EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, XAUUSD, and Brent technical analysis and forecast for 10 January 2025

Here is a detailed daily technical analysis and forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, XAUUSD, and Brent for 10 January 2025.

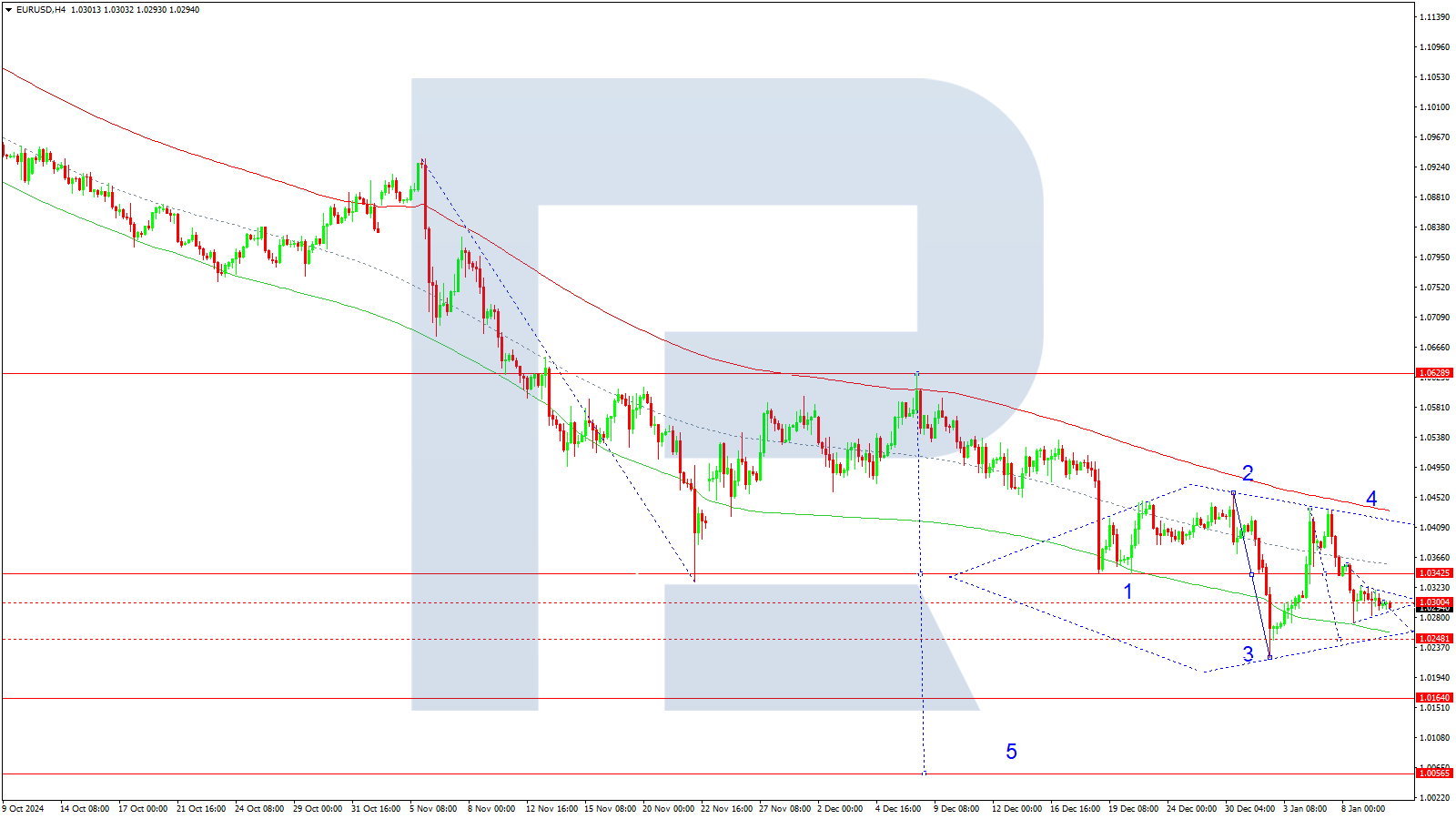

EURUSD forecast

On the H4 chart, EURUSD is consolidating within a narrow range around 1.0300. Today, 10 January 2025, a downward wave to 1.0240 is expected. A subsequent rise to 1.0300 (testing from below) is likely, followed by a potential downward breakout. Further continuation of the wave to 1.0200 as a local target is expected. After reaching this level, a correction to 1.0300 may occur. The consolidation around 1.0300 appears to be a trend continuation pattern in the current downward wave towards 1.0160, the first target.

Technically, this scenario is supported by the Elliott wave structure and the downward wave matrix centred at 1.0300. This level is considered crucial for this downward wave in the EURUSD rate. The market has rebounded downward from the central line of the price Envelope at 1.0434 and continues to move towards its lower boundary at 1.0160.

Technical indicators for today’s EURUSD forecast suggest potential declines to 1.0240 and 1.0200.

USDJPY forecast

On the H4 chart, USDJPY is consolidating broadly around 157.33. After finding support at 157.57, the market is progressing towards 158.64 today, 10 January 2025. A decline to 157.33 (testing from above) may follow, with subsequent growth to 158.88. After reaching this level, a downward wave towards 156.00 may begin.

Technically, this scenario for the USDJPY rate is supported by the Elliott wave structure and the growth wave matrix centred at 157.33. The market is near the upper boundary of the price Envelope, with further growth towards its upper boundary, which is expected at 158.88. A decline towards the envelope’s lower boundary, at 156.00, may follow.

Technical indicators for today’s USDJPY forecast suggest potential growth to 158.64 and 158.88.

USDJPY technical analysis for 10 January 2025

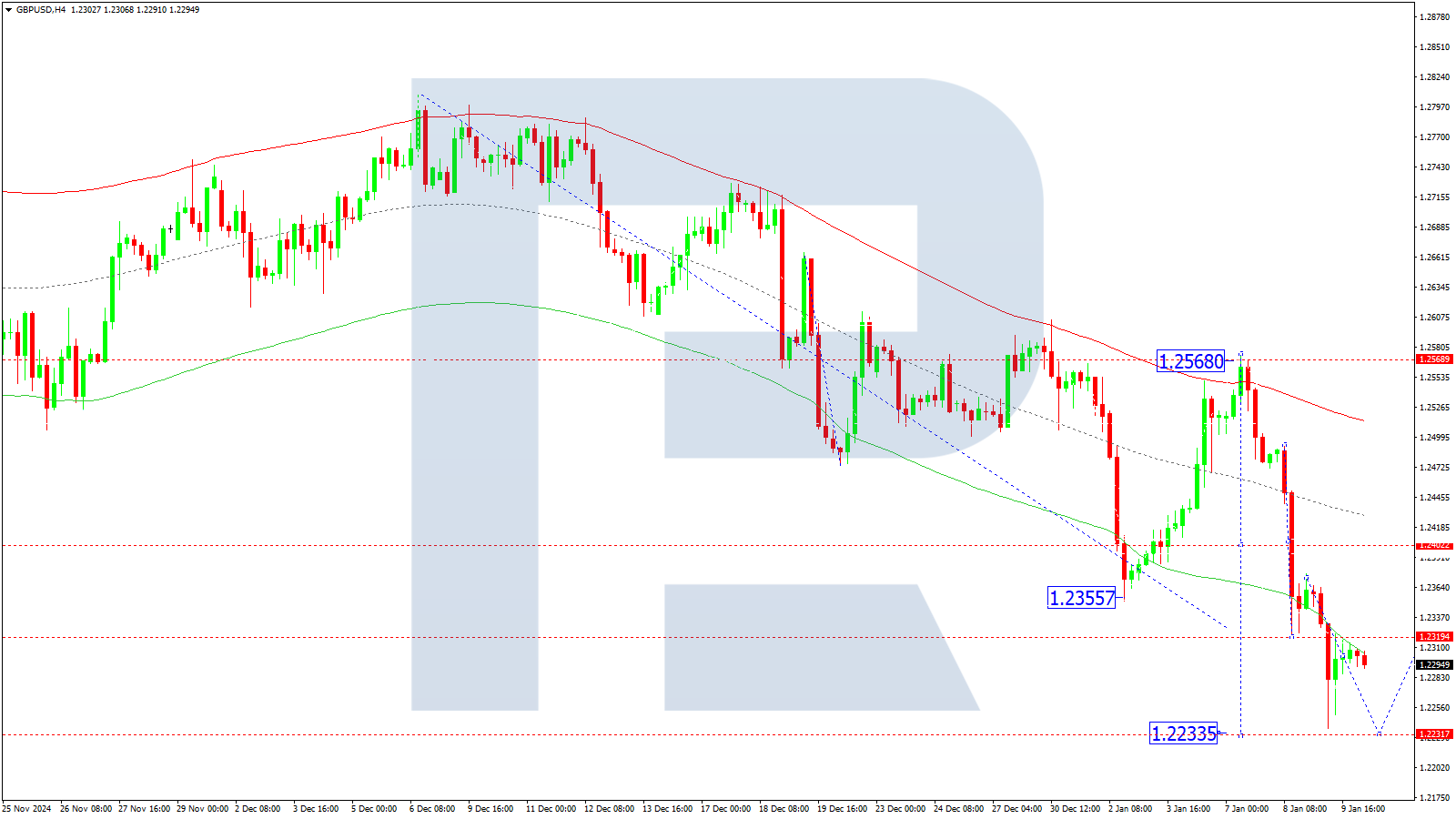

GBPUSD forecast

On the H4 chart, GBPUSD has broken below 1.2320 and completed a downward wave to 1.2237. Today, 10 January 2025, the market has corrected to 1.2319 (testing from below). The structure of the downward wave suggests a potential extension to 1.2230. After reaching this level, a correction to 1.2400 may follow.

Technically, this scenario for the GBPUSD rate is supported by the Elliott wave structure and the wave matrix centred at 1.2568. The market has rebounded from the upper boundary of the price Envelope at 1.2568 and completed a decline to its lower boundary at 1.2323, the primary estimated target. The potential for further downward movement to 1.2323 is exhausted. The shape and structure of the last fifth downward wave suggest its potential extension to 1.2230.

Technical indicators for today’s GBPUSD forecast suggest a potential continuation of the decline to 1.2230.

AUDUSD forecast

On the H4 chart, AUDUSD broke below 0.6214 and continued to decline towards 0.6125. Today, 10 January 2025, the price is expected to reach this target. A correction to 0.6214 may follow, continuing the downward trend towards 0.6000 and further to 0.5930.

Technically, this scenario for the AUDUSD rate is supported by the Elliott wave structure and the downward wave matrix centred at 0.6434. The market has achieved the downward wave’s local target, declining to the lower boundary of the price Envelope at 0.6188 and corrected to its upper boundary at 0.6300. A decline towards the Envelope’s lower boundary at 0.6125 is expected today, followed by a potential correction to the central line at 0.6214.

Technical indicators for today’s AUDUSD forecast suggest potential declines to 0.6140 and 0.6125.

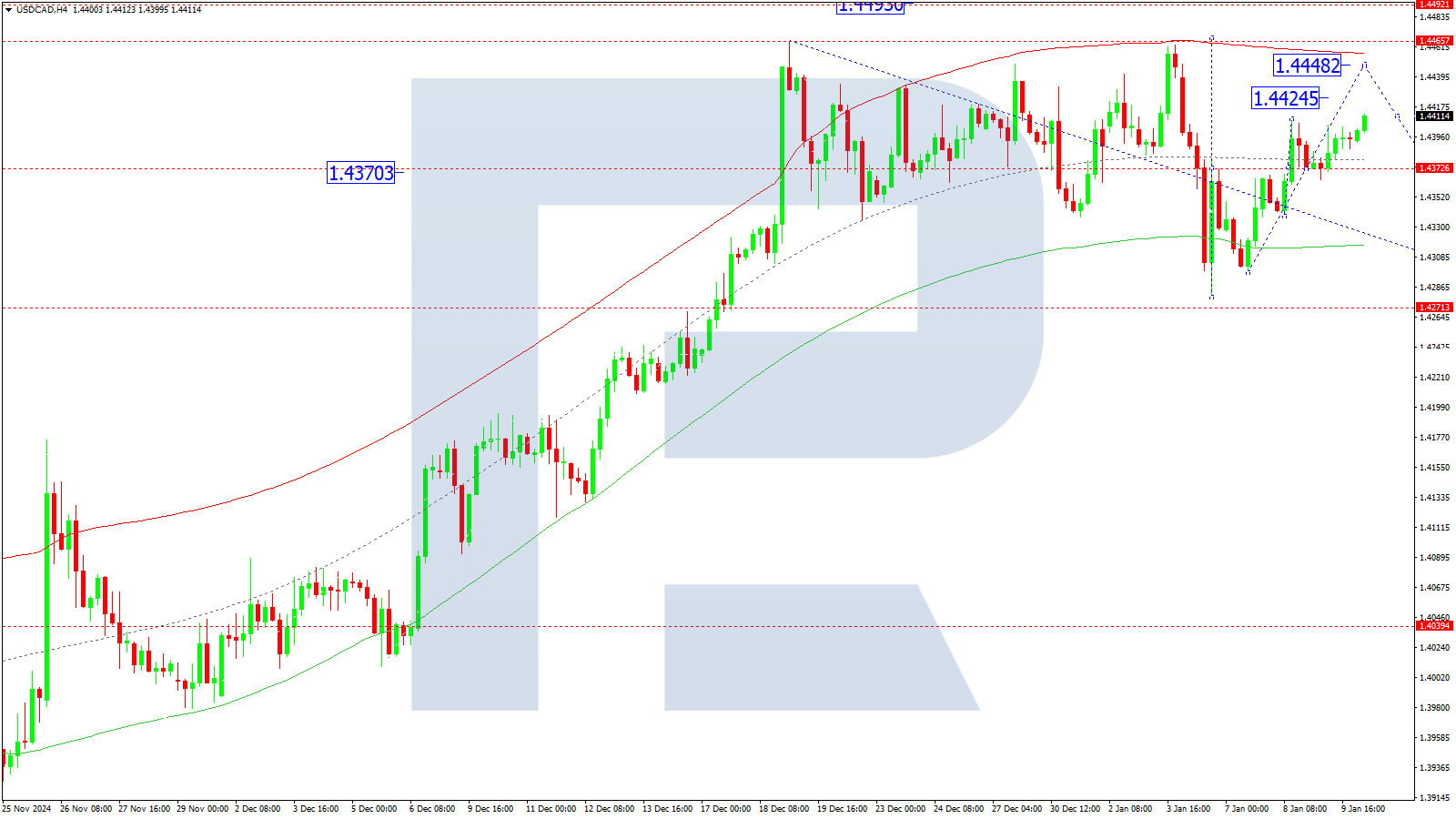

USDCAD forecast

On the H4 chart, USDCAD is forming an upward wave towards 1.4424, and this target is expected to be reached today, 10 January 2025. A new consolidation range may form afterwards. If the range breaks upwards, the wave may continue to 1.4448, potentially extending to 1.4467. If it breaks downwards, a correction to 1.4373 is possible, with subsequent growth to 1.4467.

Technically, this scenario is supported by the Elliott wave structure and the wave matrix centred at 1.4370. This level is considered crucial for this wave in the USDCAD rate. The market is moving towards the upper boundary of the price Envelope at 1.4467. After reaching this level, a decline to the lower boundary at 1.4270 may follow. A breakout below this level will open the potential for reaching 1.4040.

Technical indicators for today’s USDCAD forecast suggest that the growth wave may continue towards 1.4424, 1.4448, and 1.4467.

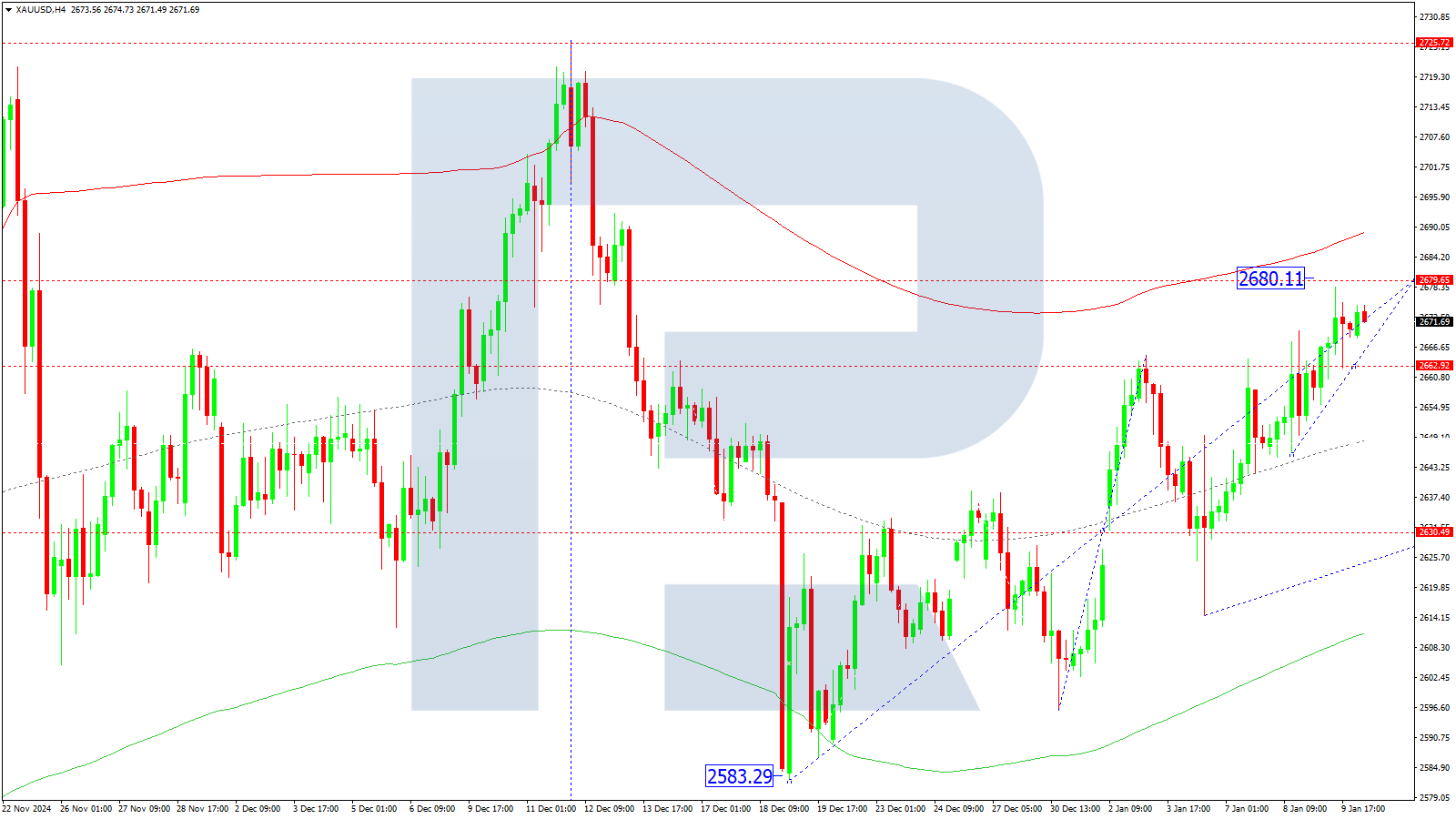

XAUUSD forecast

On the H4 chart, XAUUSD has broken above 2,666 and is forming a wave towards 2,680, expected to be reached today, 10 January 2025. A correction to 2,630 may follow. If this level breaks downwards, a further decline to 2,600 is possible, with the trend potentially continuing to 2,576.

Technically, this scenario is supported by the Elliott wave structure and the wave matrix centred at 2,630. The level is considered crucial for the corrective wave in the XAUUSD rate. Further movement towards the upper boundary of the price Envelope at 2,680 is expected, with a subsequent potential decline to the lower boundary at 2,600.

Technical indicators for today’s XAUUSD forecast suggest potential growth to 2,680 and a decline to 2,630.

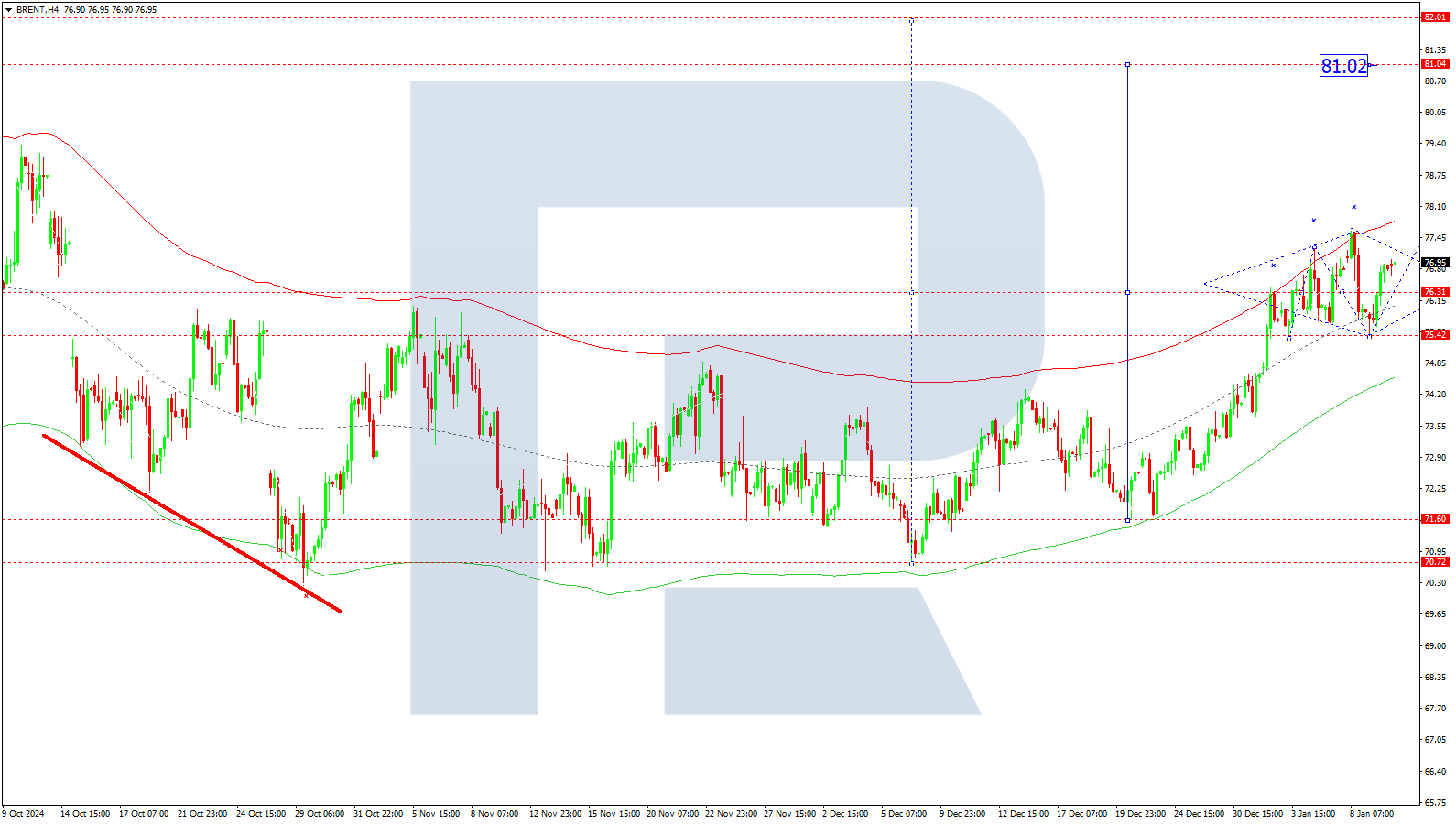

Brent forecast

On the H4 chart, Brent crude oil found support at 75.45 and continues to rise. Today, 10 January 2025, a breakout above 77.60 and the formation of an upward wave towards 81.00 as the local target is expected. A correction to 77.60 may follow. Subsequently, a new wave of growth towards 82.00 is expected.

Technically, this scenario is supported by the Elliott wave structure and the wave matrix centred at 76.30. The level is considered crucial for the Brent rate around the central line of the price Envelope. Further upward movement towards the envelope’s upper boundary at 81.00 is possible today.

Technical indicators for today’s Brent forecast suggest potential growth to 81.00 and 82.00.