EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, XAUUSD, and Brent technical analysis and forecast for 10 April 2025

Here is a detailed daily technical analysis and forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, XAUUSD, and Brent for 10 April 2025.

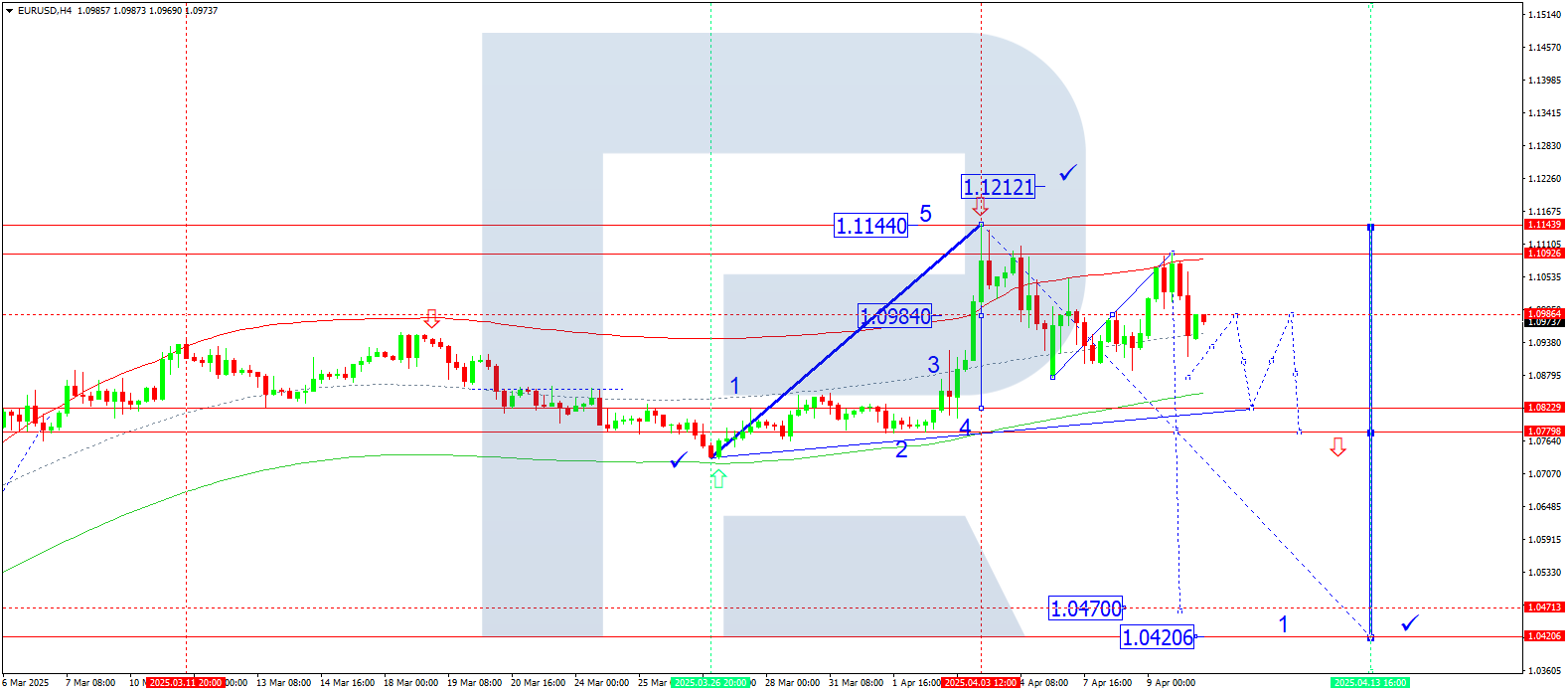

EURUSD forecast

On the H4 chart of EURUSD, the market continues forming a consolidation range around 1.0986. At the moment, the range has extended upwards to 1.1092. This growth can be considered a correction to the previous downward wave. Today, 10 April 2025, a decline to 1.0875 is possible, with a continuation of the wave towards 1.0830.

Technically, this scenario is supported by the Elliott wave structure and the downward wave matrix with a pivot point at 1.0986, which serves as a key level in the structure of this wave for EURUSD. Currently, the wave has reached the upper boundary of the price Envelope at 1.1092. Later on, a move towards the lower boundary at 1.0830 appears likely.

Technical indicators for today's EURUSD forecast suggest a continued downward wave towards 1.0830.

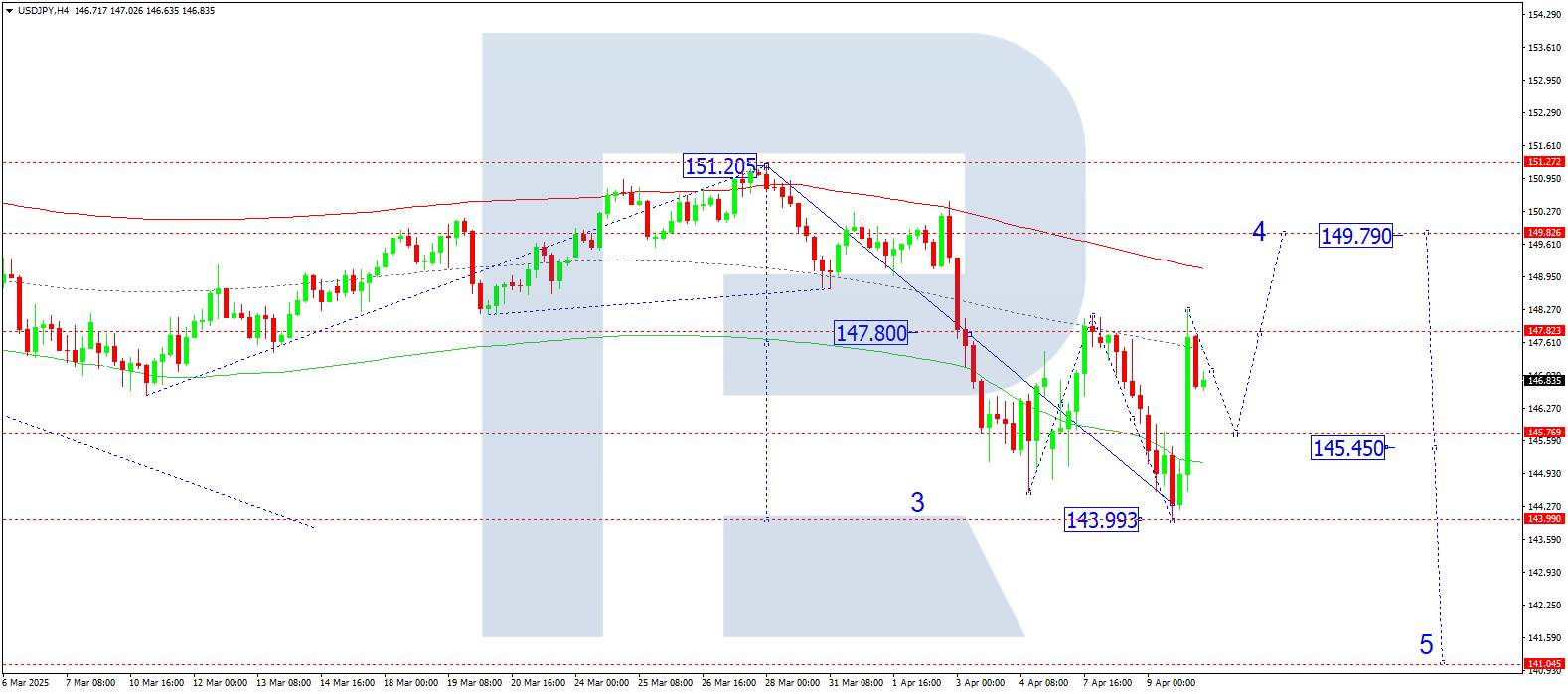

USDJPY forecast

On the H4 chart of USDJPY, the market completed a downward wave to 143.99. Today, 10 April 2025, the price may develop a growth wave towards 149.79. After reaching this level, a new downward wave to 141.00 might begin.

Technically, the Elliott wave structure and the downward wave matrix with a pivot at 147.50 confirm this scenario. This level is key within the current wave. The market has reached the lower boundary of the price Envelope at 143.99. Today, a growth wave towards the upper boundary at 149.79 looks likely.

Technical indicators for today’s USDJPY forecast suggest a wave of growth to 149.79.

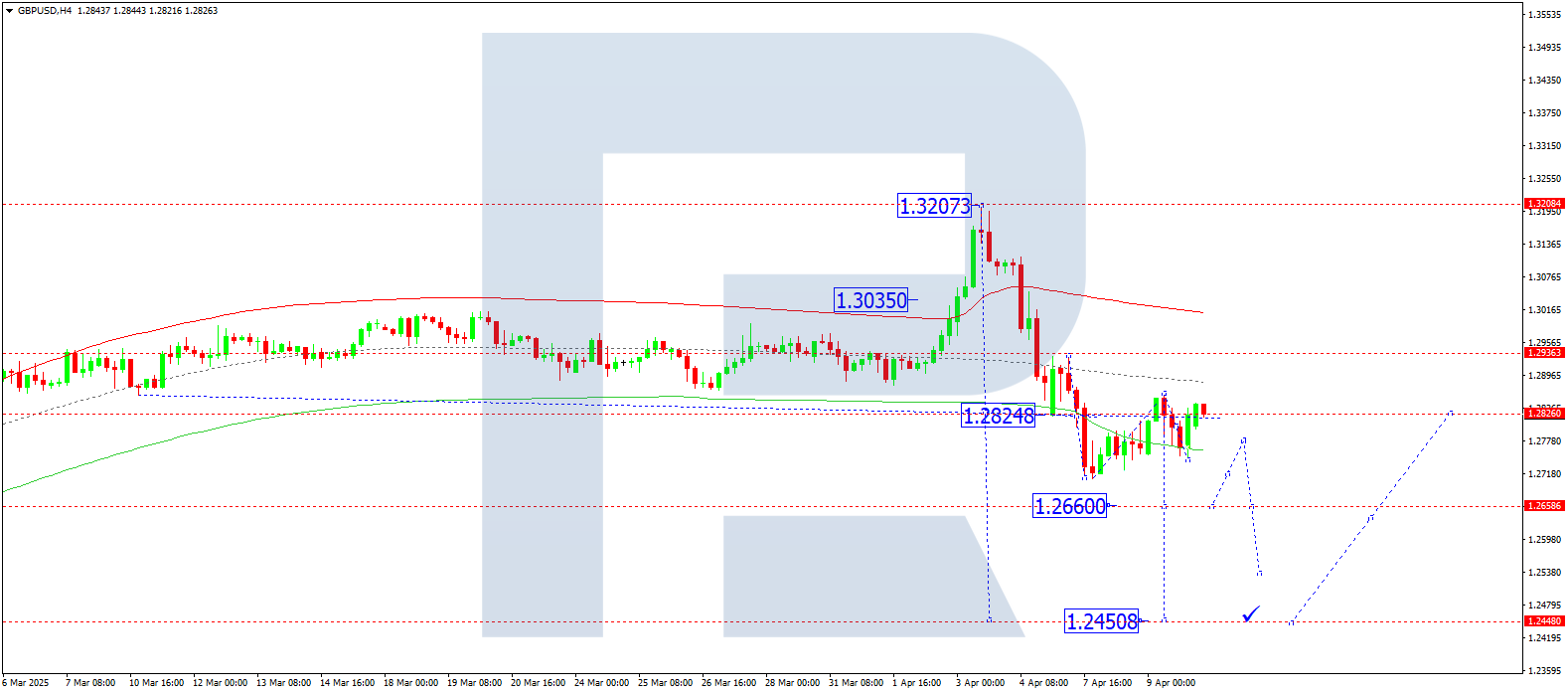

GBPUSD forecast

On the H4 chart of GBPUSD, the market is forming a consolidation range around 1.2825. Today, 10 April 2025, if the price breaks out upwards, a correctional move to 1.2936 is possible. A downward breakout could extend the wave to 1.2660, with the trend possibly continuing to 1.2450.

Technically, this scenario is confirmed by the Elliott wave structure and the downward wave matrix with a pivot at 1.2825. This level is key in the current wave structure. The market previously reached the lower boundary of the price Envelope at 1.2708. A rise to the central line at 1.2936 is possible, followed by a likely continuation of the trend down to the lower boundary at 1.2450.

Technical indicators for today’s GBPUSD forecast suggest a downward wave towards 1.2450.

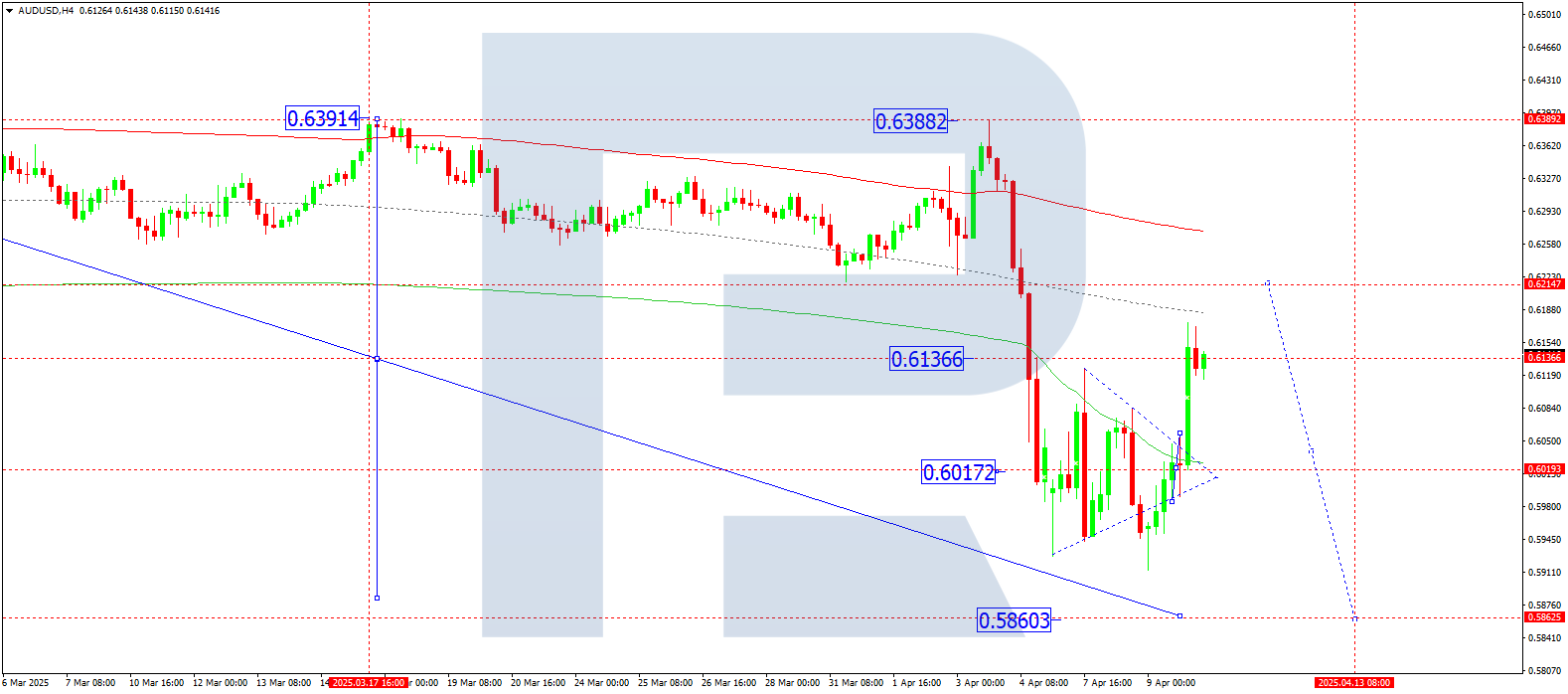

AUDUSD forecast

On the H4 chart of AUDUSD, the market is forming a consolidation range around 0.6000. Today, 10 April 2025, a rise towards 0.6215 is possible. Afterwards, a downward move towards 0.5860 may follow.

Technically, the Elliott wave structure and the downward wave matrix for AUDUSD with a pivot at 0.6136 confirm this scenario. This level is seen as key in the current wave structure. The market is consolidating near the lower boundary of the price Envelope. A growth wave to the upper boundary at 0.6215 is expected, followed by a potential decline towards the lower boundary at 0.5860.

Technical indicators for today’s AUDUSD forecast suggest a continued rise to 0.6215.

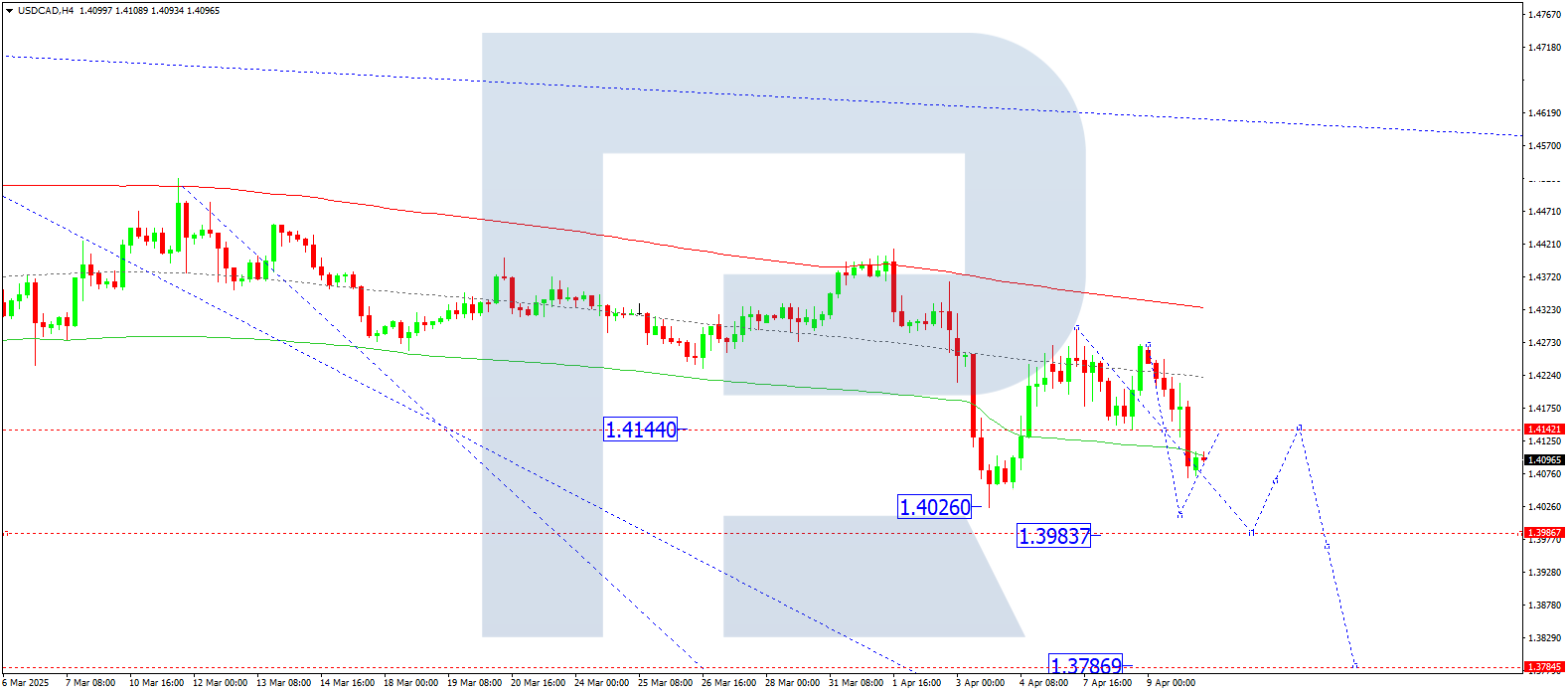

USDCAD forecast

On the H4 chart of USDCAD, the market is forming a broad consolidation range around 1.4141. Today, 10 April 2025, if the price breaks out downwards, the wave may extend to 1.3987 with a potential trend continuation to 1.3787.

Technically, the Elliott wave structure and the downward wave matrix with a pivot at 1.4141 support this scenario. This level serves as a key one in the current wave structure for USDCAD. At the moment, the market consolidates around the central line of the price Envelope at 1.4141. A decline to the lower boundary at 1.3987 appears likely.

Technical indicators for today’s USDCAD forecast suggest a downward wave to 1.3987.

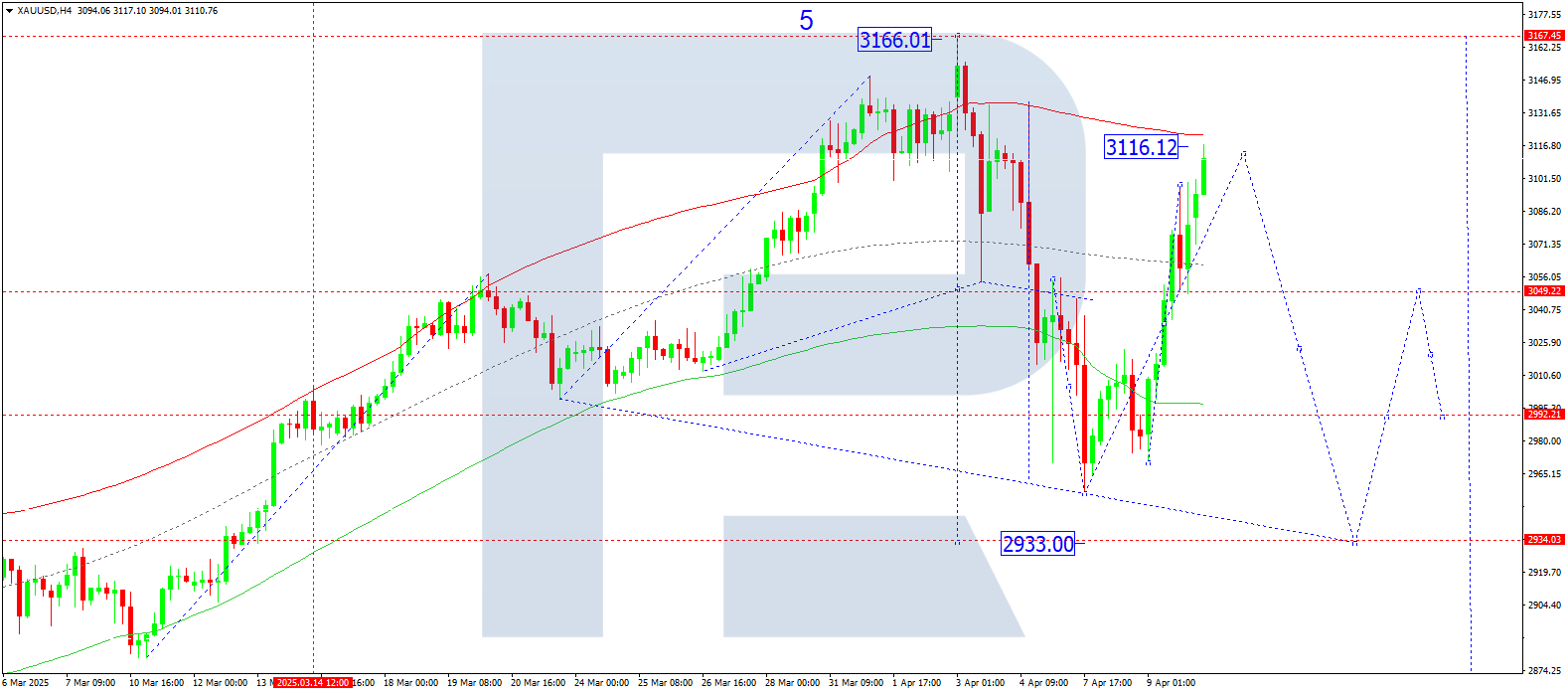

XAUUSD forecast

On the H4 chart of XAUUSD, the market completed a growth wave to 3,050. A consolidation range has formed around this level. Today, 10 April 2025, the market broke out of this range upwards and continues rising towards 3,116. After reaching this level, a new downward leg to 2,933 may follow.

Technically, this scenario is confirmed by the Elliott wave structure and the downward wave matrix with a pivot at 3,050, which is seen as a key level for XAUUSD in this wave. The market is currently developing a wave towards the upper boundary of the price Envelope at 3,116. Today, a downward move to the lower boundary at 2,933 appears likely.

Technical indicators for today’s XAUUSD forecast suggest the beginning of a new downward wave towards 2,933.

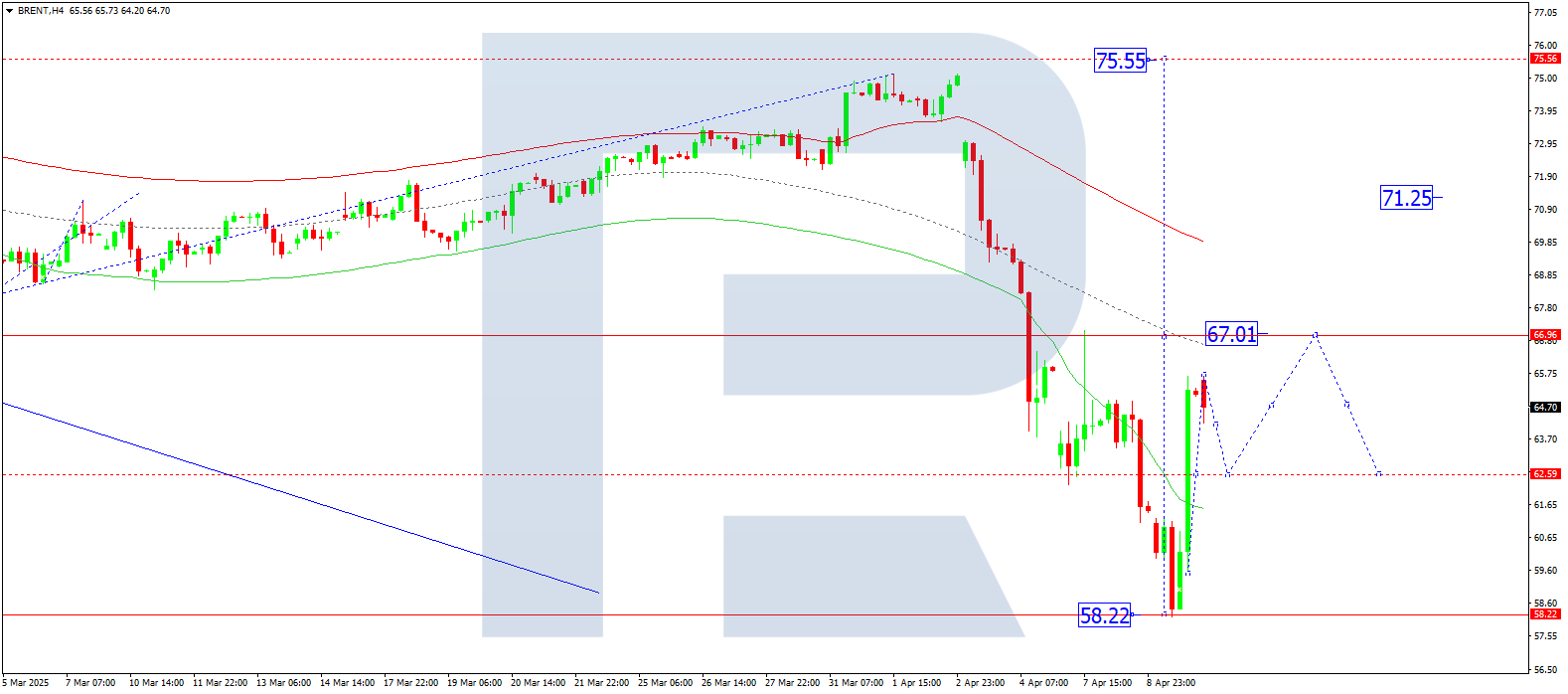

Brent forecast

On the H4 chart of Brent crude, the market completed a downward wave to 58.22. Today, 10 April 2025, a growth wave towards the first target of 67.00 is forming. Afterwards, a correction to 62.60 is possible – the second target.

Technically, this scenario is confirmed by the Elliott wave structure and the downward wave matrix with a pivot at 71.10, which is key to Brent's current wave structure. The market previously reached the lower boundary of the price Envelope at 58.22. A rise towards the upper boundary at 67.00 is now anticipated.

Technical indicators in today’s Brent forecast suggest a growth wave towards 67.00.