EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, XAUUSD, and Brent technical analysis and forecast for 16 April 2025

Here is a detailed daily technical analysis and forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, XAUUSD, and Brent for 16 April 2025.

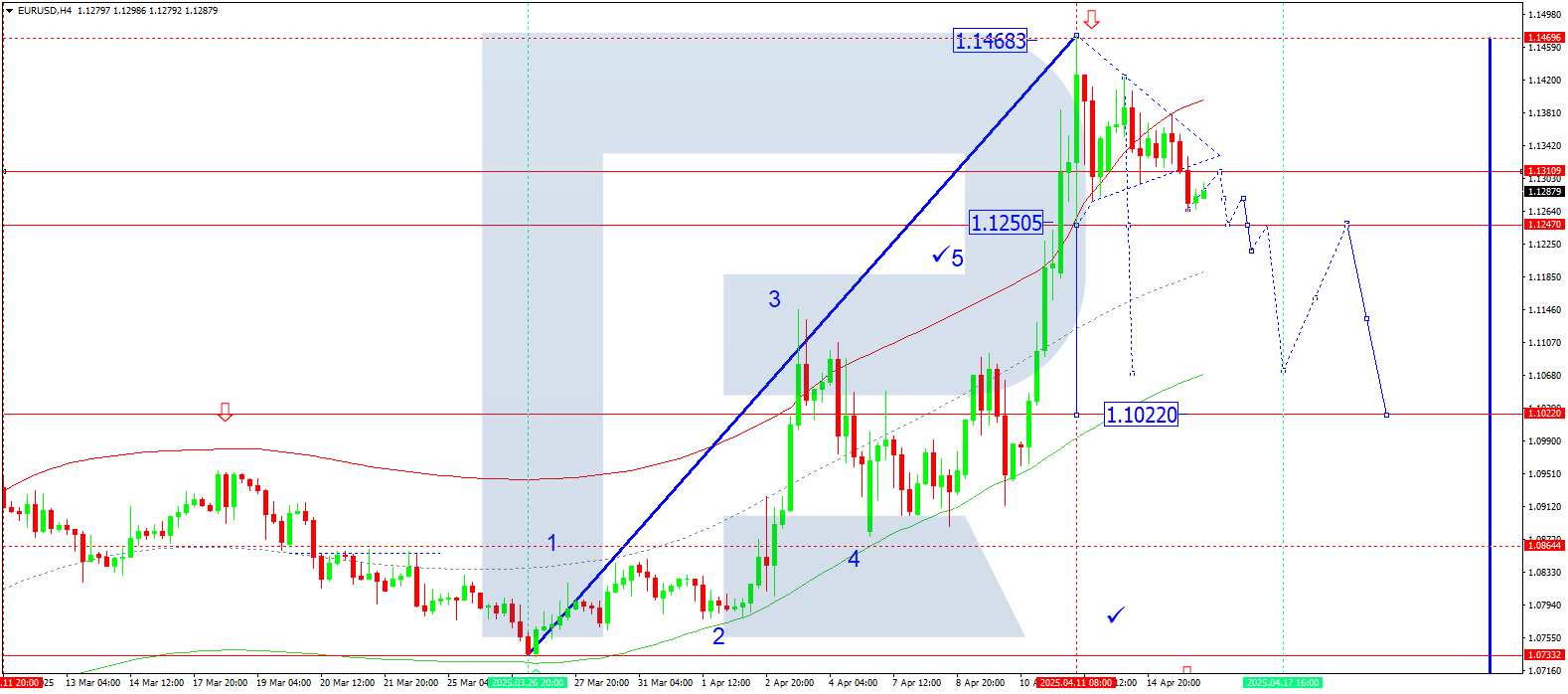

EURUSD forecast

On the H4 chart of EURUSD, the market broke below 1.1320 and continued declining to 1.1264. Today, 16 April 2025, a technical pullback to 1.1344 (testing from below) is expected. The decline may then continue towards 1.1250. After reaching this level, a narrow consolidation range may form. If the price breaks below this range, the third wave may extend towards 1.1080, a local target.

Technically, this scenario is supported by the Elliott wave structure and the growth wave matrix with a pivot at 1.1190, which acts as a key level in the current wave structure for EURUSD. The market had earlier completed a wave to the upper boundary of the price Envelope at 1.1468. Now, the wave structure is unfolding towards the lower boundary at 1.1080.

Technical indicators for today's EURUSD forecast suggest a continued decline towards 1.1250 and 1.1080.

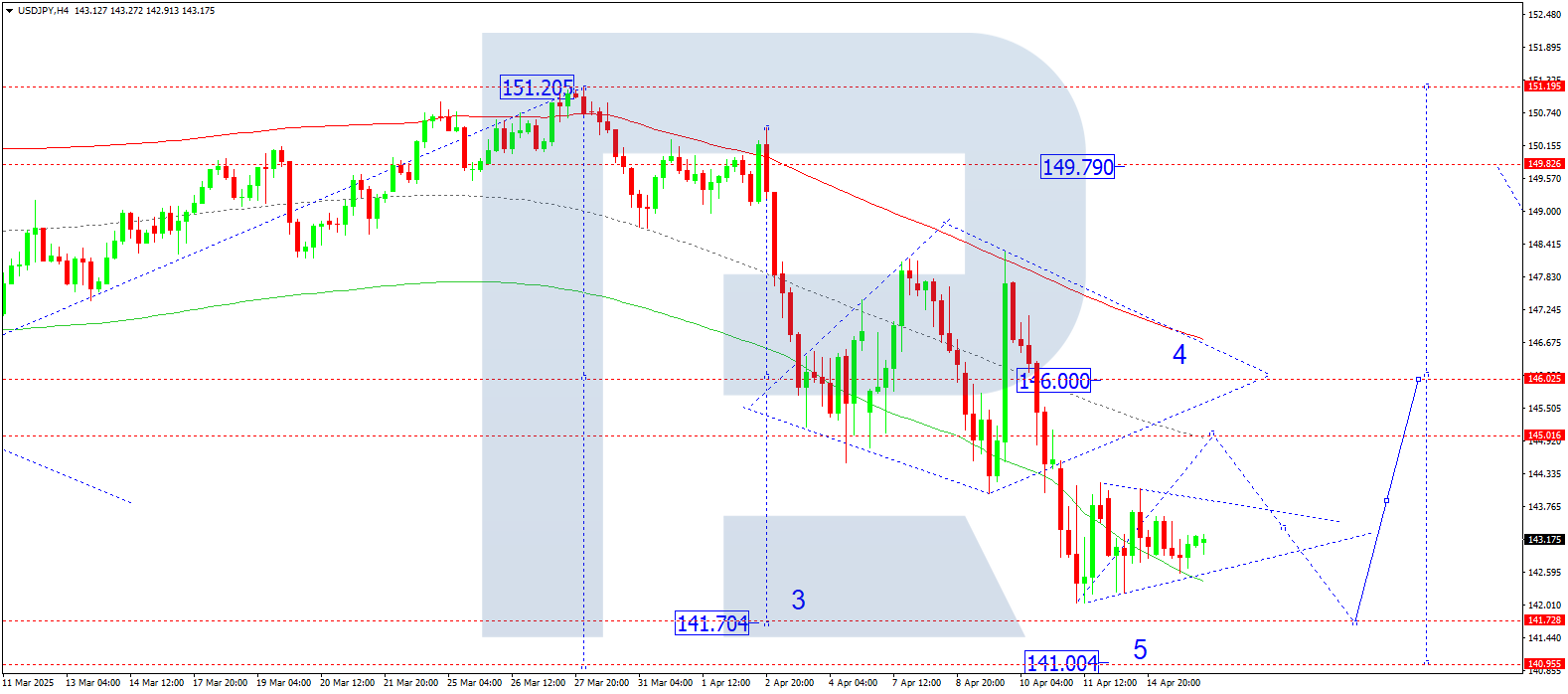

USDJPY forecast

On the H4 chart of USDJPY, the market is forming a consolidation range around 143.20 without a clear trend. Today, 16 April 2025, a breakout upwards to 145.00 is possible. A downward wave towards the local target of 141.73 is expected next. A correction to 146.00 may follow. If the range breaks downwards first, the third wave may extend directly to 141.73.

Technically, the Elliott wave structure and the downward wave matrix with a pivot at 146.00 support this scenario. This level serves as a key point in the current wave. The market is forming the third wave of decline towards the lower boundary of the price Envelope at 141.73. A move to the central line at 145.00 is possible today, followed by a downward wave to the Envelope’s lower boundary at 141.73.

Technical indicators for today’s USDJPY forecast suggest a downward wave to 141.73.

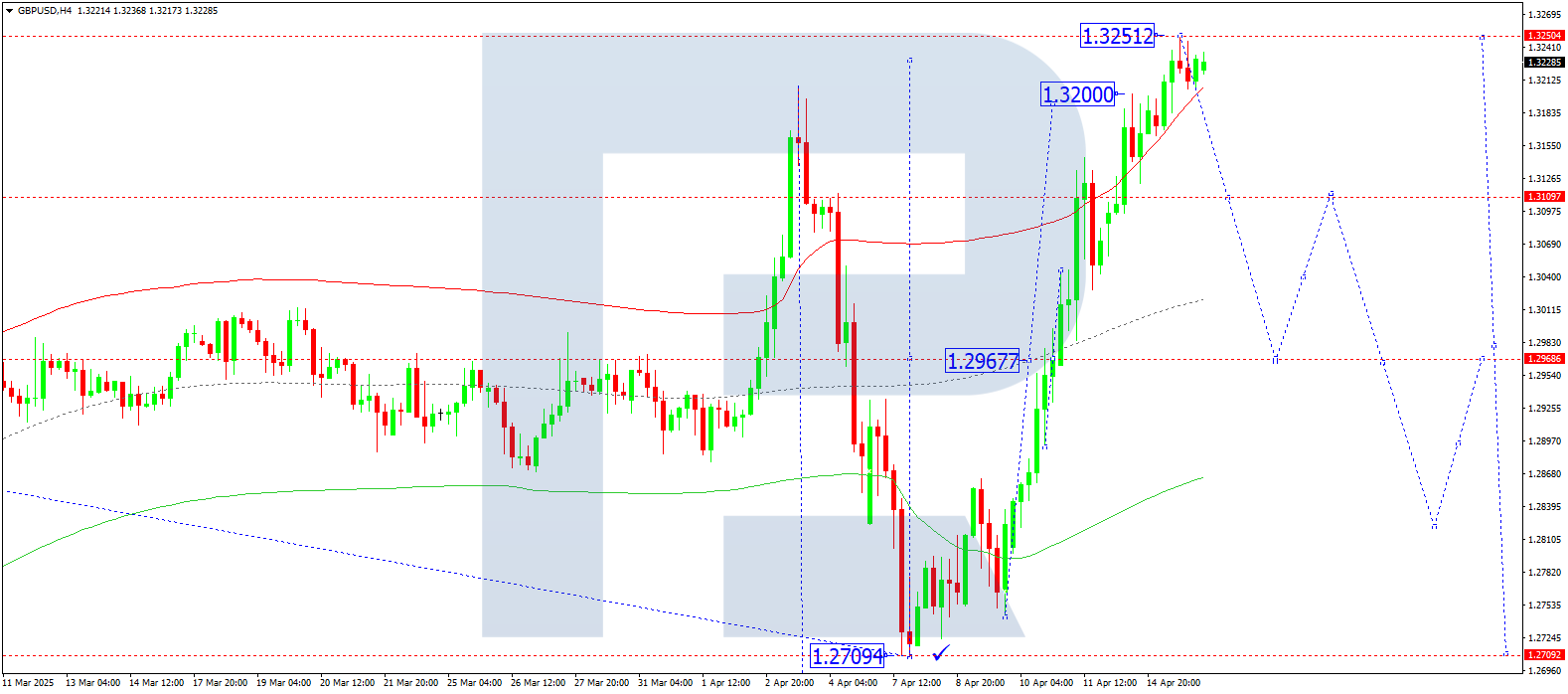

GBPUSD forecast

On the H4 chart of GBPUSD, the market completed a growth wave to 1.3251. Today, 16 April 2025, a consolidation range may develop below this level. If the price breaks upwards, a brief move to 1.3261 is possible. A downward breakout could initiate a decline towards 1.3122 and 1.2987.

Technically, the Elliott wave structure and the growth wave matrix with a pivot at 1.2989 support this scenario. This level is viewed as key within the current wave. The market is shaping a growth wave towards the upper boundary of the price Envelope at 1.3261. A decline towards the central line at 1.2987 may follow.

Technical indicators for today’s GBPUSD forecast suggest the beginning of a downward wave towards 1.3122.

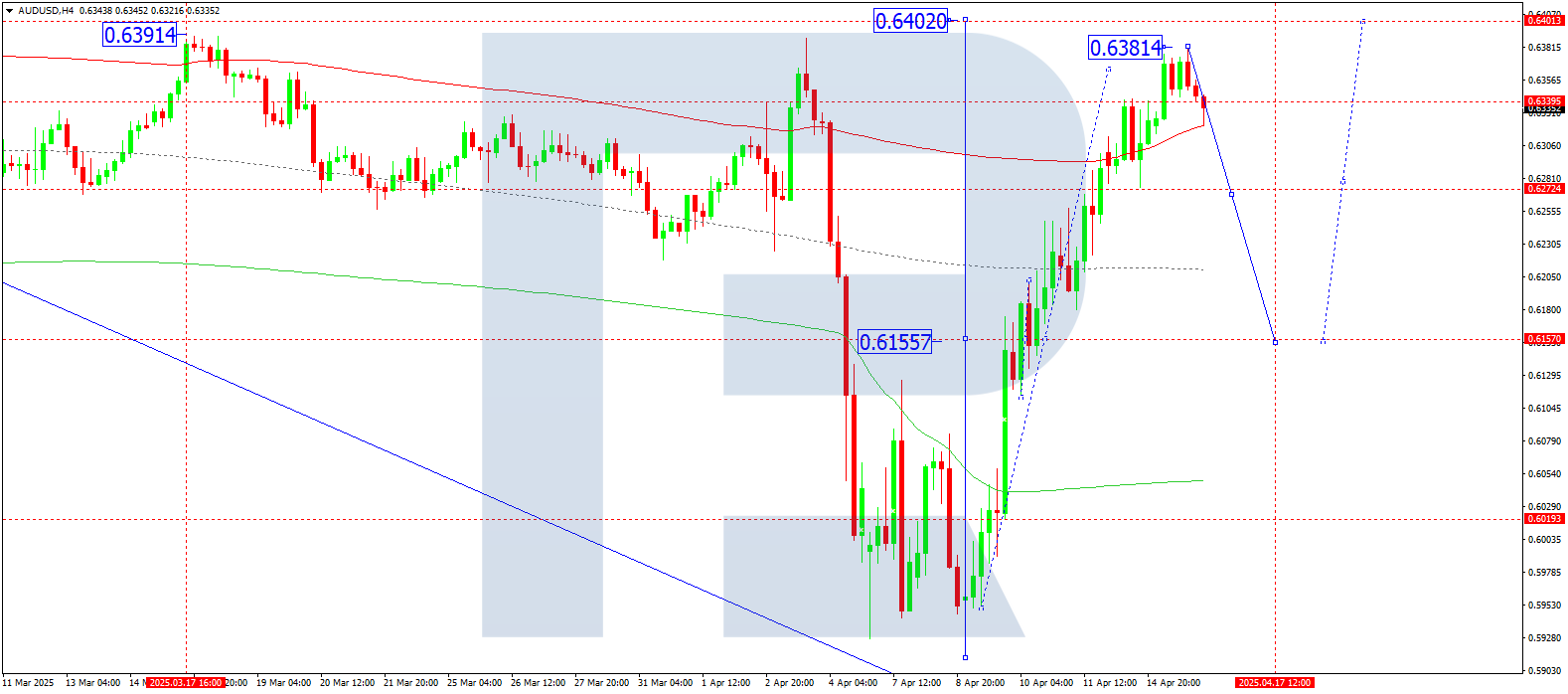

AUDUSD forecast

On the H4 chart of AUDUSD, the market completed a downward impulse to 0.6322. Today, 16 April 2025, a rise towards 0.6355 is expected. A new consolidation range may form around this level. If the price breaks downward, the next decline may reach 0.6150, the first target.

Technically, this scenario is supported by the Elliott wave structure and the growth wave matrix with a pivot at 0.6155, which acts as a key level in the wave structure. The price earlier completed a wave to the upper boundary of the price Envelope at 0.6381. A move down to the central line at 0.6150 may follow.

Technical indicators for today’s AUDUSD forecast suggest a possible beginning of a decline to 0.6150.

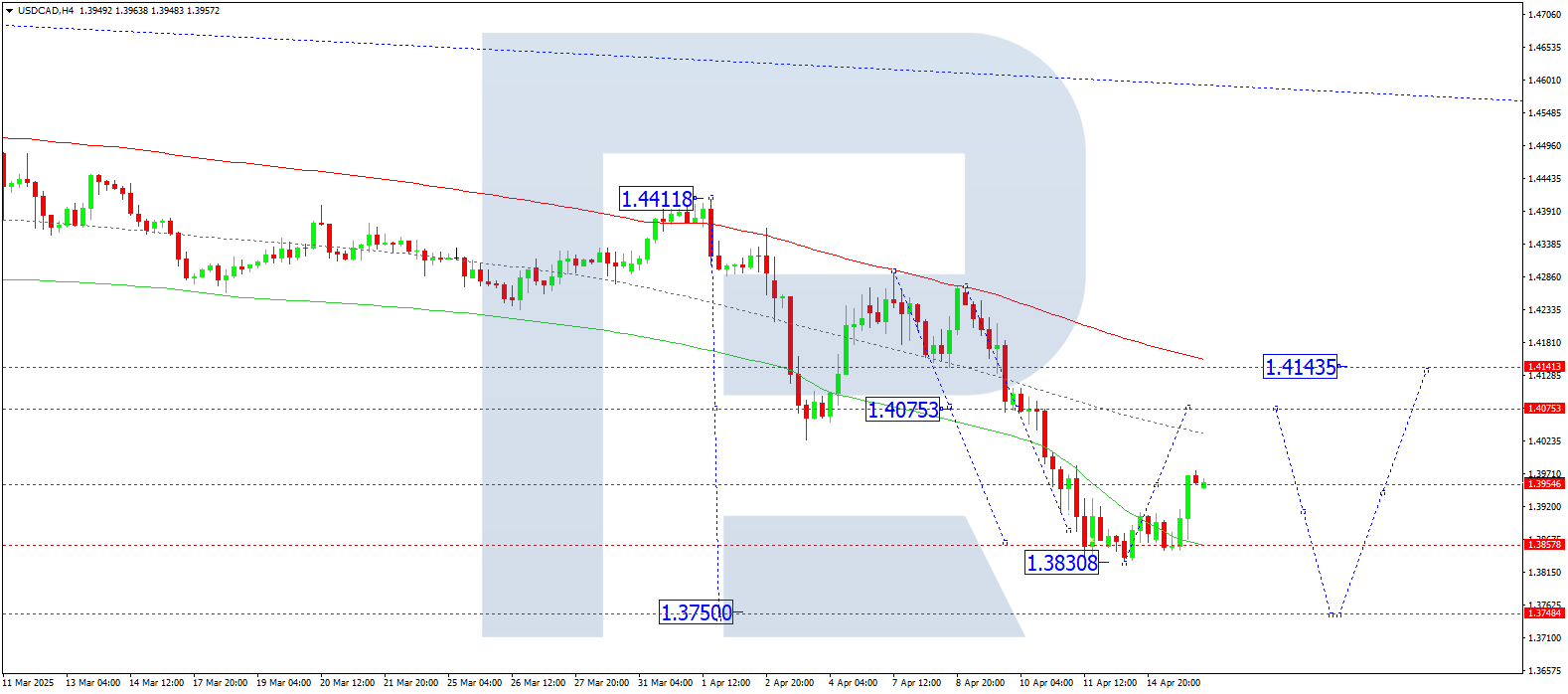

USDCAD forecast

On the H4 chart of USDCAD, the market completed a growth wave to 1.3977. Today, 16 April 2025, a consolidation range may form below this level. The wave may continue towards 1.4075. After reaching this level, a pullback to 1.3955 may follow.

Technically, this scenario is supported by the Elliott wave structure and the downward wave matrix with a pivot at 1.4075. It acts as a key level in the current wave structure. The market had previously reached the lower boundary of the price Envelope at 1.3830. A rise towards the central line at 1.4075 appears likely.

Technical indicators for today’s USDCAD forecast suggest a growth wave towards 1.4075.

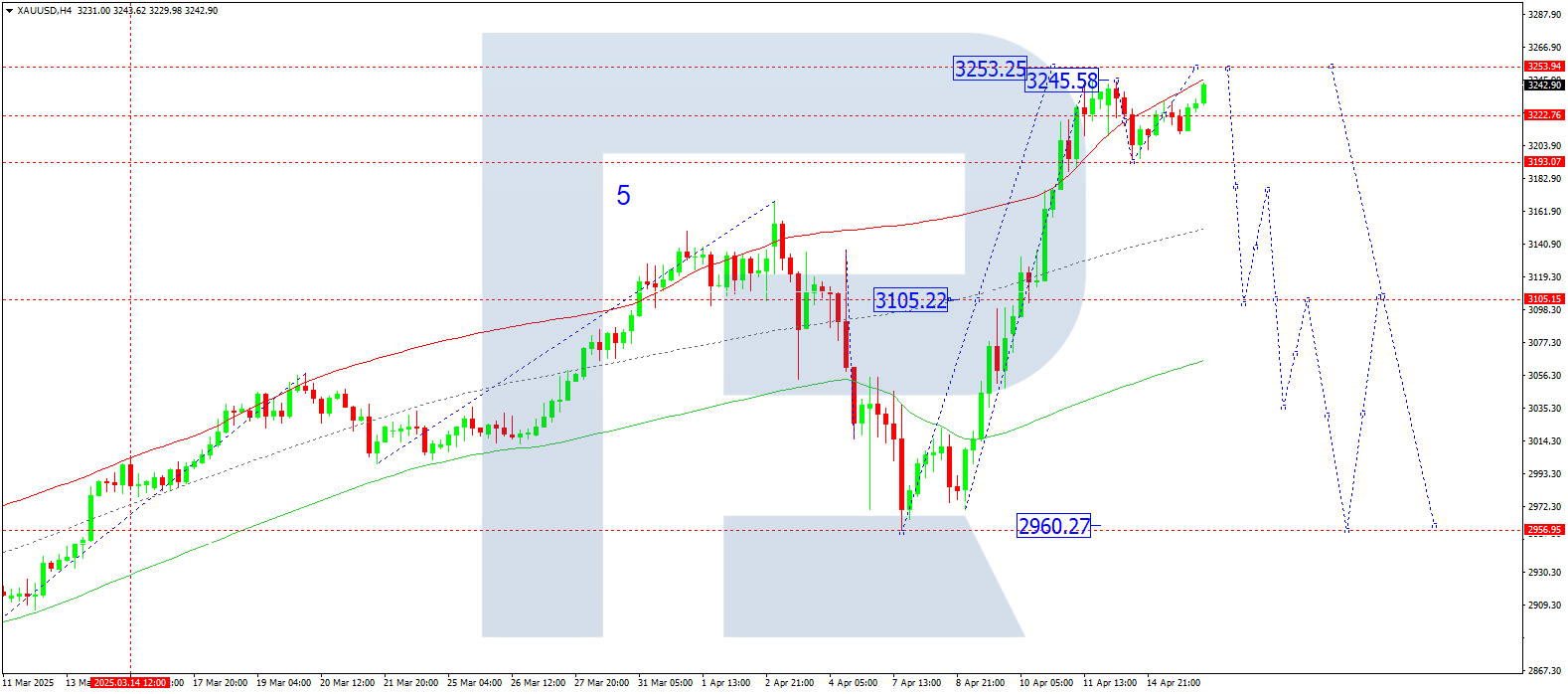

XAUUSD forecast

On the H4 chart of XAUUSD, the market is forming a consolidation range around 3,222. Today, 16 April 2025, a breakout upwards could extend the growth wave to 3,295. Afterwards, a wave of decline to 3,170 is expected. A downward breakout from the range would open the way for a decline to 3,100. Then, another growth wave towards 3,380 may develop.

Technically, the Elliott wave structure and the growth wave matrix with a pivot at 3,170 confirm this scenario. This level serves as a key point in the current wave structure for XAUUSD. The market is currently developing a wave towards the upper boundary of the price Envelope at 3,295. Once this level is reached, a reversal towards the central line at 3,170 may follow.

Technical indicators for today’s XAUUSD forecast point to the potential for a rise to 3,295.

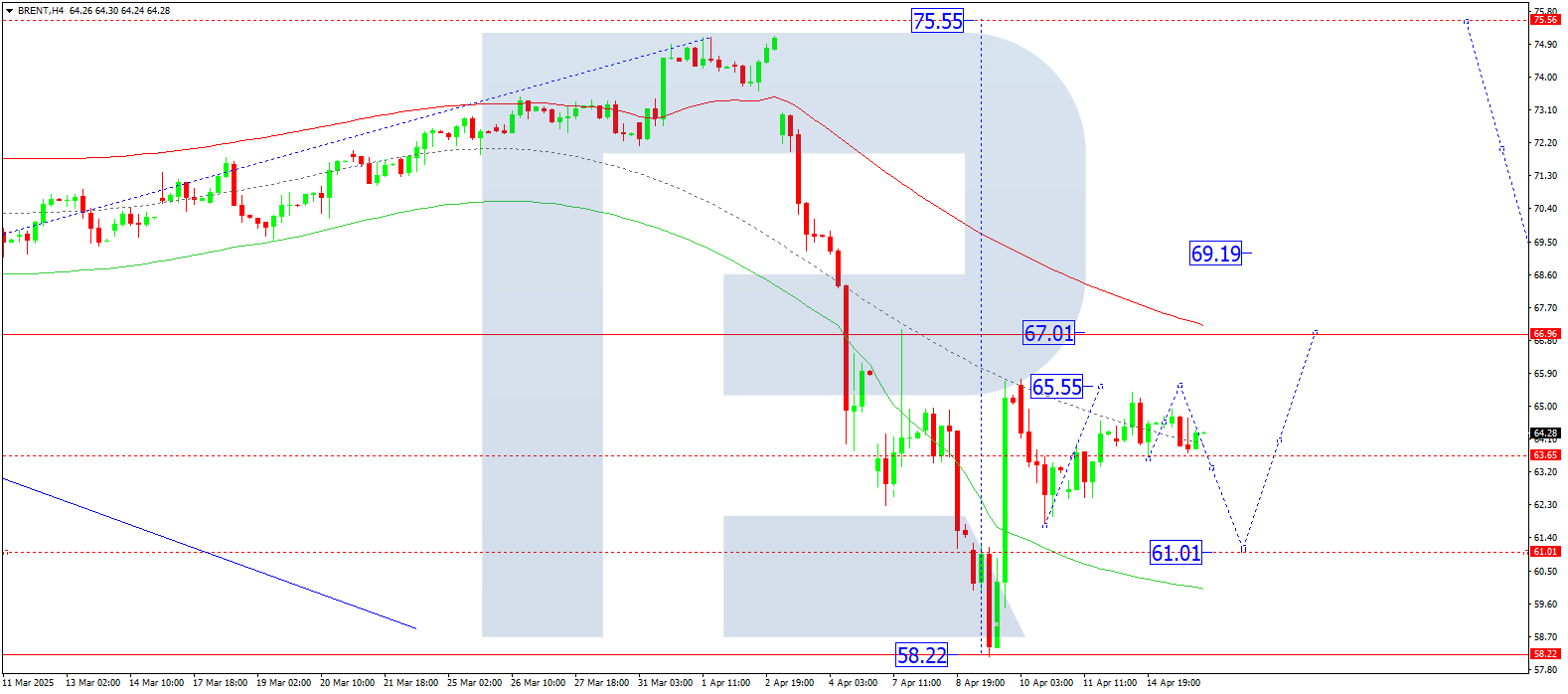

Brent forecast

On the H4 chart of Brent crude, the market is forming a consolidation range around 63.65. Today, 16 April 2025, a rise towards 65.55 is expected. Afterwards, another correction to 61.00 may develop. Once this correction ends, the market may begin a growth wave to 67.00, the first target.

Technically, the Elliott wave structure and the downward wave matrix with a pivot at 67.00 support this scenario. This level acts as a key reference in the current wave for Brent. A correction towards the lower boundary of the price Envelope at 61.00 remains possible before the market resumes its growth towards the upper boundary at 67.00.

Technical indicators in today’s Brent forecast suggest the end of the correction at 61.00 and a rise to 67.00.