EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, XAUUSD, and Brent technical analysis and forecast for 18 February 2025

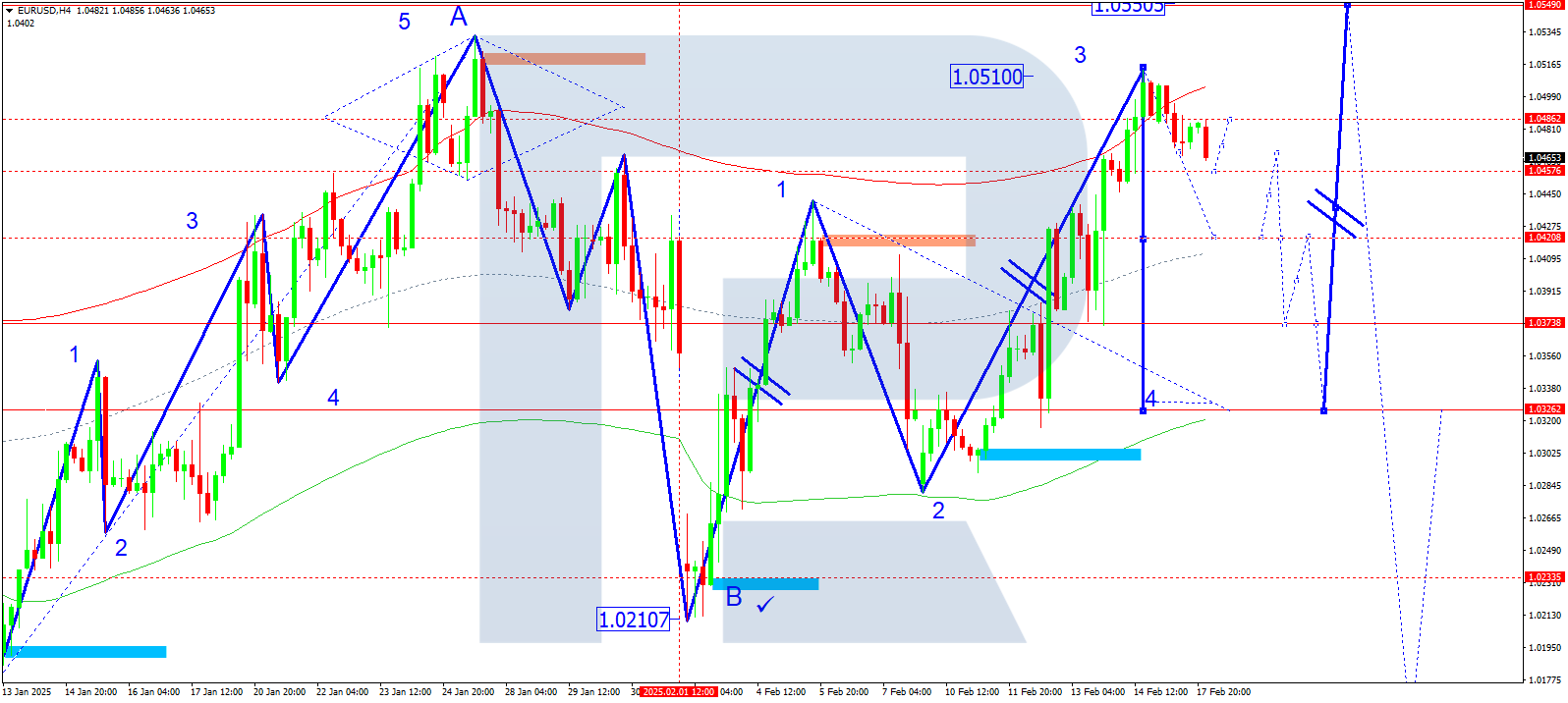

EURUSD forecast

On the H4 chart, EURUSD is forming a downward wave towards 1.0460. Today, 18 February 2025, after reaching this level, a corrective growth wave towards 1.0486 is expected. A consolidation range may develop at the peak of the growth wave. If the price breaks downward, the decline may continue to 1.0420. Later, a new growth wave towards 1.0460 is likely, followed by a potential decline to 1.0375 and 1.0326.

Technically, this scenario is confirmed by the Elliott wave structure and the growth wave matrix with a pivot point at 1.0380, considered a key level for EURUSD. Currently, the market is pulling back from the upper boundary of the price Envelope at 1.0510, continuing a downward wave towards the central line at 1.0420.

Technical indicators for today's EURUSD forecast suggest the probability of a decline towards 1.0420.

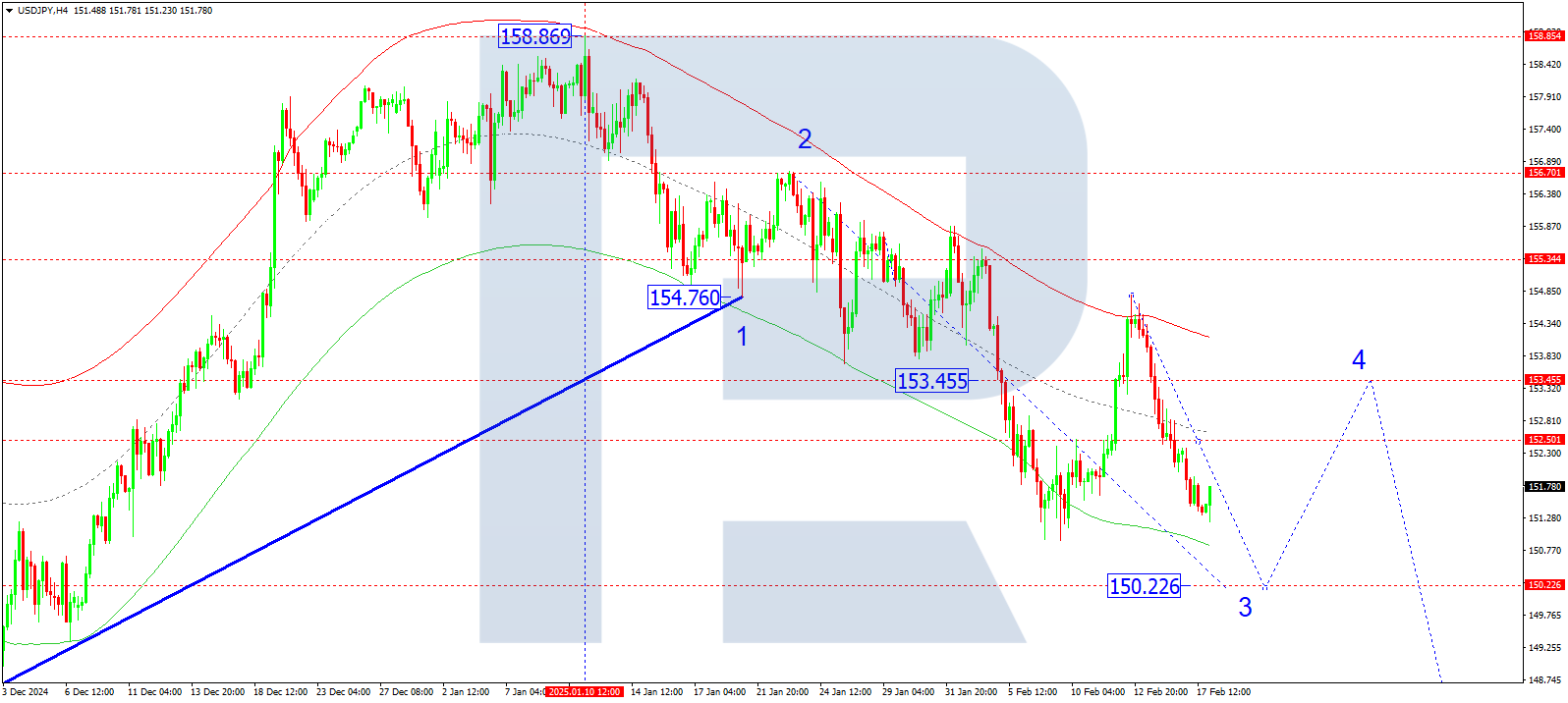

USDJPY forecast

On the H4 chart, USDJPY completed a decline to 151.23. Today, 18 February 2025, a corrective growth wave towards 152.50 is possible. After reaching this level, a further decline towards 150.22 is expected. Later, a new upward wave towards 153.45 is likely, followed by another decline towards 148.11.

Technically, this scenario for USDJPY is confirmed by the Elliott wave structure and the downward wave matrix with a pivot point at 152.50. Currently, the market is continuing its decline towards the lower boundary of the price Envelope at 150.22. After reaching this level, a growth wave towards the upper boundary at 153.45 is expected.

Technical indicators for today's USDJPY forecast suggest the probability of a decline towards 150.22.

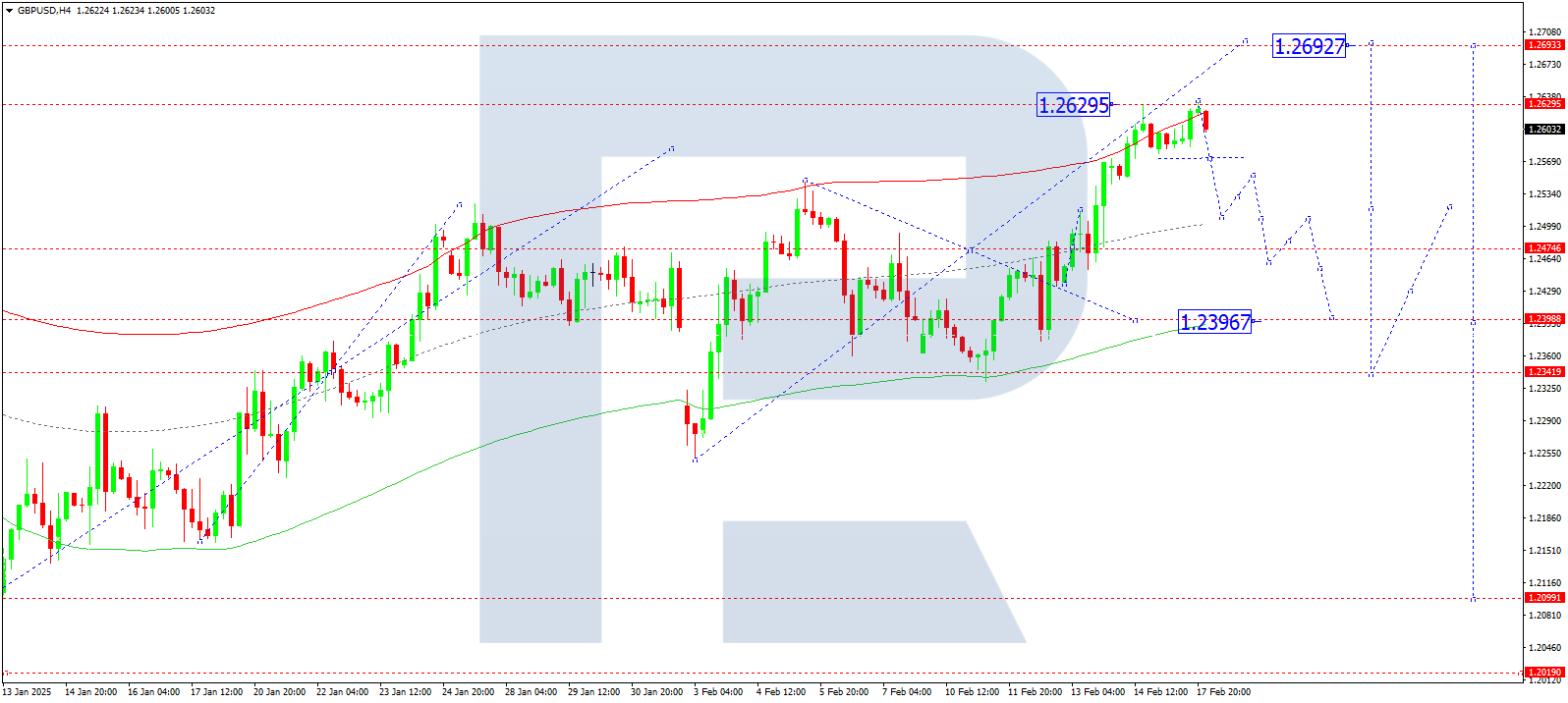

GBPUSD forecast

On the H4 chart, GBPUSD continues consolidating below 1.2629. Today, 18 February 2025, a downward breakout is expected, leading to a decline towards 1.2500. After reaching this level, a growth wave towards 1.2555 may develop. Later, a further decline towards 1.2460 is likely, with a potential continuation towards 1.2396.

Technically, this scenario for GBPUSD is confirmed by the Elliott wave structure and the growth wave matrix with a pivot point at 1.2474. Currently, the market has completed a growth wave towards the upper boundary of the price Envelope at 1.2629. A downward move towards the central line at 1.2460 is expected.

Technical indicators for today's GBPUSD forecast suggest the probability of a correction towards 1.2460.

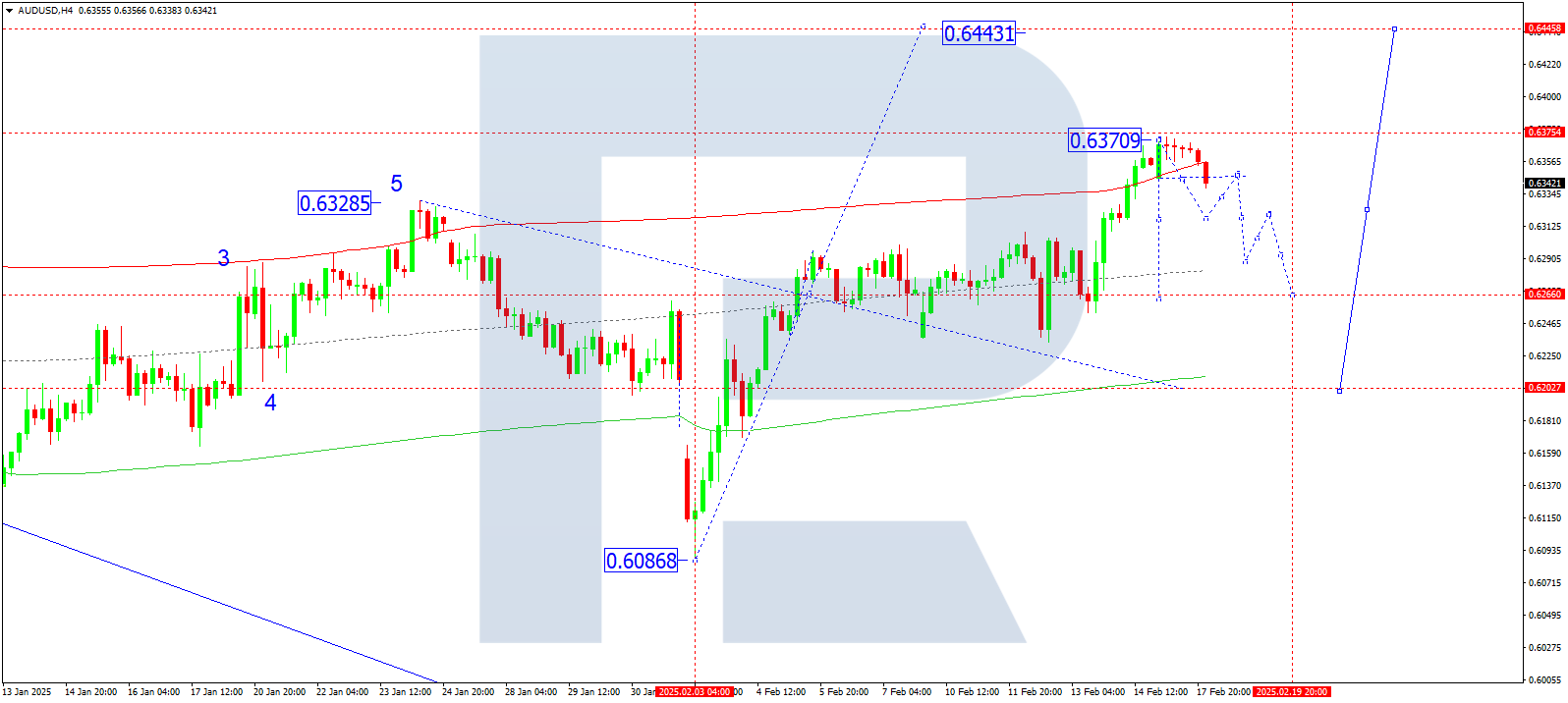

AUDUSD forecast

On the H4 chart, AUDUSD completed a decline to 0.6333, followed by a correction to 0.6363. A consolidation range has formed at the peak of the growth wave. Today, 18 February 2025, a downward breakout towards 0.6317 is expected. After reaching this level, a growth wave towards 0.6340 is possible. Later, another decline towards 0.6280 may develop, with a potential continuation towards 0.6250.

Technically, this scenario is confirmed by the Elliott wave structure and the growth wave matrix for AUDUSD, with a pivot point at 0.6266. Currently, the market has pulled back from the upper boundary of the price Envelope at 0.6370 and is forming a downward wave towards the central line at 0.6280.

Technical indicators for today's AUDUSD forecast suggest the probability of a decline towards 0.6280.

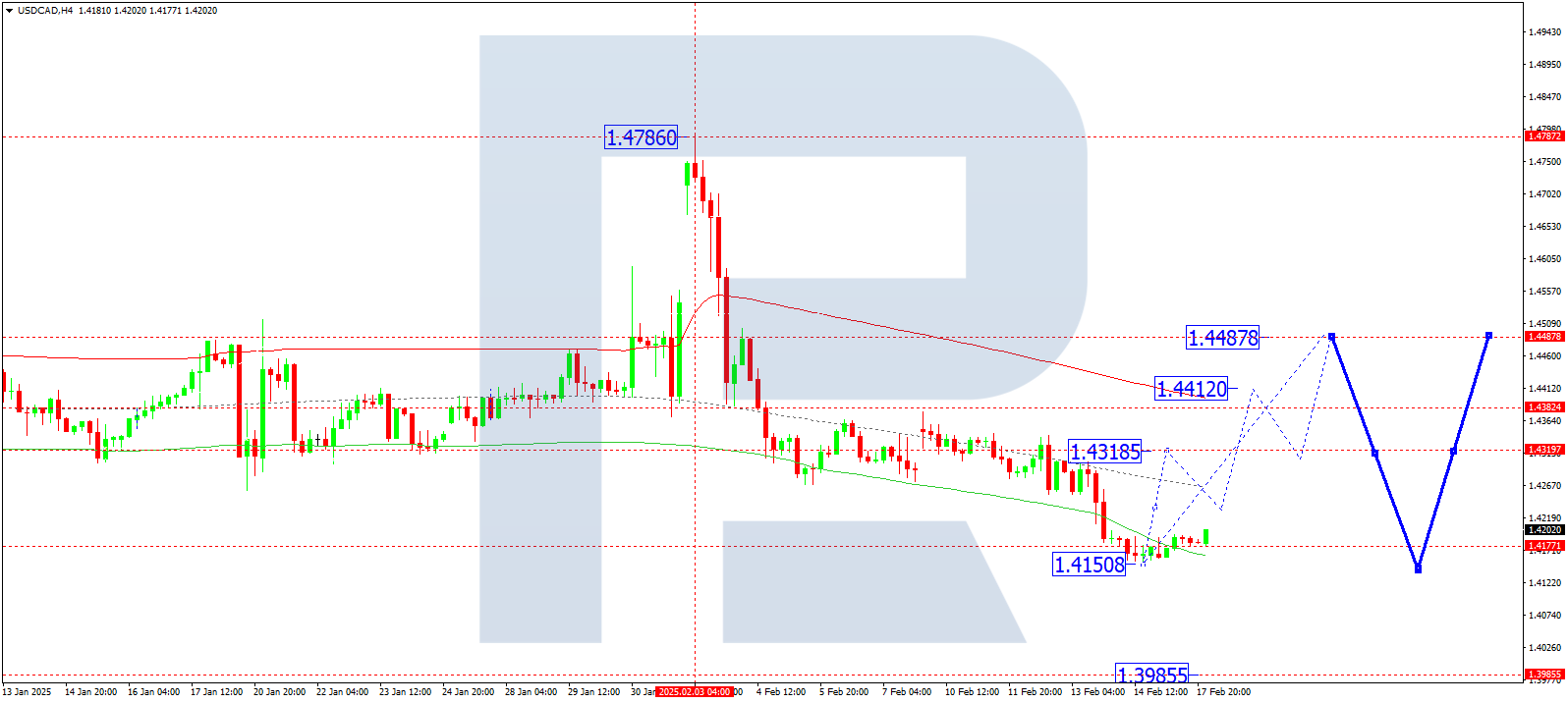

USDCAD forecast

On the H4 chart, USDCAD has formed a consolidation range around 1.4177. Today, 18 February 2025, an upward breakout is expected, initiating a growth wave towards 1.4318. After reaching this level, a decline towards 1.4233 may develop. Later, another growth wave towards 1.4410 is possible, with a further trend continuation towards 1.4488.

Technically, this scenario is confirmed by the Elliott wave structure and the downward wave matrix with a pivot point at 1.4488, considered a key level for USDCAD in this wave structure. Currently, the market has declined towards the lower boundary of the price Envelope at 1.4150. A subsequent growth wave towards the upper boundary at 1.4488 is expected.

Technical indicators for today's USDCAD forecast suggest the probability of a rise towards 1.4488.

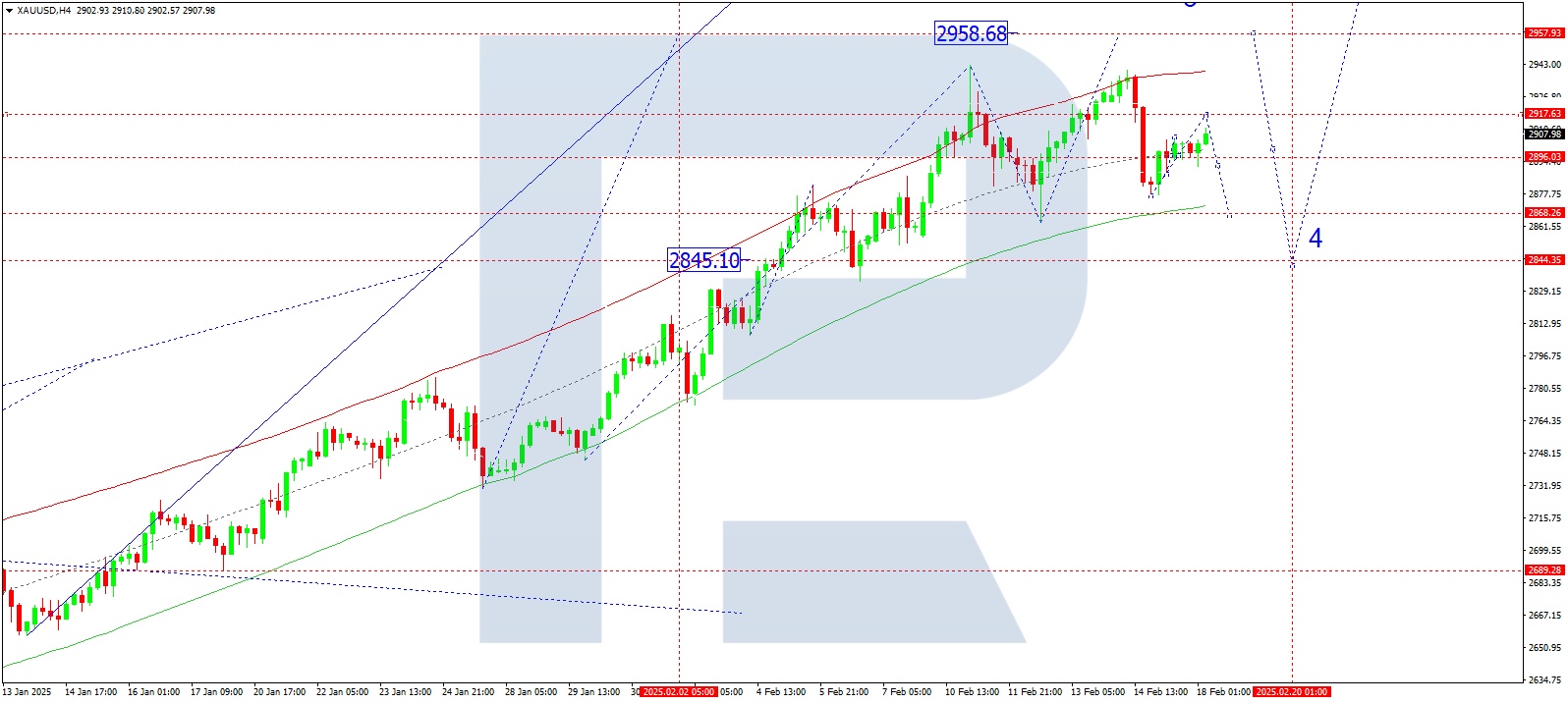

XAUUSD forecast

On the H4 chart, XAUUSD is consolidating around 2896. Today, 18 February 2025, a corrective growth wave towards 2917 is possible. Later, a decline towards 2868 may follow. After reaching this level, a new growth wave towards 2960 is expected. After reaching 2960, a correction towards 2844 may develop.

Technically, this scenario is confirmed by the Elliott wave structure and the growth wave matrix with a pivot point at 2844, considered a key level for XAUUSD in this wave. Currently, the market has completed a growth wave towards the upper boundary of the price Envelope at 2940. After rejecting this level, the market is forming a corrective move towards the lower boundary at 2844.

Technical indicators for today's XAUUSD forecast suggest the probability of a correction towards 2844.

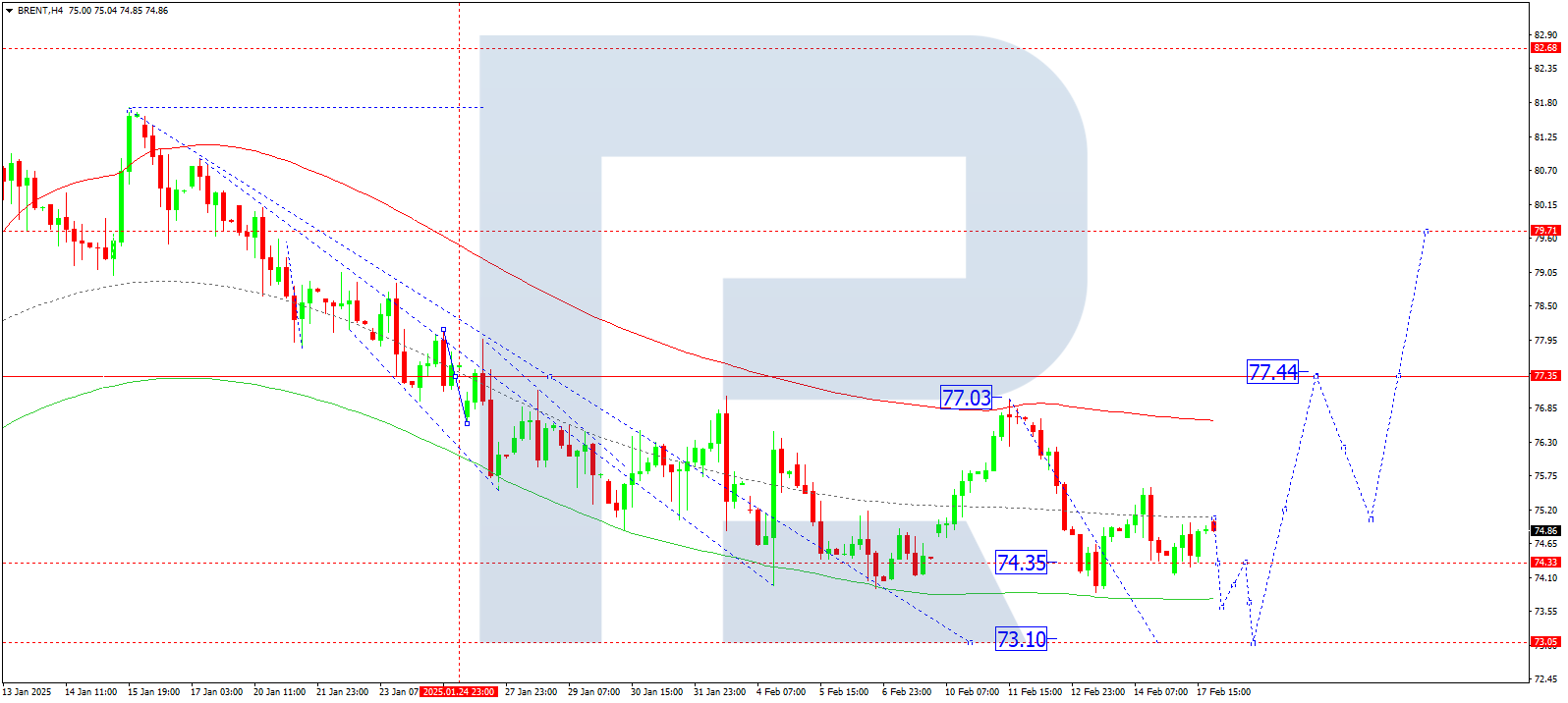

Brent forecast

On the H4 chart, Brent is consolidating around 74.99. Today, 18 February 2025, a downward breakout is expected, leading to a further decline towards 73.11. After reaching this level, a growth wave towards 77.44 is likely as the first target. If the price breaks upwards, a move towards 77.44 may develop.

Technically, this scenario is confirmed by the Elliott wave structure and the downward wave matrix with a pivot point at 74.99, considered a key level for Brent. Currently, the market is consolidating around the central line of the price Envelope. A downward breakout towards the lower boundary at 73.11 is expected, followed by a growth wave towards the upper boundary at 77.44.

Technical indicators for today's Brent forecast suggest the probability of a decline towards 73.11.