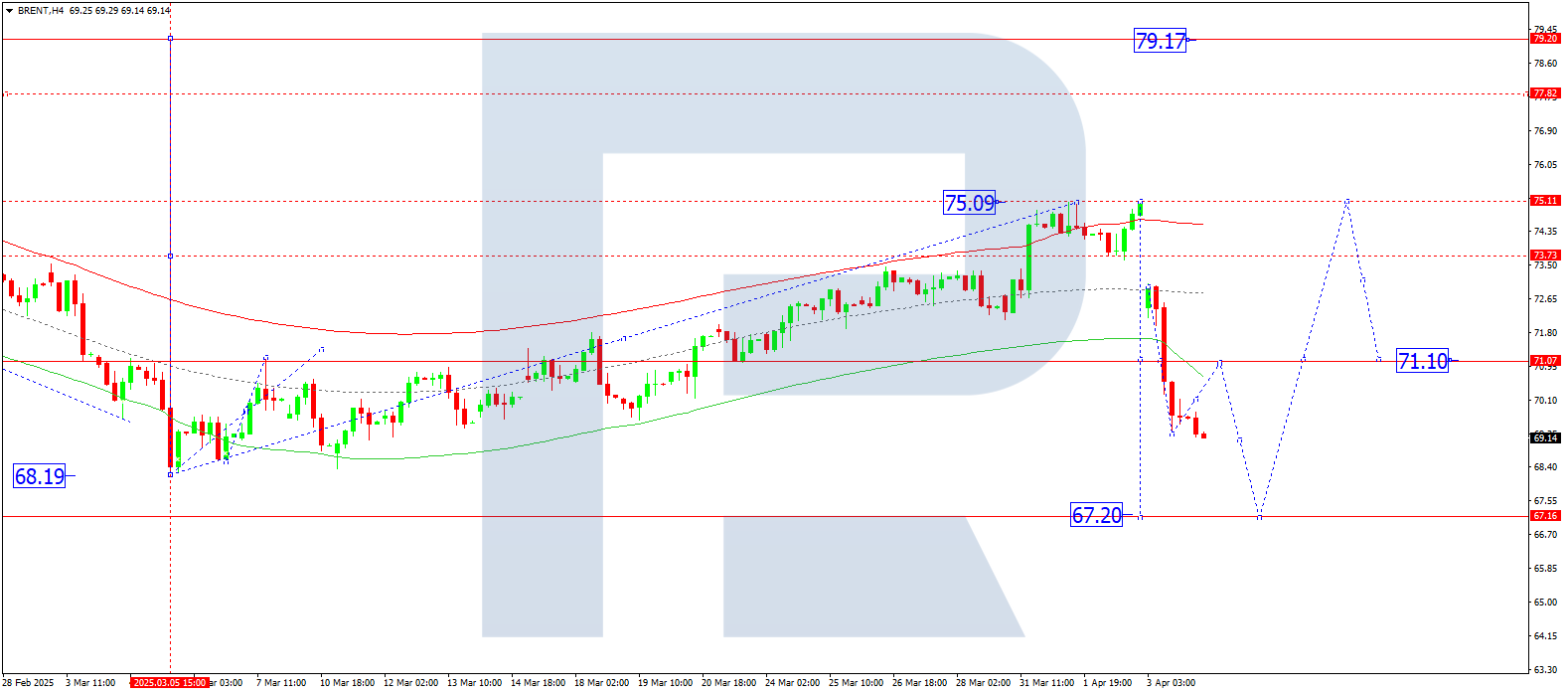

Brent forecast

On the H4 chart of Brent crude, the market continues the downward wave. Breaking below 71.10 opens the potential for a move to 67.20. Today, 4 April 2025, this target is in focus. Afterwards, a wave of growth to 75.11 may begin.

Technically, this scenario is confirmed by the Elliott wave structure and the decline wave matrix with a pivot at 71.10. This is considered key for Brent. The market is currently heading towards the lower boundary of the price Envelope at 67.20. Later, a wave of growth towards the upper boundary at 75.11 is possible.

Technical indicators for today’s Brent forecast suggest further decline towards 67.20.